The Benefits of 1031 Exchange REITs

Real Estate Investment Trusts (REITs) offer investors a unique opportunity to diversify their portfolios and generate passive income. When combined with a 1031 exchange, investors can take advantage of additional benefits that can help maximize returns and defer capital gains taxes.

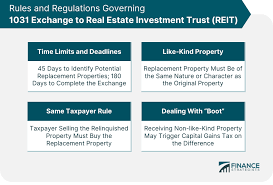

A 1031 exchange allows investors to defer paying capital gains taxes on the sale of investment properties by reinvesting the proceeds into a like-kind property. By utilizing this tax-deferred exchange, investors can potentially grow their wealth without being burdened by immediate tax liabilities.

When it comes to REITs, investors can use the funds from a sold property to invest in a REIT without triggering capital gains taxes. This strategy provides flexibility and diversification, as REITs offer exposure to different types of real estate assets such as commercial properties, residential complexes, or even infrastructure projects.

Additionally, investing in a REIT through a 1031 exchange can provide passive income streams through regular dividends paid out by the trust. This income is typically higher than what individual rental properties might generate and offers investors a hands-off approach to real estate investing.

Furthermore, REIT investments are often more liquid compared to owning physical properties, allowing investors to easily buy or sell shares on the stock market. This liquidity provides flexibility and convenience for investors looking to adjust their portfolios based on market conditions or personal financial goals.

In conclusion, combining a 1031 exchange with investments in REITs can be a powerful strategy for investors looking to grow their wealth, diversify their portfolios, and generate passive income while deferring capital gains taxes. Consult with financial advisors or real estate professionals to explore how this strategy can benefit your investment goals.

Understanding 1031 Exchange REITs: Eligibility, Qualification, and Investment Insights

- Can you do a 1031 exchange into a REITs?

- What investments qualify for 1031 exchange?

- What is a 1031 REIT?

- Can you sell property to a REIT?

Can you do a 1031 exchange into a REITs?

Yes, it is possible to do a 1031 exchange into Real Estate Investment Trusts (REITs). A 1031 exchange allows investors to defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into like-kind properties. When it comes to REITs, investors can use the funds from a sold property to invest in a REIT without triggering immediate tax liabilities. This strategy provides investors with the opportunity to diversify their real estate holdings, potentially generate passive income through dividends, and benefit from the liquidity and convenience that REIT investments offer. Consulting with tax advisors or real estate professionals can help navigate the intricacies of executing a successful 1031 exchange into REITs.

What investments qualify for 1031 exchange?

One frequently asked question regarding 1031 exchanges is, “What investments qualify for a 1031 exchange?” In the context of real estate, properties used for business or investment purposes typically qualify for a 1031 exchange. This includes commercial buildings, rental properties, vacant land held for investment, and even certain types of personal property used in a business. It’s important to note that primary residences and properties primarily held for personal use do not qualify for a 1031 exchange. Consulting with a qualified intermediary or tax advisor can provide further clarity on which investments meet the criteria for a successful 1031 exchange transaction.

What is a 1031 REIT?

A 1031 REIT, also known as a Real Estate Investment Trust within a 1031 exchange, offers investors the opportunity to defer capital gains taxes by reinvesting proceeds from the sale of a property into a diversified real estate portfolio managed by the REIT. This investment vehicle allows individuals to potentially grow their wealth through passive income generated by the trust’s real estate holdings while deferring tax liabilities. By combining the benefits of a 1031 exchange with the advantages of investing in a REIT, investors can access a tax-efficient strategy that provides flexibility, diversification, and potential long-term growth in their investment portfolios.

Can you sell property to a REIT?

One frequently asked question regarding 1031 exchange REITs is whether you can sell property to a REIT. The answer is generally no. A Real Estate Investment Trust (REIT) typically acquires properties through direct purchases or by investing in various real estate assets. However, as an individual investor, you can sell your property and use the proceeds to invest in a REIT through a 1031 exchange, allowing you to defer capital gains taxes and potentially benefit from the income and diversification opportunities that REIT investments offer. It’s important to consult with tax advisors or real estate professionals to understand the specific rules and implications of selling property to a REIT within the context of a 1031 exchange.

Tags: 1031 exchange, 1031 exchange reit, benefits, capital gains taxes, convenience, diversify portfolios, financial advisors, liquidity, passive income, real estate assets, reits, tax-deferred exchange, wealth growth