Owning Commercial Real Estate: A Smart Investment Choice

When it comes to investing, commercial real estate has long been considered a lucrative and stable option. From office buildings and retail spaces to warehouses and industrial complexes, owning commercial real estate offers a range of advantages that make it an attractive investment choice for many savvy investors.

One of the key benefits of owning commercial real estate is the potential for consistent cash flow. Unlike residential properties where tenants come and go, commercial properties typically have longer lease terms, often spanning several years. This provides owners with a reliable stream of rental income, allowing them to plan their finances more effectively.

Moreover, commercial leases often include annual rent escalations, which means that as the property value appreciates over time, so does the rental income. This can lead to significant long-term returns on investment and increased cash flow for property owners.

Additionally, owning commercial real estate offers the potential for greater control over your investment compared to other asset classes. As an owner, you have the ability to make strategic decisions regarding tenant selection, lease terms, and property management. This level of control allows you to optimize your investment by attracting high-quality tenants and maximizing rental rates.

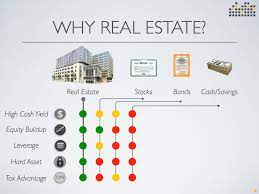

Furthermore, owning commercial real estate can provide excellent diversification within an investment portfolio. Commercial properties tend to have low correlation with other asset classes such as stocks or bonds. This means that when other investments may be experiencing volatility or downturns, commercial real estate can serve as a stable anchor in your portfolio.

Another advantage is the potential for appreciation in property value over time. Well-located and well-maintained commercial properties have historically shown strong appreciation rates. As businesses thrive and demand for prime locations increases, the value of your commercial property can rise significantly.

Moreover, unlike residential real estate where emotions often play a role in pricing negotiations, valuations in the commercial sector are primarily driven by financial factors such as net operating income (NOI) and market cap rates. This provides a more objective approach to property valuation and can lead to more favorable investment outcomes.

Lastly, owning commercial real estate offers the opportunity for tax benefits. Property owners can take advantage of deductions such as mortgage interest, property taxes, insurance premiums, and depreciation expenses. These deductions can help reduce taxable income and increase overall returns on investment.

Of course, like any investment, owning commercial real estate comes with its own set of risks and challenges. Market fluctuations, tenant turnover, and economic downturns can impact cash flow and property values. It is important to conduct thorough due diligence before making any investment decisions and work with experienced professionals who can guide you through the process.

In conclusion, owning commercial real estate can be a smart investment choice for those seeking stable cash flow, long-term appreciation potential, portfolio diversification, greater control over their investments, and tax benefits. With careful planning and a comprehensive understanding of the market dynamics, commercial real estate ownership can provide investors with a solid foundation for building wealth and achieving financial success.

7 Pros of Owning Commercial Real Estate: Unlocking Long-Term Appreciation, Tax Advantages, Stable Cash Flow, Leverage Opportunities, Diversification Benefits, Capital Preservation, and Building a Professional Network

- Potential for long-term appreciation

- Tax benefits

- Stable cash flow

- Leverage

- Diversification

- Capital preservation

- Professional network

Challenges of Owning Commercial Real Estate: A Comprehensive Overview

Potential for long-term appreciation

Potential for Long-Term Appreciation: Building Wealth through Commercial Real Estate

Investing in commercial real estate offers a unique advantage that sets it apart from many other investment options: the potential for long-term appreciation. This means that over time, the value of your commercial property can increase, allowing you to build equity and generate wealth.

Unlike some investments that may experience volatility or unpredictable returns, commercial real estate has historically shown strong appreciation rates. This is due to several factors that contribute to the growth in value over time.

Firstly, location plays a critical role in determining the value of commercial properties. Well-located properties in thriving business districts or high-demand areas tend to experience higher appreciation rates. As businesses flourish and demand for prime locations increases, the value of your commercial property can rise significantly.

Additionally, the physical condition and quality of the property itself can impact its appreciation potential. Properties that are well-maintained and offer modern amenities are more likely to attract high-quality tenants and command higher rental rates. This increased income stream can positively influence the property’s overall value.

Furthermore, economic factors such as inflation can contribute to long-term appreciation in commercial real estate. As the cost of goods and services rises over time, so does the value of real estate assets. This inflation hedge aspect of commercial real estate ownership helps protect against erosion of purchasing power and preserves wealth.

Another factor that contributes to long-term appreciation is leverage. Many investors use financing options such as mortgages to acquire commercial properties. By utilizing leverage, investors can amplify their returns on investment as property values increase over time. This allows for accelerated wealth creation through capital appreciation.

Moreover, unlike residential real estate where emotions often play a role in pricing negotiations, valuations in the commercial sector are primarily driven by financial factors such as net operating income (NOI) and market cap rates. This provides a more objective approach to property valuation and can lead to more favorable investment outcomes.

It is important to note that while the potential for long-term appreciation in commercial real estate is promising, it is not guaranteed. Market fluctuations, economic downturns, and other external factors can impact property values. Therefore, thorough research, due diligence, and market analysis are essential before making any investment decisions.

In conclusion, the potential for long-term appreciation in commercial real estate offers investors an opportunity to build equity and generate wealth over time. By carefully selecting well-located properties, maintaining and improving them, and staying informed about market trends, investors can position themselves for financial success through commercial real estate ownership.

Tax benefits

Tax Benefits: A Lucrative Advantage of Owning Commercial Real Estate

When it comes to investing in commercial real estate, one significant advantage that cannot be overlooked is the array of tax benefits it offers. Commercial properties provide investors with various deductions and incentives that can significantly reduce taxable income, resulting in substantial savings. Let’s explore how these tax benefits make owning commercial real estate a lucrative opportunity.

First and foremost, one of the major tax advantages of owning commercial real estate is the ability to deduct mortgage interest payments. Unlike residential properties, where there are limitations on the amount of mortgage interest that can be deducted, commercial property owners can usually deduct the full amount of interest paid on their loans. This deduction can lead to significant savings, especially for those who have substantial mortgage obligations.

Additionally, property taxes are another expense that can be deducted from taxable income when owning commercial real estate. These taxes can often be a considerable financial burden for property owners. However, by taking advantage of this deduction, investors can offset some of these costs and reduce their overall tax liability.

Furthermore, depreciation expenses offer yet another valuable tax benefit for commercial property owners. The government allows investors to recover the cost of their investment over time through annual depreciation deductions. This means that owners can deduct a portion of the property’s value each year as an expense against their taxable income. Depreciation not only helps offset rental income but also accounts for wear and tear on the property over its useful life.

It’s important to note that depreciation deductions are based on the building structure itself and not on land value since land does not depreciate. This distinction allows investors to maximize their tax benefits by focusing on the depreciable portion of their investment.

By taking advantage of these tax benefits, commercial real estate owners can effectively reduce their overall tax liability while generating consistent rental income from their properties. These savings can then be reinvested or used to further grow their portfolio.

However, it’s crucial to consult with tax professionals and stay up-to-date with tax regulations and laws to ensure compliance and optimize the benefits available. Tax rules can be complex, and navigating them requires expertise in the field. Seeking professional advice will help investors make informed decisions and fully capitalize on the tax advantages associated with commercial real estate ownership.

In conclusion, the tax benefits of owning commercial real estate are a compelling reason for investors to consider this asset class. The ability to deduct mortgage interest, property taxes, and depreciation expenses can result in significant savings, ultimately boosting cash flow and increasing overall returns on investment. By leveraging these tax advantages wisely, commercial real estate owners can enjoy the financial rewards while building long-term wealth.

Stable cash flow

Stable Cash Flow: A Key Advantage of Owning Commercial Real Estate

When it comes to investing in real estate, one of the most appealing benefits of owning commercial properties is the potential for stable cash flow. Unlike other investment options that may be subject to market volatility or unpredictable returns, commercial real estate offers owners a reliable and consistent source of income.

One of the primary ways commercial real estate generates cash flow is through rental payments. Commercial leases typically have longer terms compared to residential properties, often ranging from three to ten years or more. This extended lease duration provides owners with a steady stream of rental income over an extended period.

Furthermore, commercial leases often include provisions for rent escalations. These annual increases in rental rates can help owners keep up with inflation and maximize their cash flow over time. As the property value appreciates, owners can adjust rental rates accordingly, ensuring that their investment continues to generate a healthy return.

In addition to rental income, commercial properties offer various avenues for generating revenue. For instance, retail spaces can benefit from percentage-based rent agreements where tenants pay a percentage of their sales in addition to base rent. This arrangement allows property owners to share in the success of their tenants and potentially earn even higher returns.

Moreover, commercial properties may provide opportunities for additional revenue streams beyond traditional leasing arrangements. For example, owners could explore options such as installing vending machines, leasing rooftop space for advertising or telecommunication equipment, or offering parking services. These alternative revenue sources can further enhance the stability and profitability of owning commercial real estate.

The stability of cash flow in commercial real estate is also attributed to the nature of businesses occupying these spaces. Commercial tenants are typically established companies or professionals who are more likely to honor lease obligations and maintain long-term occupancy. This reduces the risk of frequent turnover and vacancies that can disrupt cash flow in residential properties.

It’s important to note that maintaining stable cash flow requires effective property management practices. Owners must ensure proper tenant screening, lease administration, and regular property maintenance to minimize potential disruptions and maximize their investment returns.

In conclusion, stable cash flow is a significant advantage of owning commercial real estate. The longer lease terms, potential for rent escalations, alternative revenue streams, and reliable tenants contribute to a consistent income stream for property owners. This stability allows investors to plan their finances more effectively and enjoy the benefits of a reliable source of income from their commercial real estate investments.

Leverage

Leverage: Maximizing Returns in Commercial Real Estate Investments

One of the key advantages of owning commercial real estate is the ability to leverage your investment. Leverage refers to the practice of using borrowed money to finance a property purchase, allowing investors to increase their returns without having to put up the full amount of cash upfront.

By utilizing leverage, commercial real estate investors can amplify their purchasing power and take advantage of opportunities that may have been otherwise out of reach. This strategy allows them to acquire larger and more valuable properties, potentially leading to higher rental income and greater appreciation over time.

The concept is relatively straightforward: instead of using solely personal funds, investors secure a loan from a financial institution or private lender to cover a portion of the property’s purchase price. The remaining amount is then covered by the investor’s own capital. This approach enables them to control a much larger asset with a smaller initial investment.

The benefits of leveraging in commercial real estate are twofold. First, it allows investors to diversify their portfolios and spread their risk across multiple properties. By using borrowed funds, they can allocate their available capital across different assets, reducing exposure to any single property or market.

Secondly, leveraging can significantly enhance investment returns. When property values appreciate over time, the return on investment (ROI) is calculated based on the total value of the property rather than just the initial equity invested. As a result, even a modest increase in property value can yield substantial gains when considering leverage.

It’s important to note that while leverage offers potential advantages, it also carries inherent risks. Higher debt levels mean increased financial obligations and interest payments. Investors must carefully assess their ability to meet these obligations and ensure that rental income covers mortgage payments while leaving room for unexpected expenses.

Moreover, leveraging should be approached with caution during periods of economic uncertainty or market volatility when rental income may be less predictable or property values could decline. Conducting thorough due diligence, understanding market dynamics, and working with experienced professionals are crucial steps in mitigating these risks.

In conclusion, leveraging is a powerful tool that allows commercial real estate investors to maximize their returns and expand their investment portfolios. By utilizing borrowed funds, investors can acquire larger properties, diversify their holdings, and benefit from potential appreciation without having to put up the full amount of cash upfront. However, it is important to exercise prudence and carefully evaluate the risks associated with leverage to ensure long-term financial success in commercial real estate investments.

Diversification

Diversification: The Power of Commercial Real Estate in Your Portfolio

When it comes to investing, diversification is often touted as a key strategy for reducing risk and maximizing returns. One effective way to achieve diversification is by including commercial real estate in your investment portfolio. Unlike stocks or bonds, commercial real estate is an asset class that offers unique advantages in terms of risk reduction and portfolio stability.

One of the primary benefits of investing in commercial real estate for diversification purposes is its low correlation with traditional financial assets. While the stock market may experience ups and downs due to various factors such as economic conditions or geopolitical events, the value of commercial properties tends to be influenced by different market dynamics.

By adding commercial real estate to your investment mix, you can reduce the overall volatility of your portfolio. This means that even if stocks are performing poorly, your commercial property investments may continue to generate stable cash flow and appreciate in value. This diversification helps to cushion your portfolio against potential losses and provides a more balanced investment strategy.

Furthermore, the income generated from commercial real estate investments tends to be relatively stable compared to other asset classes. Commercial leases typically have longer terms, often spanning several years, which provides owners with a consistent stream of rental income. This steady cash flow can help offset any fluctuations or downturns experienced in other areas of your investment portfolio.

Another advantage of diversifying into commercial real estate is the potential for long-term appreciation. Well-located and well-maintained properties have historically shown strong appreciation rates over time. As businesses thrive and demand for prime locations increases, the value of your commercial property can rise significantly.

In addition to these benefits, investing in commercial real estate also allows you to tap into specific sectors or markets that may be performing well even when others are not. For example, if retail spaces are facing challenges due to changing consumer behavior, industrial or office properties may be experiencing growth due to increased demand from e-commerce or technology companies. This flexibility allows you to capitalize on market opportunities and optimize your investment returns.

It is important to note that investing in commercial real estate does come with its own set of risks and challenges. Market fluctuations, tenant turnover, and economic downturns can impact cash flow and property values. Therefore, it is crucial to conduct thorough due diligence, work with experienced professionals, and diversify within the commercial real estate sector itself by considering different property types, locations, and tenant profiles.

In conclusion, diversifying your investment portfolio through commercial real estate offers a powerful tool for risk reduction and stability. By investing in an asset class that is not directly correlated with stocks or bonds, you can potentially enhance your overall returns while reducing the impact of market volatility. With careful consideration and professional guidance, commercial real estate can be an effective addition to your investment strategy for long-term wealth creation.

Capital preservation

Capital Preservation: A Key Advantage of Owning Commercial Real Estate

When it comes to safeguarding your investment capital during turbulent economic times, owning commercial real estate can offer a significant advantage. Commercial properties tend to exhibit a higher level of resilience compared to other asset classes, providing investors with a measure of capital preservation when stocks become volatile or decline in value due to market conditions or geopolitical events.

During economic downturns, the stock market often experiences sharp declines, causing investors to incur substantial losses. However, commercial real estate investments have historically demonstrated a more stable performance during these periods. This is due to several factors that contribute to the resilience of commercial properties.

Firstly, commercial leases are typically structured with longer terms compared to residential leases. This provides stability and ensures a consistent stream of rental income even during challenging economic conditions. Unlike residential tenants who may struggle to pay rent during financial hardships, businesses occupying commercial spaces are more likely to prioritize their lease obligations as they rely on the space for their operations.

Furthermore, commercial leases often include clauses that allow for rent escalations over time. This means that even in an economic downturn, property owners can still benefit from increasing rental income as per the terms outlined in the lease agreements. This additional income can help offset any potential decreases in property value and provide a buffer against market volatility.

Moreover, the demand for well-located and well-maintained commercial properties tends to remain relatively stable even during economic downturns. Businesses still require office spaces, retail locations, and warehouses regardless of market conditions. As such, owning prime commercial real estate can provide investors with a sense of security knowing that there will always be demand for their property.

In addition to these factors, commercial real estate values are influenced by various financial indicators such as net operating income (NOI) and market cap rates rather than purely speculative factors like emotions or investor sentiment. This fundamental approach helps mitigate the impact of short-term market volatility on property valuations, providing a more stable investment environment.

It is important to note that while commercial real estate investments can offer capital preservation benefits, they are not entirely immune to economic downturns. Market conditions and specific industry factors can still affect rental income and property values. However, the historical performance of commercial real estate during challenging economic times highlights its potential as a reliable asset class for preserving capital in the face of market turbulence.

In conclusion, owning commercial real estate provides investors with a valuable advantage in terms of capital preservation. The stability of rental income, long-term lease agreements, consistent demand for well-located properties, and the fundamental valuation approach all contribute to the resilience of commercial real estate investments during economic downturns. By diversifying their portfolios and including commercial properties, investors can enhance their ability to weather market volatility and protect their capital over the long term.

Professional network

Professional Network: Unlocking Opportunities in Commercial Real Estate

One of the often overlooked benefits of owning commercial real estate is the access it provides to a vast professional network. When you invest in commercial properties, you become part of a community that includes brokers, lenders, developers, contractors, and other industry professionals. This network can prove invaluable in maximizing your investment opportunities over time.

Building relationships within this professional network can open doors to a wealth of resources and expertise. Commercial real estate brokers, for example, have their finger on the pulse of the market and can help you identify potential investment properties that align with your goals. They have access to off-market listings and can provide valuable insights into emerging trends and market conditions.

Lenders are another crucial component of your professional network. Establishing relationships with reputable lenders who specialize in commercial real estate can give you access to favorable financing options and help streamline the loan application process. These lenders understand the unique aspects of commercial property financing and can guide you towards loan structures that best suit your investment strategy.

Developers are yet another valuable resource within your network. They possess extensive knowledge about upcoming projects, redevelopment opportunities, and areas experiencing growth potential. By connecting with developers, you may gain early insight into new developments or repositioning projects that could offer exceptional investment prospects.

Contractors and other professionals in the construction industry are also essential members of your network. When it comes to renovating or maintaining your commercial property, having trusted contractors who understand the unique requirements of commercial spaces is crucial. They can help ensure that any necessary repairs or improvements are done efficiently and cost-effectively, ultimately enhancing the value of your investment.

Moreover, being part of a professional network allows for knowledge sharing among peers and mentors who have experience navigating the complexities of commercial real estate ownership. This exchange of ideas and experiences can help broaden your understanding of the market, provide insights into successful strategies used by others, and potentially uncover new investment approaches.

Networking events, industry conferences, and online platforms dedicated to commercial real estate are great avenues to connect with professionals in the field. By actively participating in these activities, you can expand your network and forge meaningful relationships that may lead to future collaboration and investment opportunities.

In conclusion, the professional network that comes with owning commercial real estate is a valuable asset. It provides access to industry experts, resources, and opportunities that can help you maximize your investment potential. By leveraging these relationships, you can tap into a wealth of knowledge and experience that will contribute to your long-term success as a commercial property owner.

High Upfront Costs

High Upfront Costs: A Consideration in Owning Commercial Real Estate

While owning commercial real estate offers numerous advantages, it is important to acknowledge the potential drawbacks as well. One significant con to be aware of is the high upfront costs associated with purchasing commercial properties.

Unlike residential real estate, which often requires a down payment of around 20% of the property’s value, commercial real estate transactions typically demand larger initial investments. The purchase price of commercial properties can be substantially higher, and lenders may require a higher down payment percentage, typically ranging from 25% to 40%.

Moreover, commercial properties often require specialized inspections and assessments before closing the deal. These evaluations can include environmental studies, structural assessments, and zoning investigations. These additional due diligence expenses can quickly add up and further increase the upfront costs.

In some cases, investors may need to seek additional loans or secure additional capital through partnerships or other investment avenues to cover the substantial upfront expenses associated with purchasing commercial real estate. This adds an extra layer of complexity and financial commitment to the process.

It is also worth noting that ongoing expenses related to property maintenance and management should be considered when evaluating the total cost of ownership. Commercial properties generally have higher operating costs compared to residential properties due to factors such as utilities, maintenance fees, insurance premiums, property taxes, and potentially higher management fees if owners choose to outsource property management.

Despite these challenges related to high upfront costs, it is essential to recognize that they are part of the overall investment strategy for owning commercial real estate. While these initial expenses may seem daunting at first glance, they are often offset by the potential for long-term returns on investment through rental income and property appreciation.

It is crucial for prospective owners of commercial real estate to thoroughly evaluate their financial capability and conduct proper due diligence before committing to a purchase. Engaging with experienced professionals such as brokers, lenders, and attorneys can provide valuable guidance throughout this process.

In conclusion, while the high upfront costs associated with purchasing commercial real estate can be a significant con, they should be considered within the broader context of the potential benefits and returns on investment. By carefully analyzing the financial aspects and seeking professional advice, investors can make informed decisions that align with their long-term goals and risk tolerance.

Maintenance Expenses

Maintenance Expenses: A Consideration in Owning Commercial Real Estate

While owning commercial real estate offers numerous advantages, it is important to acknowledge and understand the potential drawbacks as well. One of the significant cons of owning commercial properties is the ongoing maintenance expenses that come with it.

Commercial real estate, whether it’s an office building, a retail space, or an industrial facility, requires regular maintenance and repairs to keep it in optimal condition. From routine upkeep tasks like cleaning and landscaping to more substantial repairs such as HVAC system maintenance or roof replacements, these expenses can add up over time.

Unlike residential properties where tenants are typically responsible for minor maintenance tasks, commercial leases often place the burden of maintenance on the property owner. This means that as the owner, you are responsible for ensuring that the property remains safe, functional, and visually appealing for tenants and customers.

The costs associated with maintaining a commercial property can vary depending on factors such as property size, age, location, and specific requirements. It is crucial to budget for these expenses and have a contingency plan in place to address unexpected repairs or emergencies.

Furthermore, commercial properties may require compliance with various regulations and safety standards. This might involve regular inspections, upgrades to meet code requirements, or implementing energy-efficient measures. These additional obligations can further contribute to the overall maintenance costs.

It is worth noting that failing to adequately maintain a commercial property can have negative consequences. Poorly maintained buildings may experience higher vacancy rates as tenants seek well-maintained alternatives. Additionally, neglecting necessary repairs can lead to more significant issues down the line and potentially impact the value of your investment.

To navigate this con effectively, it is advisable to work with experienced property managers or engage reliable contractors who specialize in commercial real estate maintenance. They can help develop preventive maintenance plans, manage repair projects efficiently, and provide guidance on cost-effective solutions.

In conclusion, while owning commercial real estate presents numerous advantages as an investment option, it is essential to consider the ongoing maintenance expenses associated with it. By understanding and budgeting for these costs, as well as implementing proactive maintenance strategies, property owners can minimize risks and ensure their commercial properties remain attractive, functional, and profitable in the long term.

Long-Term Commitment

Long-Term Commitment: A Consideration in Owning Commercial Real Estate

While owning commercial real estate offers numerous advantages, it is important to acknowledge the potential downsides as well. One significant con to consider is the long-term commitment that comes with owning commercial property.

Unlike other investment options that may yield quicker returns, owning commercial real estate often requires a patient approach. It can take several years to recoup the initial investment and start generating a profit from the property. This extended timeline is primarily due to factors such as property acquisition costs, ongoing maintenance expenses, and the time it takes to attract and retain tenants.

When purchasing a commercial property, there are upfront costs involved, including down payments, closing costs, and possibly renovations or improvements. These expenses can be substantial and require careful financial planning. It may take time for rental income to cover these initial investments and begin generating positive cash flow.

Additionally, finding suitable tenants for commercial properties can sometimes be a time-consuming process. Unlike residential properties that often have a larger pool of potential renters, finding businesses or organizations willing to lease commercial spaces can take longer. This is especially true if the property is located in an area with high competition or economic fluctuations.

Furthermore, maintaining and managing commercial properties can be demanding and require ongoing financial resources. Regular repairs, upgrades, insurance premiums, and property taxes all contribute to the overall cost of ownership. It’s important for owners to budget for these expenses throughout their ownership tenure.

The long-term commitment involved in owning commercial real estate also means that liquidity can be limited. Unlike stocks or bonds which can be easily bought or sold on the market, selling a commercial property may take time due to market conditions or specific buyer requirements. This lack of immediate liquidity should be taken into consideration when evaluating investment options.

Despite these challenges, many investors find that the long-term commitment associated with owning commercial real estate is outweighed by its potential rewards. With careful planning, thorough market research, and a realistic understanding of the time it takes to recoup investments, commercial property ownership can be a profitable venture.

It is crucial for prospective owners to carefully assess their financial goals, risk tolerance, and investment horizon before committing to commercial real estate. Consulting with experienced professionals in the field can provide valuable insights and help navigate the complexities of long-term ownership.

In conclusion, while the long-term commitment required in owning commercial real estate is indeed a con, it should not deter investors from exploring this asset class. With proper due diligence and realistic expectations, the potential benefits of owning commercial property can still make it an attractive investment option for those seeking stable returns over an extended period.

Risk of Vacancy

Risk of Vacancy: A Challenge in Owning Commercial Real Estate

While owning commercial real estate has numerous advantages, it’s important to acknowledge the potential challenges and risks involved. One significant concern that property owners may face is the risk of vacancy. This occurs when tenants choose not to renew their leases or decide to move out, leaving the property unoccupied and generating no income from rent payments.

The risk of vacancy can arise due to various reasons. Market conditions, changes in business strategies, or economic downturns can all impact tenants’ decisions to stay or leave a commercial property. Even with careful tenant selection and lease agreements, unforeseen circumstances can arise that result in vacancies.

When a commercial property sits vacant, it can have financial implications for the owner. Without rental income, cash flow may be disrupted, making it challenging to cover mortgage payments, maintenance costs, and other expenses associated with property ownership. Additionally, an empty property may require additional marketing efforts and investment to attract new tenants.

However, it’s essential to note that vacancy risk can be mitigated through proactive strategies. Here are a few approaches that property owners can consider:

- Tenant Retention: Building strong relationships with tenants and providing excellent customer service can increase the likelihood of lease renewals. Addressing their concerns promptly and maintaining open lines of communication helps foster long-term tenant satisfaction.

- Diversification: Owning a diversified portfolio of commercial properties across different industries and locations can help spread the risk of vacancies. If one property experiences a vacancy, income from other properties may help offset the loss.

- Marketing and Tenant Attraction: Implementing effective marketing strategies to attract new tenants is crucial when facing a potential vacancy. Utilizing various channels such as online listings, networking within relevant industries, and partnering with reputable real estate agents can help reach potential tenants efficiently.

- Lease Flexibility: Offering flexible lease terms or incentives like rent abatement or tenant improvement allowances may attract tenants and encourage lease renewals. This can be particularly beneficial in competitive markets or during economic downturns.

- Property Management: Engaging professional property management services can help ensure that vacancies are minimized and promptly addressed. Experienced property managers can actively market the property, screen potential tenants, and negotiate lease agreements to mitigate the risk of prolonged vacancy periods.

By adopting these strategies, property owners can navigate the risk of vacancy more effectively and minimize its impact on their investment returns. It’s crucial to stay informed about market trends, maintain a strong tenant-landlord relationship, and adapt to changing circumstances to optimize occupancy rates and cash flow.

While the risk of vacancy is a valid concern when owning commercial real estate, with proper planning, proactive management, and a comprehensive understanding of the market dynamics, investors can mitigate this challenge and continue to reap the benefits associated with commercial property ownership.

Regulatory Compliance

Regulatory Compliance: A Challenge in Owning Commercial Real Estate

While owning commercial real estate offers numerous advantages, it is important to acknowledge the potential challenges that come with it. One such challenge is the need to comply with regulatory requirements imposed by local authorities. These regulations cover various aspects such as safety standards, occupancy limits, environmental considerations, and more. While these regulations aim to protect the well-being of occupants and the environment, they can also add additional costs and complexities for property owners.

Maintaining compliance with safety regulations is a top priority for commercial property owners. This includes ensuring that the building meets fire codes, has proper emergency exits, fire suppression systems, and adheres to accessibility standards. Regular inspections may be required to ensure ongoing compliance, and any necessary upgrades or repairs can be costly.

Occupancy limits are another aspect of regulatory compliance that property owners must navigate. Depending on the type of commercial property and its intended use, there may be restrictions on the number of people allowed inside at any given time. This requires careful monitoring and management to avoid violations and potential penalties.

Environmental standards are also crucial considerations in commercial real estate ownership. Owners must comply with laws related to hazardous materials, waste disposal, energy efficiency, and more. Ensuring compliance often involves implementing environmentally friendly practices or making necessary upgrades to meet sustainability requirements. These initiatives can require significant investments upfront but may result in long-term cost savings.

Furthermore, keeping up with changing regulations can be a challenge in itself. Local laws regarding commercial real estate can vary from one jurisdiction to another and are subject to updates over time. Property owners must stay informed about any changes in regulations that may impact their properties and take appropriate actions to remain compliant.

The costs associated with regulatory compliance should not be overlooked when evaluating the financial feasibility of owning commercial real estate. Property owners may need to allocate funds for regular inspections, maintenance activities, upgrades or renovations required for compliance purposes, as well as potential fines or penalties resulting from non-compliance.

Despite the challenges, it is essential for commercial property owners to prioritize regulatory compliance. Not only does it ensure the safety and well-being of occupants and the surrounding environment, but it also helps maintain a positive reputation and can attract quality tenants.

Navigating regulatory compliance in commercial real estate requires careful planning, ongoing monitoring, and a proactive approach to address any necessary changes. Working with knowledgeable professionals such as property managers, legal advisors, and environmental consultants can help property owners stay on top of regulations and ensure compliance while minimizing potential risks.

In conclusion, regulatory compliance is an important aspect of owning commercial real estate. While it can add costs and complexities to property management, it is crucial for ensuring the safety of occupants, meeting environmental standards, and maintaining a positive reputation. By staying informed about local regulations and working with experienced professionals, property owners can effectively navigate these challenges while reaping the benefits of owning commercial real estate.

Tags: owning commercial real estate

Wow, wonderful blog structure! How lengthy have

you been running a blog for? you make blogging glance easy.

The overall look of your web site is wonderful, let alone the content!

You can see similar: dobry sklep and here najlepszy sklep

Thank you for your kind words! We appreciate your feedback on our blog article about owning commercial real estate. We strive to provide valuable insights and information for our readers. If you have any specific questions or topics you’d like us to cover in future articles, feel free to let us know. Also, thank you for sharing the links to other websites; we’ll be sure to check them out.

You’re so interesting! I don’t believe I have read anything like this before.

So wonderful to find someone with unique thoughts on this

topic. Seriously.. thanks for starting this up.

This site is something that is required on the internet, someone

with a little originality! I saw similar here: Najlepszy sklep

Thank you for your kind words and positive feedback! We’re glad you found our article on owning commercial real estate to be insightful and unique. It’s great to know that you appreciate the valuable information we provide. Feel free to explore more of our content related to this topic on our website. Your support is truly appreciated!

Hey there would you mind letting me know which hosting company you’re utilizing?

I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot quicker then most.

Can you suggest a good web hosting provider at a honest price?

Kudos, I appreciate it! I saw similar here: Dobry sklep

Thank you for your comment and feedback on our blog article about owning commercial real estate. We’re glad to hear that you found the content informative and engaging. In regards to your inquiry about web hosting providers, we recommend researching reputable companies that offer reliable services at competitive prices. It’s essential to consider factors such as server performance, uptime guarantees, customer support, and scalability when choosing a hosting provider for your website. Additionally, reading reviews and comparing different hosting options can help you make an informed decision. Thank you for sharing your thoughts and the link to the “Dobry sklep” website.

Hello! Do you know if they make any plugins to help with Search Engine Optimization? I’m

trying to get my blog to rank for some targeted keywords but I’m

not seeing very good success. If you know of any please share.

Cheers! You can read similar article here: Ecommerce

Thank you for your comment! When it comes to improving your blog’s Search Engine Optimization (SEO) for targeted keywords, there are indeed plugins available that can help. You may want to consider looking into SEO plugins like Yoast SEO or All in One SEO Pack, which can assist in optimizing your content for search engines. Additionally, focusing on creating high-quality and relevant content, using proper headings and meta descriptions, and building backlinks can also contribute to better ranking results. Best of luck with your SEO efforts!