Investing in real estate through a Self-Directed IRA: A Powerful Wealth-Building Strategy

When it comes to building wealth for retirement, many people think of traditional investment options such as stocks, bonds, and mutual funds. However, there is a lesser-known but highly effective strategy that can potentially yield significant returns: investing in real estate through a Self-Directed Individual Retirement Account (IRA).

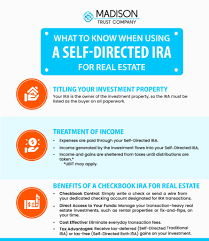

A Self-Directed IRA is a unique retirement account that allows individuals to take control of their investments and diversify beyond the usual financial assets. With a Self-Directed IRA, investors have the freedom to include real estate as part of their retirement portfolio.

So, how does it work? First, it’s important to understand that not all IRAs are created equal. Traditional IRAs offered by banks or brokerage firms typically limit investment options to stocks, bonds, and mutual funds. However, a Self-Directed IRA opens up a world of possibilities by allowing investments in alternative assets like real estate.

Investing in real estate through a Self-Directed IRA offers several advantages. Firstly, it provides an opportunity for diversification. Real estate has historically shown low correlation with traditional asset classes like stocks and bonds. By adding real estate to your retirement portfolio, you can potentially reduce risk and increase the likelihood of consistent returns.

Secondly, investing in real estate through a Self-Directed IRA allows for tax advantages. Just like any other IRA, contributions made to a Self-Directed IRA can be tax-deductible or grow tax-free in the case of Roth IRAs. Additionally, income generated from rental properties or capital gains from property sales can be tax-deferred or even tax-free if held within the IRA until retirement age.

Another significant benefit is the potential for higher returns compared to traditional investments. Real estate has proven to be a reliable long-term investment with the potential for appreciation over time. By leveraging the power of compounding growth within a Self-Directed IRA, investors can maximize their returns and accelerate wealth accumulation.

Investing in real estate through a Self-Directed IRA does require careful consideration and adherence to specific rules and regulations. It is crucial to work with a reputable custodian who specializes in Self-Directed IRAs to ensure compliance with IRS guidelines. The custodian will handle administrative tasks, such as processing transactions and maintaining accurate records, while you focus on identifying and managing your real estate investments.

When it comes to choosing real estate investments within a Self-Directed IRA, the options are vast. Investors can consider residential properties, commercial properties, rental properties, land development projects, and even private real estate funds or syndications. The key is to conduct thorough due diligence, seek professional advice when needed, and choose investments that align with your risk tolerance and long-term goals.

In conclusion, investing in real estate through a Self-Directed IRA offers an alternative path to building wealth for retirement. By diversifying your portfolio beyond traditional assets and taking advantage of tax benefits, you can potentially achieve higher returns while mitigating risk. However, it’s essential to approach this strategy with careful planning and guidance from experts in the field. With the right knowledge and support, a Self-Directed IRA can be a powerful tool for realizing your financial goals through real estate investment.

Exploring the Benefits of Self-Directed IRA Real Estate: Tax Advantages, Diversification, Control, Leverage, and Passive Income

Challenges of Self-Directed IRA Real Estate Investments: Complexity, High Fees, and IRS Regulations

- Self-directed IRA real estate investments can be complicated and time consuming, as the investor must research and manage all aspects of their own investment.

- The fees associated with self-directed IRA real estate investments can be high due to additional services needed for setting up and managing the account.

- The IRS imposes strict rules and regulations on self-directed IRA real estate investments which may limit the potential returns for investors who do not understand these restrictions.

Tax Benefits

Maximizing Your Retirement Savings: The Tax Benefits of Self-Directed IRA Real Estate Investments

When it comes to planning for retirement, finding ways to maximize your savings while minimizing your tax liability is crucial. That’s where the tax benefits of investing in real estate through a Self-Directed Individual Retirement Account (IRA) come into play.

One significant advantage of utilizing a Self-Directed IRA for real estate investments is the ability to use pre-tax dollars. By contributing to your Self-Directed IRA with pre-tax income, you effectively reduce your taxable income for the year. This reduction can lead to immediate tax savings, allowing you to keep more of your hard-earned money.

Furthermore, as your real estate investment grows within the Self-Directed IRA, any income generated from rental properties or capital gains from property sales can be tax-deferred or even tax-free until you start making withdrawals during retirement. This means that you have the potential to accumulate wealth without having to pay taxes on the investment earnings year after year.

The power of these tax benefits cannot be overstated. By investing in real estate through a Self-Directed IRA, you not only have the opportunity to grow your retirement savings but also potentially reduce your overall tax burden. This can translate into significant long-term financial advantages as you build wealth for your future.

It’s important to note that navigating the intricacies of self-directed IRAs and their associated tax benefits requires careful attention and adherence to IRS guidelines. Working with a knowledgeable custodian who specializes in self-directed IRAs is essential in ensuring compliance and maximizing the available tax advantages.

In conclusion, utilizing a Self-Directed IRA for real estate investments offers compelling tax benefits that can help boost your retirement savings. The ability to invest with pre-tax dollars and potentially defer taxes on income and gains allows you to keep more money working for you over time. As always, consult with financial professionals who specialize in self-directed IRAs and real estate investments to ensure you make informed decisions that align with your long-term financial goals. With the right strategy and guidance, you can take full advantage of the tax benefits offered by self-directed IRA real estate investments and pave the way to a more financially secure retirement.

Diversification

Diversification: The Key to Reducing Risk with Self-Directed IRA Real Estate Investments

When it comes to securing your financial future, diversification is often touted as one of the most effective strategies. By spreading your investments across different asset classes, you can reduce the risk associated with market volatility. One powerful way to achieve diversification within your retirement portfolio is by investing in real estate through a self-directed IRA.

Real estate has long been recognized as a valuable and stable investment option. Its performance is not directly tied to the ups and downs of the stock market, making it an attractive choice for those seeking to mitigate risk. By incorporating real estate into your self-directed IRA, you can further diversify your holdings and potentially shield yourself from the impact of market fluctuations.

The beauty of a self-directed IRA lies in its flexibility. Unlike traditional IRAs that limit investment options to stocks, bonds, and mutual funds, a self-directed IRA allows you to invest in alternative assets like real estate. This opens up a whole new world of opportunities for diversification within your retirement portfolio.

By allocating a portion of your self-directed IRA funds towards real estate investments, you can balance out the risks associated with other asset classes. When stocks or bonds experience volatility, the value of well-chosen real estate properties may remain relatively stable or even appreciate over time.

Furthermore, different types of real estate investments offer varying levels of risk and return potential. Residential properties provide steady rental income and potential appreciation, while commercial properties offer higher income potential but may come with additional complexities. Land development projects present opportunities for substantial returns but also carry higher risks.

By carefully selecting a mix of real estate investments that align with your risk tolerance and investment goals, you can create a diversified portfolio within your self-directed IRA. This diversification helps protect against any single investment negatively impacting your overall retirement savings.

In addition to reducing risk, diversifying into real estate through a self-directed IRA also provides potential for attractive returns. Real estate has a proven track record of long-term appreciation, and rental income can provide a steady cash flow stream during retirement. By combining the benefits of diversification and potential returns, you can position yourself for a more secure financial future.

It’s important to note that investing in real estate through a self-directed IRA does require careful planning and adherence to IRS guidelines. Working with a reputable custodian who specializes in self-directed IRAs is crucial to ensure compliance and proper administration of your investments.

In conclusion, diversification is a key component of any successful investment strategy, especially when it comes to securing your retirement savings. Investing in real estate through a self-directed IRA offers an excellent opportunity to diversify your portfolio and reduce the risk of market volatility. By carefully selecting real estate investments that align with your goals, you can potentially enjoy stable returns while safeguarding your financial future.

Control

One of the significant advantages of investing in real estate through a Self-Directed IRA is the level of control it offers. Unlike traditional IRAs that limit investment options to stocks, bonds, and mutual funds, a self-directed IRA empowers you to choose from a wide range of investment opportunities.

With a self-directed IRA, you have the freedom to explore various real estate options that align with your investment goals and risk tolerance. Whether you prefer single-family homes, multi-family units, commercial properties, or even raw land for development, the choice is yours. This level of control allows you to tailor your investments to suit your preferences and expertise.

By having a say in which properties or projects you invest in, you can leverage your knowledge and experience to make informed decisions. You can conduct thorough research, analyze market trends, and identify opportunities that have the potential for long-term growth and profitability.

Moreover, with control comes the ability to actively manage your investments. Unlike other retirement accounts where investment decisions are often left in the hands of financial institutions or fund managers, a self-directed IRA puts you in charge. You can take a hands-on approach by overseeing property management or hiring professionals who specialize in real estate to handle day-to-day operations.

This level of control also allows for greater flexibility. Real estate investments can be tailored to meet specific financial goals. For example, if you’re looking for steady cash flow during retirement years, investing in rental properties may be ideal. On the other hand, if you’re seeking higher returns through property appreciation over time, focusing on commercial properties or land development might be more suitable.

It’s important to note that while having control over your investments can be empowering, it also requires careful consideration and due diligence. Real estate transactions involve legal complexities and market risks that should be thoroughly assessed before making any investment decisions. Seeking guidance from professionals experienced in self-directed IRAs and real estate investing is crucial to ensure compliance with IRS regulations and maximize the potential of your investments.

In summary, the control offered by a self-directed IRA when investing in real estate is a significant advantage. It allows you the freedom to select from a wide range of investment options and tailor your portfolio to your preferences and expertise. By actively managing your investments and making informed decisions, you can potentially achieve greater returns and work towards your financial goals with confidence.

Leverage

Unlocking the Power of Leverage with Self-Directed IRA Real Estate Investments

When it comes to investing in real estate, one of the most significant advantages of using a Self-Directed Individual Retirement Account (IRA) is the ability to leverage your investments. Unlike other retirement accounts, such as 401(k)s or traditional IRAs that don’t allow borrowing against them, a self-directed IRA provides you with the opportunity to acquire more property through leverage.

Leverage refers to the use of borrowed funds to increase your purchasing power. With a self-directed IRA, you can take advantage of this powerful financial tool by securing a non-recourse loan. A non-recourse loan is a type of loan where the lender’s sole recourse in case of default is limited to the property itself, without any personal liability on the borrower.

By utilizing leverage within your self-directed IRA, you can potentially amplify your real estate investments and achieve greater returns. Here’s how it works: let’s say you have $100,000 in your self-directed IRA account. Instead of using that entire amount to purchase a single property outright, you can use a portion as a down payment and secure a non-recourse loan for the remaining balance.

By leveraging your funds in this way, you can acquire multiple properties or invest in more substantial and potentially higher-yielding real estate opportunities than would be possible with solely cash purchases. This strategy allows you to diversify your portfolio and spread your risk across different properties or investment types.

The power of leverage lies in its ability to magnify both gains and losses. When real estate values appreciate, leveraging can significantly boost your returns on investment. For example, if you purchase a property for $200,000 using $50,000 from your self-directed IRA and secure a non-recourse loan for the remaining $150,000, any increase in property value will be calculated based on the full $200,000 rather than just your initial investment. This means that even a modest appreciation can yield substantial profits.

However, it’s essential to approach leverage with caution and conduct thorough due diligence. While leverage can enhance your gains, it also exposes you to higher risks. If the real estate market experiences a downturn or the property doesn’t generate sufficient income to cover loan payments, you may face financial challenges. It’s crucial to carefully analyze the potential risks and rewards of each investment opportunity and ensure that the rental income or potential appreciation is sufficient to cover expenses and loan obligations.

Additionally, it’s important to work with experienced professionals who specialize in self-directed IRAs and understand the intricacies of leveraging within this unique retirement account structure. They can guide you through the process, help you navigate any legal requirements, and provide valuable insights into identifying suitable investment opportunities.

In conclusion, leveraging your self-directed IRA for real estate investments opens up a world of possibilities by allowing you to acquire more property than would be possible with other retirement accounts. By using non-recourse loans strategically, you can potentially maximize your returns and accelerate wealth accumulation. However, remember that leverage comes with increased risk, so careful analysis and professional guidance are essential for successful implementation.

Passive Income Stream

One of the key advantages of investing in real estate through a self-directed IRA is the potential to generate a passive income stream. For retirees looking to supplement their retirement savings or create a steady cash flow, real estate investments can be an excellent option.

Unlike traditional stocks or bonds, which may rely on market fluctuations for returns, real estate investments have the potential to provide consistent rental income. By purchasing properties within a self-directed IRA, retirees can become landlords and collect monthly rental payments from tenants.

This passive income stream can be especially beneficial for retirees who no longer have regular employment income. The rental income generated from real estate investments can help cover living expenses, healthcare costs, or other financial obligations during retirement.

Moreover, real estate investments have the potential to grow faster than traditional investment options alone. Over time, properties may appreciate in value, leading to increased rental rates and potential capital gains upon sale. By reinvesting the rental income back into additional real estate within the self-directed IRA, retirees can further accelerate their wealth accumulation.

Another advantage of generating passive income through real estate investments is that it provides a level of stability and predictability. Rental payments typically come in on a regular basis, providing retirees with a reliable source of cash flow. This stability can help retirees plan their finances more effectively and reduce concerns about market volatility impacting their retirement savings.

It’s important to note that managing rental properties does require some level of involvement. However, with proper planning and assistance from property management companies or professionals in the field, retirees can minimize their direct involvement and enjoy the benefits of passive income without significant day-to-day responsibilities.

In summary, investing in real estate through a self-directed IRA offers retirees an opportunity to generate passive income streams that can supplement their retirement savings. With consistent rental payments and the potential for property appreciation over time, these investments have the ability to grow retirement funds faster than traditional stocks or bonds alone. By diversifying their portfolio and taking advantage of the passive income potential of real estate, retirees can enhance their financial security and enjoy a more comfortable retirement.

Self-directed IRA real estate investments can be complicated and time consuming, as the investor must research and manage all aspects of their own investment.

Self-Directed IRA Real Estate: A Con to Consider – Complexity and Time Commitment

While investing in real estate through a Self-Directed IRA can offer numerous benefits, it’s important to consider the potential drawbacks as well. One significant con to be aware of is the complexity and time commitment involved in managing these types of investments.

Unlike traditional investment options like stocks or bonds, real estate investments require hands-on involvement. With a Self-Directed IRA, the investor becomes responsible for researching, acquiring, and managing all aspects of their real estate investment. This includes tasks such as property selection, due diligence, financing arrangements, property maintenance, tenant management (if applicable), and more.

The process of researching and identifying suitable real estate opportunities can be time-consuming. Investors must thoroughly analyze market conditions, evaluate properties for potential returns and risks, and conduct due diligence to ensure they are making informed decisions. This level of involvement may not be suitable for individuals who prefer a more passive approach to investing or those with limited time available.

Furthermore, managing a real estate investment within a Self-Directed IRA requires ongoing attention and effort. Property maintenance and repairs need to be addressed promptly to maintain the value and appeal of the investment. Additionally, if rental properties are part of the portfolio, managing tenants’ needs, collecting rent payments, addressing legal matters, and handling any disputes becomes the investor’s responsibility.

It’s crucial for investors to have a solid understanding of real estate regulations and laws specific to their chosen locations as well. Compliance with local zoning laws, building codes, landlord-tenant regulations, tax obligations, and other legal requirements is essential when investing in real estate through a Self-Directed IRA.

To navigate these complexities successfully, investors may need to seek professional assistance from experienced real estate agents or property managers who specialize in working with Self-Directed IRAs. These professionals can provide valuable guidance throughout the investment process but may come with additional costs that should be factored into the overall financial plan.

In conclusion, while investing in real estate through a Self-Directed IRA can be a lucrative strategy, it’s crucial to recognize and consider the potential drawbacks. The complexity and time commitment involved in researching, acquiring, and managing real estate investments can be significant. Investors must carefully assess their willingness to dedicate time and effort or seek professional assistance to ensure successful outcomes. By understanding the challenges and planning accordingly, investors can make informed decisions about whether self-directed IRA real estate investments align with their goals and resources.

The fees associated with self-directed IRA real estate investments can be high due to additional services needed for setting up and managing the account.

One important consideration when investing in real estate through a Self-Directed IRA is the potential for higher fees compared to traditional investment options. While the benefits of diversification and tax advantages are attractive, it’s crucial to be aware of the additional costs associated with setting up and managing a self-directed IRA real estate account.

Unlike traditional IRAs offered by banks or brokerage firms, self-directed IRAs require specialized custodians who can handle the unique requirements of alternative investments like real estate. These custodians charge fees for their services, which can include account setup fees, annual maintenance fees, transaction fees, and potentially even asset-based fees.

Account setup fees are typically one-time charges incurred when establishing a self-directed IRA real estate account. These fees cover administrative tasks such as processing paperwork and setting up the necessary infrastructure to facilitate real estate investments within an IRA structure.

Annual maintenance fees are recurring charges that cover ongoing administrative responsibilities performed by the custodian. These may include record-keeping, reporting, and providing statements related to the self-directed IRA real estate investments.

Transaction fees may be incurred each time you buy or sell a property within your self-directed IRA. These fees cover the custodian’s involvement in facilitating the transaction, including paperwork processing and ensuring compliance with IRS regulations.

Additionally, some custodians may charge asset-based fees, which are calculated as a percentage of your total assets held within the self-directed IRA. These fees can vary depending on the custodian and the value of your real estate investments.

It’s important to note that these additional fees can vary significantly among different custodians. Therefore, it is essential to research and compare fee structures before selecting a custodian for your self-directed IRA real estate investments.

While these extra costs may seem like a con at first glance, it’s important to weigh them against the potential benefits that investing in real estate through a Self-Directed IRA can offer. The ability to diversify your retirement portfolio, enjoy potential tax advantages, and potentially achieve higher returns may outweigh the associated fees in the long run.

Ultimately, it’s crucial to evaluate your financial goals and consider the fees as part of your overall investment strategy. Consulting with a financial advisor or tax professional who specializes in self-directed IRAs can help you navigate these costs and make informed decisions about whether this investment approach aligns with your specific needs and objectives.

The IRS imposes strict rules and regulations on self-directed IRA real estate investments which may limit the potential returns for investors who do not understand these restrictions.

Navigating the Rules: Understanding the Potential Pitfalls of Self-Directed IRA Real Estate Investments

Investing in real estate through a Self-Directed Individual Retirement Account (IRA) can be a powerful wealth-building strategy. However, it’s important to be aware of the potential pitfalls that come with it. One significant challenge is the strict rules and regulations imposed by the Internal Revenue Service (IRS) on self-directed IRA real estate investments.

The IRS has established guidelines to ensure that investors maintain the tax advantages associated with IRAs while preventing prohibited transactions or disqualified persons from benefiting unfairly. These rules are in place to protect the integrity of retirement accounts and maintain a level playing field for all investors.

One common restriction is the prohibition on self-dealing. This means that you cannot use your self-directed IRA to transact with yourself, your immediate family members, or certain other disqualified persons. For example, you cannot purchase a property owned by yourself or rent a property within your self-directed IRA to your child. Violating these rules can result in severe tax penalties and potential disqualification of your entire IRA.

Additionally, there are restrictions on personal use of properties held within a self-directed IRA. You cannot use real estate assets owned by your IRA for personal purposes, such as vacation homes or primary residences. The IRS requires that these properties be held solely for investment purposes until distribution during retirement.

Furthermore, it’s crucial to understand that managing real estate investments within a self-directed IRA can be complex and time-consuming. As an investor, you must ensure compliance with ongoing reporting requirements and maintain accurate records for all transactions related to your self-directed IRA real estate investments. Failing to meet these obligations can result in penalties and potential loss of tax advantages.

To navigate these challenges successfully, it’s essential to educate yourself about IRS regulations and work closely with professionals who specialize in self-directed IRAs. Consulting with experienced custodians, tax advisors, and legal experts can help you understand the rules and make informed decisions that align with your investment goals.

While the strict rules and regulations may limit the potential returns for those who do not fully understand them, they also serve as a safeguard for investors. By adhering to these guidelines, you can ensure that your self-directed IRA real estate investments maintain their tax advantages and contribute to your long-term retirement goals.

In conclusion, while self-directed IRA real estate investments offer great potential for building wealth, it’s crucial to be aware of the IRS-imposed restrictions. Understanding these rules is essential to avoid costly mistakes and ensure compliance. By taking the time to educate yourself and seek professional guidance, you can navigate these challenges successfully and maximize the benefits of investing in real estate through a self-directed IRA.

Tags: advantages, alternative assets, bonds, consistent returns, diversification, diversify, financial assets, investment options, mutual funds, portfolio, real estate, retirement, retirement account, risk reduction, self directed ira real estate, self-directed ira, stocks, tax advantages, tax-deductible contributions, tax-free growth, traditional investment options, wealth-building strategy