The DST 1031 Exchange: A Powerful Tool for Real Estate Investors

Real estate investment can be a lucrative venture, but it also comes with its fair share of challenges. One such challenge is the capital gains tax that investors face when selling a property. However, there is a powerful tool available to investors called the DST 1031 exchange, which provides a tax-deferred solution and opens up new opportunities for growth and diversification.

What is a DST 1031 exchange?

A DST 1031 exchange, also known as a Delaware Statutory Trust 1031 exchange, allows real estate investors to defer their capital gains tax by reinvesting the proceeds from the sale of one property into another “like-kind” property. This exchange is made possible under Section 1031 of the Internal Revenue Code.

Unlike traditional real estate investments where investors directly own and manage properties, a DST allows investors to pool their funds with other investors to acquire fractional ownership in larger, institutional-grade properties. These properties can include apartment complexes, office buildings, retail centers, or even industrial warehouses.

The benefits of a DST 1031 exchange

There are several benefits associated with utilizing a DST 1031 exchange:

- Tax deferral: The primary advantage of a DST 1031 exchange is the ability to defer capital gains taxes on the sale of an investment property. By reinvesting in another “like-kind” property within specific timeframes, investors can potentially defer their tax liability indefinitely.

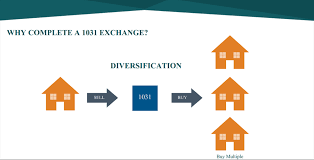

- Diversification: Through a DST 1031 exchange, investors gain access to larger-scale properties that may have been otherwise unattainable individually. This diversification helps spread risk across multiple assets and markets.

- Passive income: Investing in a DST allows investors to enjoy passive income from professionally managed properties. Investors can receive regular distributions without the responsibility of day-to-day property management.

- Limited liability: By investing in a DST, investors benefit from limited liability protection. Their personal assets are shielded from potential lawsuits or other liabilities associated with the property.

Considerations for a DST 1031 exchange

While a DST 1031 exchange offers numerous advantages, it’s important to consider the following factors:

- Investment suitability: Each investor’s financial goals and risk tolerance may vary. It is crucial to assess whether a DST aligns with your investment objectives and consult with financial professionals who specialize in real estate investments.

- Due diligence: Thoroughly research the DST sponsor, their track record, and the specific property being considered. Understanding the potential risks, projected returns, and any associated fees is essential before making an investment decision.

- Timing and deadlines: The IRS imposes strict timelines for completing a 1031 exchange. It is crucial to adhere to these deadlines to qualify for tax deferral benefits.

In conclusion

A DST 1031 exchange provides real estate investors with an opportunity to defer capital gains taxes while diversifying their portfolio through fractional ownership of larger-scale properties. It offers passive income potential and limited liability protection. However, it is vital to conduct thorough due diligence and seek professional advice before proceeding with a DST 1031 exchange. By leveraging this powerful tool, investors can potentially optimize their returns and achieve long-term financial success in the real estate market.

5 Essential Tips for Navigating a DST 1031 Exchange Successfully

- 1. Understand the basics

- 2. Research reputable DST sponsors

- 3. Diversify your investments

- 4. Evaluate potential cash flow

- 5. Consult with professionals

1. Understand the basics

To successfully navigate a DST 1031 exchange, it is crucial to start by understanding the basics. Familiarize yourself with the concept of a 1031 exchange and how it can defer capital gains taxes. Learn about the requirements and timeframes set by the IRS for qualifying exchanges. Gain knowledge about the role of Delaware Statutory Trusts (DSTs) in facilitating these exchanges and how they offer fractional ownership in larger properties. By grasping these fundamental principles, you lay a solid foundation for making informed decisions and maximizing the benefits of a DST 1031 exchange.

2. Research reputable DST sponsors

When considering a DST 1031 exchange, it is crucial to thoroughly research reputable DST sponsors. The sponsor plays a significant role in the success of the investment and its ability to deliver on projected returns. Look for sponsors with a proven track record of successfully managing DST properties and delivering consistent results. Evaluate their experience, expertise, and financial stability. Additionally, consider their communication style and transparency in providing information about the properties and investment opportunities. By conducting thorough research on reputable DST sponsors, investors can make informed decisions and enhance their chances of a successful exchange.

3. Diversify your investments

Diversifying your investments is a crucial tip when considering a DST 1031 exchange. By spreading your investment across multiple properties or asset classes, you reduce the risk associated with having all your eggs in one basket. A DST 1031 exchange enables you to access larger-scale properties that may have been unattainable individually, allowing for greater diversification. This diversification can help protect your investment portfolio from potential market fluctuations and provide opportunities for long-term growth and stability. It is important to carefully evaluate different property options and consult with professionals to ensure that your diversified investments align with your financial goals and risk tolerance.

4. Evaluate potential cash flow

When considering a DST 1031 exchange, it is crucial to evaluate the potential cash flow of the investment. This involves analyzing the projected income from the property and comparing it to any associated expenses, such as property management fees, maintenance costs, and taxes. By carefully assessing the cash flow potential, investors can ensure that the investment aligns with their financial goals and provides a steady stream of passive income. Additionally, evaluating cash flow helps investors make informed decisions about whether the investment will generate sufficient returns to meet their expectations and cover any ongoing expenses.

5. Consult with professionals

When considering a DST 1031 exchange, it is highly recommended to consult with professionals who specialize in real estate investments and tax planning. These experts can provide valuable guidance and ensure that you make informed decisions throughout the exchange process. They can help assess the suitability of a DST for your investment goals, conduct thorough due diligence on potential properties and sponsors, and navigate the complex rules and deadlines set by the IRS. By seeking professional advice, you can maximize the benefits of a DST 1031 exchange and minimize potential risks, ultimately setting yourself up for a successful and tax-efficient investment strategy.

Tags: apartment complexes, capital gains tax, challenges, delaware statutory trust 1031 exchange, diversification, dst, dst 1031 exchange, due diligence timing and deadlines, fractional ownership, growth, industrial warehouses, institutional-grade properties, internal revenue code, like-kind property, office buildings, own and manage properties, passive income, pool funds, powerful tool, real estate investors, retail centers, section 1031, tax-deferred solution, traditional real estate investments