Buying a Home: A Guide to Making the Right Investment

Buying a home is one of the most significant financial decisions most people make in their lifetime. It’s not just about finding a place to live; it’s about making an investment that can have long-term benefits. Whether you’re a first-time buyer or an experienced investor, here are some essential factors to consider when buying a home.

Location, location, location – This age-old real estate mantra holds true even today. The location of your potential home plays a crucial role in determining its value and future growth potential. Consider factors such as proximity to schools, workplaces, amenities, and transportation options. Research the neighborhood’s safety, community spirit, and future development plans to ensure it aligns with your lifestyle and investment goals.

Budget wisely – Before embarking on your home-buying journey, establish a realistic budget. Take into account not just the purchase price but also additional costs like property taxes, insurance, maintenance expenses, and potential renovations or upgrades. Consult with financial experts or mortgage lenders to determine how much you can comfortably afford without compromising your financial stability.

Get pre-approved for a mortgage – Obtaining pre-approval for a mortgage is highly recommended before starting your search. This step will give you a clear understanding of how much you can borrow from lenders based on your financial situation and creditworthiness. Pre-approval not only strengthens your negotiating power but also helps streamline the buying process once you find your dream home.

Consider your long-term plans – Think beyond the present moment when evaluating potential homes. Consider your future plans and how well the property aligns with them. Are you planning to start or expand your family? Do you anticipate changing jobs or retiring soon? These factors can influence the size, layout, and overall suitability of the property for years to come.

Work with professionals – Buying a home involves complex legal processes and negotiations that require expertise. Engage professionals such as real estate agents, home inspectors, and attorneys to guide you through the transaction. Their experience and knowledge can help you navigate potential pitfalls and ensure a smooth and successful purchase.

Inspect the property – Never underestimate the importance of a thorough home inspection. Hire a qualified inspector to assess the condition of the property, including its structural integrity, electrical systems, plumbing, and any potential issues that may require attention or repairs. Understanding the true condition of the property can help you make an informed decision and avoid costly surprises down the road.

Trust your instincts – While it’s crucial to analyze data, statistics, and expert opinions during your home-buying process, don’t discount your gut feeling. If a property feels right for you and meets most of your criteria, it may be worth considering even if it doesn’t tick every box on your checklist.

Buying a home is an exciting journey filled with possibilities. By carefully considering these factors and working with professionals who have your best interests at heart, you can make a confident decision that not only fulfills your immediate needs but also sets you up for long-term success in homeownership. Remember, buying a home is not just about acquiring property; it’s about investing in your future.

Answers to Your Top 5 Questions About Buying

- How do I buy something?

- Where can I buy it?

- What is the best place to buy it?

- How much does it cost to buy it?

- Is there a discount when I buy more than one item?

How do I buy something?

Buying something can be a straightforward process, especially with the convenience of online shopping. Here are some general steps to guide you through the buying process:

- Determine what you want to buy: Identify the item or service you wish to purchase. Consider your needs, preferences, and budget.

- Research and compare: Take the time to research different options available in the market. Read product reviews, compare prices, and evaluate features or specifications to ensure you make an informed decision.

- Find a reputable seller: Look for trusted sellers or retailers that offer reliable products and quality customer service. Check reviews and ratings from other buyers to gauge their reputation.

- Make your purchase: Once you have chosen a seller, proceed with making your purchase. If buying online, add the item to your cart and proceed to checkout. Provide necessary information such as shipping address and payment details.

- Payment: Choose a payment method that is secure and convenient for you. Common options include credit/debit cards, PayPal, or other digital payment platforms.

- Review your order: Before finalizing the purchase, review your order details carefully, including quantity, size (if applicable), color (if applicable), and any additional options or accessories.

- Place your order: Confirm your purchase by clicking the “Place Order” button or similar action on the website or app.

- Track your order: If applicable, track your order using any tracking information provided by the seller or retailer. This will help you stay updated on its status and estimated delivery date.

- Receive and inspect the item: Once your order arrives, inspect it carefully to ensure it matches what you purchased and is in good condition.

- Contact customer support if needed: If there are any issues with your purchase (e.g., wrong item received, damaged goods), contact customer support promptly for assistance in resolving the matter.

Remember that specific steps may vary depending on where and what you are buying. Always review the seller’s terms and conditions, return policy, and any applicable warranties before making a purchase.

Where can I buy it?

To purchase a home, you have several options available to you. Here are some common avenues for buying a property:

- Real Estate Agencies: Contact local real estate agencies in your area. They have access to listings and can help match you with properties that meet your criteria. Real estate agents are knowledgeable about the market, negotiate on your behalf, and guide you through the buying process.

- Online Real Estate Platforms: Explore online platforms such as Zillow, Realtor.com, Redfin, or Trulia. These websites provide comprehensive listings with detailed information about properties for sale. You can filter your search based on location, price range, amenities, and more.

- Auctions: Keep an eye out for property auctions in your area. Auctions can offer opportunities to purchase homes at competitive prices. Research local auction houses or online platforms that specialize in real estate auctions.

- For Sale by Owner (FSBO): Some homeowners choose to sell their properties directly without involving a real estate agent. Look for “For Sale by Owner” signs or websites dedicated to FSBO listings.

- Networking: Spread the word among friends, family, and colleagues that you are looking to buy a home. Sometimes the best opportunities arise through personal connections or word-of-mouth referrals.

Remember that buying a home is a significant decision, so it’s essential to approach the process with careful consideration and seek professional advice when needed.

What is the best place to buy it?

Determining the “best” place to buy a home depends on various factors that are specific to your preferences and needs. Here are some considerations to help you identify the ideal location for your home purchase:

- Research local real estate markets: Explore different regions, cities, or neighborhoods to understand their current real estate market conditions. Look for areas with stable or growing property values, low crime rates, and a strong job market.

- Lifestyle and amenities: Consider what amenities and features are important to you. Are you looking for proximity to schools, parks, shopping centers, or recreational facilities? Assess whether the potential location aligns with your desired lifestyle and offers the conveniences you seek.

- Commute and transportation: Evaluate the accessibility of transportation options in the area. Consider proximity to major highways, public transportation systems like buses or trains, and commuting distance to your workplace or other frequently visited destinations.

- Schools and education: If you have children or plan to start a family in the future, research the quality of schools in the area. Look into school district rankings, availability of educational resources, extracurricular activities, and other factors that contribute to a well-rounded education.

- Future development plans: Investigate any future development projects planned for the area. Urban renewal initiatives or infrastructure improvements can positively impact property values over time.

- Affordability: Analyze housing affordability in different locations based on your budget and financial goals. Compare average home prices, property taxes, insurance rates, and cost of living between potential areas.

- Climate and environment: Take into account climate conditions that suit your preferences. Consider factors such as temperature range, rainfall levels, natural disasters (if applicable), and proximity to bodies of water or natural attractions.

- Community atmosphere: Visit potential neighborhoods during different times of day to get a sense of their atmosphere and community spirit. Engage with locals if possible to gather insights about the area’s culture, events, and sense of belonging.

Ultimately, the best place to buy a home is subjective and depends on your unique circumstances and priorities. It’s essential to conduct thorough research, visit potential locations, and consult with real estate professionals who can provide valuable guidance based on your specific needs and preferences.

How much does it cost to buy it?

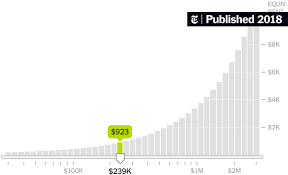

The cost of buying a home can vary significantly depending on various factors such as location, size, condition, and market conditions. It’s important to consider not just the purchase price but also additional expenses involved in the home-buying process. Here are some costs to keep in mind:

- Down Payment: This is the initial payment made towards the purchase of a home and is typically a percentage of the total purchase price. The down payment amount can vary but is often around 10-20% of the home’s value.

- Closing Costs: These are fees associated with finalizing the sale and transferring ownership of the property. Closing costs typically include expenses such as appraisal fees, title insurance, attorney fees, loan origination fees, and property taxes. Closing costs can range from 2-5% of the purchase price.

- Mortgage Loan: If you require financing to purchase a home, you’ll need to consider mortgage-related costs. These may include application fees, credit report fees, appraisal fees, and potentially mortgage insurance premiums if your down payment is less than 20% of the purchase price.

- Home Inspection: It’s highly recommended to have a professional home inspection before purchasing a property to identify any potential issues or repairs needed. The cost of a home inspection can range from a few hundred to several hundred dollars depending on factors such as location and property size.

- Moving Expenses: Don’t forget to budget for moving expenses such as hiring movers or renting a moving truck if needed.

- Ongoing Costs: After purchasing a home, there will be ongoing costs to consider such as homeowners’ insurance, property taxes, maintenance expenses (repairs, renovations), utilities (electricity, water), and possibly homeowner association (HOA) fees if applicable.

It’s important to note that these figures are general estimates and can vary based on individual circumstances and local market conditions. To get an accurate idea of the total cost of buying a specific property, it’s recommended to consult with a real estate agent, mortgage lender, or financial advisor who can provide personalized information based on your unique situation.

Is there a discount when I buy more than one item?

Thank you for your interest! At Robert Norat Realty, we don’t offer physical items for sale, but rather provide real estate services. As a real estate agency, our pricing structure is based on the specific properties and services we offer to our clients. Each property is unique and priced individually based on its market value and other factors.

However, it’s worth noting that negotiations are common in real estate transactions. Depending on the circumstances and the seller’s willingness, there may be room for negotiation on the purchase price or other terms of the deal. This can vary from property to property and is typically discussed during the negotiation process.

If you have any specific questions or would like more information about a particular property or service we offer, please feel free to reach out to us. Our team will be happy to assist you and provide any necessary details regarding pricing or potential discounts available.

Tags: additional costs, amenities, budget wisely, buy, community spirit, essential factors, experienced investor, financial decisions, first-time buyer, future development plans, future growth potential, guide, lifetime, location, long-term benefits, neighborhood's safety, place to live, property taxes, proximity to schools, purchase price, real estate mantra, realistic budget, right investment, transportation options, value, workplaces