REIT Real Estate: Unlocking Investment Opportunities

Real Estate Investment Trusts, commonly known as REITs, have emerged as a popular investment vehicle in the real estate market. Offering individuals the opportunity to invest in income-generating properties without the hassle of direct ownership, REITs have revolutionized the way people participate in real estate investments.

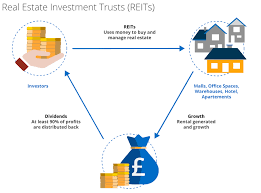

So, what exactly is a REIT? A REIT is a company that owns, operates, or finances income-generating real estate assets. These assets can range from office buildings and shopping centers to apartments and hotels. By pooling funds from multiple investors, REITs provide a diversified portfolio of properties that generate rental income and potentially appreciate over time.

One of the key advantages of investing in REITs is their accessibility. Unlike traditional real estate investments that require substantial capital and expertise, REITs allow investors to enter the market with smaller amounts of money. This opens up opportunities for individuals who may not have had access to real estate investments otherwise.

Another significant benefit is liquidity. Unlike owning physical properties, which can be challenging to sell quickly if needed, investing in publicly traded REITs provides investors with the ability to buy or sell shares on stock exchanges easily. This liquidity feature allows for greater flexibility and enables investors to adjust their portfolios according to market conditions or personal financial goals.

Furthermore, investing in REITs offers diversification benefits. As mentioned earlier, a single REIT can own multiple properties across different sectors and geographic locations. This diversification helps mitigate risk by reducing exposure to any single property or market segment. By spreading investments across various types of real estate assets, investors can potentially enhance their overall risk-adjusted returns.

For income-oriented investors seeking regular cash flow, REITs are an attractive option. By law, most REITs are required to distribute at least 90% of their taxable income as dividends to shareholders. This means that investors can receive consistent income streams from rental payments collected by the REIT. These dividends can be particularly appealing for retirees or those seeking passive income.

Moreover, the growth potential of REITs should not be overlooked. As the real estate market appreciates over time, the underlying properties owned by the REITs may also increase in value. This appreciation can lead to capital gains for investors when they sell their shares. Additionally, some REITs actively engage in property development and redevelopment projects, further enhancing their potential for growth.

When considering investing in REITs, it is essential to conduct thorough research and due diligence. Factors such as the quality and location of the underlying properties, management expertise, financial stability of the REIT, and overall market conditions should all be carefully evaluated.

In conclusion, REITs have transformed real estate investment by providing individuals with an accessible and diversified avenue to participate in this asset class. With liquidity, income potential, diversification benefits, and growth opportunities, investing in REITs has become an appealing option for many investors seeking exposure to real estate without direct ownership. As always, consulting with a financial advisor or professional is recommended to determine how REIT investments align with your specific financial goals and risk tolerance.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial or investment advice. Always conduct thorough research and consult with a qualified professional before making any investment decisions.

Frequently Asked Questions About REIT Real Estate Investments

- Can I invest $1000 in a REIT?

- How does a real estate REIT work?

- Are REITs a good way to invest in real estate?

- What are REITs in real estate?

Can I invest $1000 in a REIT?

Yes, it is possible to invest $1000 in a REIT. Many REITs offer publicly traded shares that can be purchased through brokerage accounts. These shares are typically priced based on the market value of the REIT and can be bought in increments of one share or more, depending on the specific REIT and its share price.

With $1000, you may be able to purchase a certain number of shares based on the current share price of the REIT you are interested in. Keep in mind that transaction fees or commissions charged by your brokerage may apply when buying or selling shares.

It’s important to note that the availability and minimum investment requirements for specific REITs may vary. Some REITs may have higher minimum investment thresholds, while others may have lower minimums or even allow fractional share investing. Researching different REIT options and consulting with your financial advisor or brokerage can provide more information on available investment opportunities within your budget.

Remember to carefully evaluate the specific REIT’s performance, track record, underlying properties, management team, and overall market conditions before making any investment decisions.

How does a real estate REIT work?

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate properties. REITs allow individuals to invest in real estate without directly owning and managing properties themselves. Here’s a breakdown of how a real estate REIT works:

- Property Acquisition: A REIT identifies and acquires income-generating properties such as office buildings, shopping centers, apartments, hotels, or industrial facilities. The properties are carefully selected based on various factors like location, potential for rental income, and growth prospects.

- Rental Income: Once the properties are acquired, the tenants occupying the spaces pay rent to the REIT. This rental income becomes one of the primary sources of revenue for the REIT.

- Diversification: One of the key advantages of investing in a REIT is diversification. Most REITs own multiple properties across different sectors or geographic locations. This diversification helps spread risk by reducing exposure to any single property or market segment.

- Distribution of Income: By law, most REITs are required to distribute at least 90% of their taxable income as dividends to shareholders. These dividends are typically paid out quarterly or monthly and provide investors with regular cash flow.

- Shareholder Ownership: Investors can purchase shares in a publicly traded REIT through stock exchanges just like any other publicly traded company. Each share represents ownership in the underlying portfolio of real estate assets held by the REIT.

- Professional Management: A team of experienced professionals manages the day-to-day operations of the REIT, including property maintenance, tenant management, lease agreements, and financial reporting.

- Liquidity: Unlike direct ownership of physical properties that can be challenging to sell quickly if needed, investing in publicly traded REITs offers liquidity. Investors have the ability to buy or sell shares on stock exchanges easily.

- Capital Appreciation: As the value of the underlying properties owned by the REIT appreciates over time, the market price of the REIT’s shares may also increase. This potential for capital appreciation allows investors to benefit from the growth in real estate values.

- Regulatory Compliance: To qualify as a REIT, companies must comply with specific requirements set by tax authorities, such as distributing a significant portion of income to shareholders and investing a minimum percentage of assets in real estate.

- Types of REITs: There are different types of REITs, including equity REITs that own and operate income-generating properties, mortgage REITs that invest in real estate mortgages or mortgage-backed securities, and hybrid REITs that combine elements of equity and mortgage REITs.

It’s important to note that investing in a REIT carries risks, including fluctuations in property values, interest rates, and overall market conditions. Investors should conduct thorough research, evaluate the financial stability and performance of the REIT, and consider their own investment goals before making any investment decisions.

Disclaimer: The information provided here is for informational purposes only and should not be considered as financial or investment advice. Always conduct thorough research and consult with a qualified professional before making any investment decisions.

Are REITs a good way to invest in real estate?

REITs can be a good way to invest in real estate, but it ultimately depends on your investment goals, risk tolerance, and financial situation. Here are some factors to consider when evaluating whether REITs are a suitable investment for you:

Accessibility: REITs offer a more accessible entry point into real estate investing compared to direct property ownership. They allow individuals to invest in a diversified portfolio of income-generating properties without the need for significant capital or expertise.

Diversification: Investing in REITs provides diversification benefits by spreading investments across various types of real estate assets, sectors, and geographic locations. This can help mitigate risk by reducing exposure to any single property or market segment.

Liquidity: Publicly traded REITs offer liquidity as they can be bought or sold on stock exchanges easily. This provides flexibility to adjust your investment portfolio according to changing market conditions or personal financial goals.

Income Potential: Most REITs are required by law to distribute a significant portion of their taxable income as dividends to shareholders. This means that investors can potentially receive regular income from rental payments collected by the REIT.

Growth Opportunities: As the real estate market appreciates over time, the underlying properties owned by REITs may also increase in value, leading to capital gains for investors when they sell their shares. Some REITs actively engage in property development and redevelopment projects, further enhancing growth potential.

However, it’s important to note that investing in REITs also comes with certain considerations:

Market Volatility: Like any investment, REITs can be subject to market fluctuations and volatility. Real estate markets can be influenced by economic conditions, interest rates, and other factors that may impact the performance of REIT investments.

Management Risk: The success of a REIT largely depends on the expertise and management capabilities of its team. It’s crucial to research and evaluate the track record, experience, and financial stability of the REIT’s management before investing.

Interest Rate Sensitivity: REITs can be sensitive to changes in interest rates. Rising interest rates may increase borrowing costs for REITs and impact their profitability.

Tax Considerations: While REIT dividends are typically taxed at the individual level, they may have different tax implications compared to other types of investments. It’s advisable to consult with a tax professional to understand the tax implications specific to your situation.

As with any investment, it’s important to conduct thorough research, assess your risk tolerance, and consider your overall investment strategy before investing in REITs or any other asset class. Consulting with a financial advisor or professional can provide valuable guidance tailored to your specific circumstances.

What are REITs in real estate?

REITs, or Real Estate Investment Trusts, are companies that own, operate, or finance income-generating real estate assets. They provide individuals with the opportunity to invest in real estate without directly owning or managing properties. REITs were created by the U.S. Congress in 1960 to allow small investors to access the benefits of real estate ownership through a publicly traded investment vehicle.

To qualify as a REIT, a company must meet certain requirements set by tax laws. These requirements include distributing at least 90% of their taxable income as dividends to shareholders and investing at least 75% of their total assets in real estate-related activities. By meeting these criteria, REITs are exempt from corporate income taxes and can pass on most of their earnings to investors.

There are different types of REITs that focus on various sectors within the real estate market. Some examples include:

Equity REITs: These REITs primarily own and operate income-generating properties such as office buildings, shopping centers, apartments, hotels, industrial facilities, and healthcare facilities. They generate revenue from rental income collected from tenants.

Mortgage REITs: Unlike equity REITs that own properties directly, mortgage REITs invest in mortgages or mortgage-backed securities. They earn income through interest payments received from borrowers.

Hybrid REITs: These REITs combine elements of both equity and mortgage REITs by investing in both properties and mortgages.

Investing in REITs offers several advantages for individuals looking to participate in the real estate market:

Diversification: By pooling funds from multiple investors and owning multiple properties across different sectors or geographic locations, REIT investments offer diversification benefits that can help reduce risk.

Income Generation: Most REITs distribute a significant portion of their taxable income as dividends to shareholders on a regular basis. This provides investors with potential steady cash flow.

Liquidity: REITs are publicly traded on stock exchanges, allowing investors to buy and sell shares easily. This provides liquidity and flexibility compared to direct real estate ownership.

Professional Management: REITs are managed by experienced professionals who handle property acquisition, leasing, maintenance, and other operational aspects. Investors can benefit from the expertise of these professionals without the need for direct involvement.

It’s important to note that investing in REITs carries its own risks and considerations. Factors such as market conditions, interest rates, property performance, and management quality can impact the performance of REIT investments. As with any investment decision, it is advisable to conduct thorough research and consult with a financial advisor before investing in REITs or any other investment vehicle.

Tags: accessibility, apartments, appreciate over time, assets, company, direct ownership, diversified portfolio, finances, hotels, income-generating properties, investment vehicle, investors, office buildings, operates, owns, participate, pooling funds, real estate investment trusts, real estate market, reit, reit real estate, rental income, revolutionized, shopping centers, smaller amounts of money