Understanding the 1031 DST Exchange in Real Estate

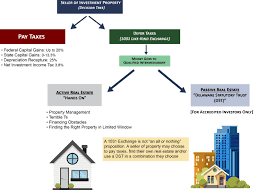

When it comes to real estate investments, one strategy that investors often consider is a 1031 DST exchange. A 1031 DST exchange, also known as a Delaware Statutory Trust exchange, allows investors to defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into another like-kind property.

The key benefit of a 1031 DST exchange is the ability to defer paying capital gains taxes, which can result in significant savings and allow investors to keep more of their profits working for them. This exchange is governed by Section 1031 of the Internal Revenue Code and has specific rules and timelines that must be followed to qualify for tax deferral.

Investors looking to participate in a 1031 DST exchange must work with a qualified intermediary who will facilitate the transaction and ensure compliance with IRS regulations. The intermediary holds the proceeds from the sale of the relinquished property and uses them to acquire replacement properties on behalf of the investor.

Delaware Statutory Trusts are a popular choice for investors participating in a 1031 exchange because they offer fractional ownership of institutional-quality properties without the responsibilities of active management. This structure provides diversification, potential for stable income, and access to larger commercial properties that may be out of reach for individual investors.

It’s important for investors considering a 1031 DST exchange to conduct thorough due diligence on potential replacement properties and seek advice from financial and tax professionals. Understanding the risks, benefits, and requirements of this strategy is essential to making informed investment decisions.

In conclusion, a 1031 DST exchange can be a powerful tool for real estate investors seeking tax advantages and portfolio diversification. By deferring capital gains taxes through this structured exchange process, investors have the opportunity to grow their wealth while maintaining flexibility in their investment strategies.

Understanding 1031 DSTs: Key Differences, Qualifications, Fundamentals, and Investment Minimums

- What is the difference between 1031 and 1031 DST?

- Do DST qualify for a 1031 exchange?

- What is 1031 DST?

- What is the minimum investment for a 1031 DST?

What is the difference between 1031 and 1031 DST?

When discussing 1031 exchanges, a common question that arises is the difference between a traditional 1031 exchange and a 1031 DST exchange. In a traditional 1031 exchange, an investor sells a property and reinvests the proceeds into another like-kind property within a specific timeframe to defer capital gains taxes. On the other hand, a 1031 DST exchange involves investing in a Delaware Statutory Trust, which allows investors to pool their funds with other investors to own fractional interests in institutional-grade properties managed by a trustee. While both options offer tax deferral benefits, the key distinction lies in the ownership structure and management responsibilities, with a 1031 DST providing passive ownership and professional management of the property. Understanding these differences is crucial for investors seeking to make informed decisions about their real estate investment strategies.

Do DST qualify for a 1031 exchange?

One frequently asked question regarding 1031 DST exchanges is whether DSTs qualify for a 1031 exchange. The answer is yes, Delaware Statutory Trusts (DSTs) do qualify for a 1031 exchange. By investing in a DST as part of a 1031 exchange, investors can defer capital gains taxes on the sale of their relinquished property and potentially access institutional-quality real estate investments without the burden of active management. It’s important for investors to work with qualified professionals to ensure compliance with IRS regulations and maximize the benefits of utilizing DSTs in a 1031 exchange strategy.

What is 1031 DST?

A 1031 DST, or Delaware Statutory Trust, is a tax-deferred investment strategy commonly used in real estate. It allows investors to defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into another like-kind property. By utilizing a 1031 DST exchange, investors can potentially increase their returns and grow their wealth while deferring taxes. This structured exchange process is governed by Section 1031 of the Internal Revenue Code and has specific rules and requirements that investors must adhere to in order to qualify for tax deferral benefits.

What is the minimum investment for a 1031 DST?

When considering a 1031 DST exchange, a common question that arises is, “What is the minimum investment required?” The minimum investment for a 1031 DST can vary depending on the specific DST offering. Typically, the minimum investment amount for a 1031 DST can range from $25,000 to $100,000 or more. It’s important for investors to carefully review the offering documents and consult with their financial advisors to determine the minimum investment required for a particular DST opportunity. Understanding the financial commitment needed can help investors make informed decisions about participating in a 1031 DST exchange.

Tags: 1031 dst, 1031 dst exchange, active management, capital gains taxes, commercial properties, delaware statutory trust exchange, diversification, due diligence, financial professionals, fractional ownership, institutional-quality properties, internal revenue code, investment properties, irs regulations, like-kind property, qualified intermediary, real estate, replacement properties, section 1031, stable income, tax deferral, tax professionals