Exploring Alternative Real Estate Investments

When it comes to investing in real estate, most people think of buying residential properties or investing in commercial real estate. However, there are alternative real estate investment opportunities that can offer diversification and potentially higher returns. Let’s explore some of these alternative options:

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their funds together to invest in properties. This option provides access to real estate investments with lower capital requirements and the ability to diversify across different projects.

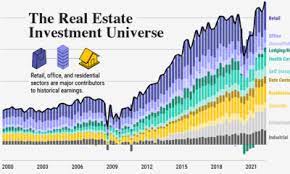

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate across a range of sectors. Investing in REITs provides liquidity, diversification, and the opportunity to earn dividends without directly owning physical properties.

Real Estate Limited Partnerships

Real estate limited partnerships involve investors contributing capital to a partnership managed by a general partner who oversees property acquisition and management. Limited partners receive returns based on the performance of the partnership.

Real Estate Notes

Investing in real estate notes involves purchasing debt secured by real estate properties. Investors can earn interest income or potentially acquire the underlying property through foreclosure if the borrower defaults.

Vacation Rentals

Owning vacation rental properties can be a lucrative alternative investment option, especially in popular tourist destinations. Investors can generate rental income from short-term stays while also enjoying personal use of the property.

In conclusion, alternative real estate investments offer unique opportunities for diversification and potentially higher returns compared to traditional property ownership. Before venturing into these options, it’s essential to conduct thorough research, assess risks, and consult with financial advisors to make informed investment decisions.

Exploring Alternative Real Estate Investments: Types, Examples, and Profitability Insights

- What are at least 3 types of real estate investments?

- What are 4 examples of alternative investments?

- What are alternative investments in real estate?

- What is the most profitable type of real estate investment?

What are at least 3 types of real estate investments?

When exploring alternative real estate investments, investors often inquire about the various types available. Three common options include real estate crowdfunding, which allows pooling of funds for property investments; Real Estate Investment Trusts (REITs), providing access to diversified real estate portfolios; and Real Estate Limited Partnerships, where investors contribute capital to a partnership managed by a general partner for property acquisition and management. Each of these investment types offers unique benefits and considerations, catering to different investment preferences and risk profiles.

What are 4 examples of alternative investments?

When exploring alternative investments in real estate, four examples stand out as compelling options for diversification and potential returns. Real estate crowdfunding platforms enable investors to participate in property projects with lower capital requirements and increased diversification. Real Estate Investment Trusts (REITs) offer the opportunity to invest in a portfolio of income-generating properties without direct ownership. Real estate limited partnerships involve pooling capital with a general partner to invest in real estate ventures, providing passive income opportunities. Lastly, investing in real estate notes by purchasing debt secured by properties can yield interest income or potential property acquisition through foreclosure. These alternative investment avenues offer unique ways to engage with the real estate market beyond traditional ownership models.

What are alternative investments in real estate?

Alternative investments in real estate refer to non-traditional ways of investing in the real estate market beyond owning physical properties. These alternatives can include options such as real estate crowdfunding, real estate investment trusts (REITs), real estate limited partnerships, real estate notes, and vacation rentals. These investment avenues provide investors with opportunities for diversification, potentially higher returns, and varying levels of risk compared to traditional property ownership. By exploring alternative investments in real estate, investors can access a broader range of options to build their investment portfolios and achieve their financial goals.

What is the most profitable type of real estate investment?

When considering alternative real estate investments, one frequently asked question is, “What is the most profitable type of real estate investment?” While profitability can vary based on market conditions and individual preferences, some investors find that certain options, such as real estate crowdfunding or investing in high-demand rental properties in growing markets, can offer attractive returns. It’s essential for investors to conduct thorough research, assess their risk tolerance, and consider factors like location, property type, and investment horizon to determine the most suitable and potentially profitable real estate investment strategy for their financial goals.

Tags: alternative real estate investments, real estate crowdfunding, real estate investment trusts reits, real estate limited partnerships, real estate notes, vacation rentals