The Role of a Brokerage House in the Financial Market

A brokerage house, also known as a brokerage firm or simply a broker, plays a crucial role in the functioning of the financial market. It acts as an intermediary between buyers and sellers, facilitating the smooth execution of various financial transactions.

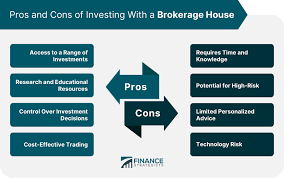

One of the primary functions of a brokerage house is to provide a platform for investors to buy and sell various types of securities, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Through their trading platforms, brokers enable individuals and institutional investors to access financial markets and execute trades efficiently.

Brokerage houses offer their clients access to real-time market data, research reports, and analysis tools that assist investors in making informed decisions. These resources help investors evaluate investment opportunities, monitor market trends, and manage their portfolios effectively.

In addition to executing trades on behalf of clients, brokerage houses often provide additional services such as wealth management, financial planning advice, retirement planning assistance, and tax planning strategies. These services cater to investors who seek comprehensive guidance in managing their finances and achieving their long-term financial goals.

Brokerage firms also play a critical role in initial public offerings (IPOs) by underwriting new securities issuances. They assess the value of the securities being offered and help companies determine an appropriate price range for their IPO. Additionally, brokerage houses distribute IPO shares to individual investors or institutional clients who wish to participate in these offerings.

Regulatory compliance is another significant aspect of brokerage houses’ responsibilities. They must adhere to strict rules and regulations imposed by government authorities to protect investor interests. Compliance departments within brokerage firms ensure that all transactions are conducted within legal boundaries while maintaining transparency and fairness.

It’s important for individuals considering engaging with a brokerage house to carefully evaluate factors such as reputation, fees, customer service, and the range of services offered. Different brokerage firms may have varying fee structures, account minimums, and investment options. Investors should also assess the quality of research and educational resources provided by the firm to ensure they align with their investment needs.

In conclusion, a brokerage house serves as a vital link between investors and financial markets. By providing access to trading platforms, research tools, and additional services, these firms empower investors to participate in the financial market effectively. Whether individuals seek assistance with executing trades or comprehensive wealth management advice, brokerage houses play a crucial role in helping investors navigate the complexities of the financial world.

5 Essential Tips for Choosing the Right Brokerage House for Your Investment Goals

- Research and compare different brokerage houses to find one that suits your investment needs.

- Consider the fees and commissions charged by each brokerage house to ensure they align with your budget.

- Check if the brokerage house offers a wide range of investment options, such as stocks, bonds, mutual funds, and ETFs.

- Look for a brokerage house that provides reliable customer support and user-friendly online trading platforms.

- Before making any investment decisions, carefully read and understand the terms and conditions provided by the brokerage house.

Research and compare different brokerage houses to find one that suits your investment needs.

When it comes to choosing a brokerage house, it’s essential to conduct thorough research and compare different options to find the one that best suits your investment needs. Take the time to evaluate factors such as reputation, fees, customer service, and the range of services offered. Consider your investment goals, trading preferences, and the level of support you require. By doing your due diligence and comparing brokerage houses, you can ensure that you select a firm that aligns with your financial objectives and provides the tools and resources necessary for successful investing.

Consider the fees and commissions charged by each brokerage house to ensure they align with your budget.

When choosing a brokerage house, it is essential to carefully consider the fees and commissions they charge to ensure they align with your budget. Different brokerage firms have varying fee structures, and these costs can significantly impact your investment returns. Take the time to understand the fee schedule, including account maintenance fees, trade commissions, and any additional charges for services such as research or advisory assistance. By comparing the fee structures of different brokerage houses, you can make an informed decision that suits your financial goals and investment strategy while ensuring that you are comfortable with the costs involved.

Check if the brokerage house offers a wide range of investment options, such as stocks, bonds, mutual funds, and ETFs.

When considering a brokerage house, it is essential to check if they offer a wide range of investment options. A reputable brokerage firm should provide access to various investment instruments, including stocks, bonds, mutual funds, and ETFs. This diversity allows investors to build a well-rounded portfolio that aligns with their financial goals and risk tolerance. By offering a comprehensive selection of investment options, the brokerage house ensures that clients have the flexibility to diversify their holdings and capitalize on different market opportunities.

Look for a brokerage house that provides reliable customer support and user-friendly online trading platforms.

When choosing a brokerage house, it is essential to prioritize reliable customer support and user-friendly online trading platforms. A brokerage firm that offers excellent customer support ensures that you have access to assistance whenever you need it. Whether you have questions about your account, need technical guidance, or require help with executing trades, responsive customer support can make a significant difference. Additionally, user-friendly online trading platforms are crucial for seamless and efficient trading experiences. Intuitive interfaces, comprehensive research tools, and easy navigation contribute to a positive trading experience. By selecting a brokerage house that prioritizes reliable customer support and user-friendly platforms, you can feel confident in your ability to navigate the financial markets effectively.

Before making any investment decisions, carefully read and understand the terms and conditions provided by the brokerage house.

Before making any investment decisions, it is crucial to take the time to carefully read and fully understand the terms and conditions provided by the brokerage house. These terms and conditions outline important details regarding fees, account minimums, trading policies, and other relevant information that may impact your investment experience. By thoroughly reviewing these documents, you can ensure that you are well-informed about the services offered by the brokerage house and any potential risks involved. This knowledge will enable you to make informed investment decisions that align with your financial goals and risk tolerance.

Tags: analysis tools, bonds, brokerage house, buyers, exchange-traded funds etfs, financial market, financial planning advice, government authorities, initial public offerings ipos, intermediary, investment opportunities, investors, market data, market trends, mutual funds, portfolios, regulatory compliance, reputation, research reports, retirement planning assistance, securities, sellers, stocks, tax planning strategies, trading platforms, transactions, underwriting new securities issuances, wealth management