The Advantages of Cash Flow Rental Property

Investing in cash flow rental property can be a lucrative and rewarding endeavor for individuals seeking to build wealth and generate passive income. Cash flow rental properties are real estate investments that produce positive cash flow after all expenses have been paid, including mortgage payments, property taxes, insurance, and maintenance costs.

There are several advantages to investing in cash flow rental property:

- Steady Income: Cash flow rental properties provide investors with a steady stream of income each month, which can help supplement their primary source of income or serve as a primary source of income in retirement.

- Appreciation Potential: In addition to generating monthly cash flow, rental properties also have the potential to appreciate in value over time, allowing investors to build equity and increase their overall net worth.

- Tax Benefits: Rental property owners may be eligible for various tax benefits, including deductions for mortgage interest, property taxes, insurance premiums, maintenance expenses, and depreciation.

- Diversification: Investing in cash flow rental property can help diversify an investment portfolio and reduce risk by spreading assets across different asset classes.

- Control Over Investment: Unlike other investment vehicles like stocks or mutual funds, owning rental property gives investors more control over their investment decisions, such as choosing tenants, setting rental rates, and managing property maintenance.

Before investing in cash flow rental property, it is essential to conduct thorough research, analyze market trends, assess potential risks and returns, and develop a comprehensive financial plan. Working with a knowledgeable real estate agent or property management company can also help streamline the investment process and maximize returns.

In conclusion, cash flow rental property offers investors an opportunity to generate passive income, build equity, enjoy tax benefits, diversify their investment portfolio, and maintain control over their investments. With careful planning and due diligence, investing in cash flow rental property can be a rewarding long-term strategy for building wealth and financial security.

Unlocking Rental Property Profits: Understanding Average Cash Flow, Monthly Earnings, and Optimal Cash Flow Metrics

- What is the average cash flow on a property?

- How much monthly profit should you make on a rental property?

- What is a good cash flow on a rental property?

What is the average cash flow on a property?

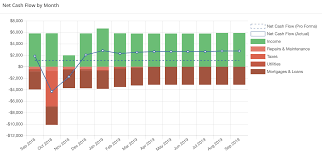

The average cash flow on a rental property can vary significantly depending on various factors such as location, property type, market conditions, rental rates, expenses, and financing terms. Typically, investors aim for a positive cash flow, where the rental income exceeds all expenses associated with the property, including mortgage payments, property taxes, insurance, maintenance costs, and vacancy rates. The average cash flow percentage can range from 6% to 12% of the property’s purchase price annually. However, it is crucial for investors to conduct thorough financial analysis and due diligence to determine the specific cash flow potential of a property before making an investment decision.

How much monthly profit should you make on a rental property?

When determining how much monthly profit you should make on a rental property, several factors come into play. The ideal monthly profit will vary depending on factors such as the property’s location, market conditions, rental demand, operating expenses, mortgage payments, and your investment goals. As a general guideline, many real estate investors aim for a monthly profit that covers all expenses related to the property and provides a reasonable return on their investment. It is essential to conduct a thorough financial analysis and consider both short-term cash flow and long-term appreciation potential when setting your target monthly profit for a rental property.

What is a good cash flow on a rental property?

When considering what constitutes a good cash flow on a rental property, it is crucial to assess various factors such as location, market conditions, property type, expenses, and financing terms. Generally, a good cash flow on a rental property is one that generates enough income to cover all operating expenses and debt service while still providing a profit for the investor. A common benchmark is aiming for a positive cash flow that exceeds the monthly mortgage payment by a comfortable margin to account for unforeseen expenses and vacancies. Ultimately, what constitutes a good cash flow can vary depending on individual investment goals, risk tolerance, and market dynamics. Conducting thorough financial analysis and consulting with real estate professionals can help investors determine what constitutes a good cash flow for their specific rental property investment.

Tags: advantages, appreciation potential, average cash flow, cash flow percentage, cash flow rental property, control over investment, diversification, monthly profit, rental property, steady income, tax benefits