The Benefits of Turnkey Real Estate Investing

Turnkey real estate investing has gained popularity in recent years as a hassle-free way for individuals to invest in real estate without the traditional responsibilities of being a landlord. This investment strategy involves purchasing a fully renovated and managed property, typically through a turnkey real estate company.

One of the main benefits of turnkey real estate investing is the passive income it generates. With a turnkey property, investors can enjoy rental income without having to deal with the day-to-day management tasks such as finding tenants, handling maintenance issues, or collecting rent. This makes it an attractive option for busy professionals or those looking to diversify their investment portfolio.

Another advantage of turnkey real estate investing is the potential for higher returns compared to other investment options. By investing in a property that is already generating rental income, investors can start earning profits immediately without waiting for property appreciation or dealing with lengthy renovation projects.

Turnkey properties are also ideal for investors who are new to real estate investing or do not have the time or expertise to manage a rental property themselves. With a turnkey investment, all the hard work is done by the turnkey company, from selecting and renovating the property to finding and screening tenants.

In conclusion, turnkey real estate investing offers an attractive opportunity for individuals looking to generate passive income and build wealth through real estate. With its low entry barrier and hands-off approach, it is a convenient way for investors to benefit from the lucrative real estate market without the typical hassles associated with property management.

6 Essential Tips for Successful Turnkey Real Estate Investing

- Research the turnkey real estate company thoroughly before investing.

- Consider the location of the property and its potential for growth.

- Review the financial projections and expected returns carefully.

- Ensure that the property management provided by the company is reliable.

- Understand all fees involved in the investment, including maintenance costs and property management fees.

- Diversify your investments across different properties or locations to reduce risk.

Research the turnkey real estate company thoroughly before investing.

Before diving into turnkey real estate investing, it is crucial to thoroughly research the turnkey real estate company you are considering investing with. Take the time to investigate their track record, reputation, and customer reviews to ensure they have a proven history of successful property management and investor satisfaction. By conducting thorough due diligence on the turnkey company, you can mitigate risks and make an informed decision that aligns with your investment goals and expectations.

Consider the location of the property and its potential for growth.

When engaging in turnkey real estate investing, it is crucial to carefully evaluate the location of the property and its growth potential. The location plays a significant role in determining the property’s long-term value and rental income potential. Investing in an area with strong economic growth, increasing job opportunities, and desirable amenities can lead to higher returns on investment. By considering the location and its potential for growth, investors can make informed decisions that align with their financial goals and maximize the benefits of turnkey real estate investing.

Review the financial projections and expected returns carefully.

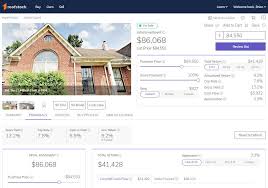

When considering turnkey real estate investing, it is crucial to review the financial projections and expected returns carefully. By thoroughly examining these projections, investors can gain a clear understanding of the potential profitability of the investment. This step allows investors to make informed decisions based on realistic expectations and ensures that the investment aligns with their financial goals. Taking the time to analyze financial projections can help investors avoid unexpected surprises and set themselves up for success in their real estate investment journey.

Ensure that the property management provided by the company is reliable.

When considering turnkey real estate investing, it is crucial to verify the reliability of the property management services offered by the company. A dependable property management team can make all the difference in ensuring that your investment property is well-maintained, tenants are satisfied, and rental income flows smoothly. By entrusting your property to a reputable and reliable management company, you can have peace of mind knowing that your investment is in good hands and set up for long-term success.

Understand all fees involved in the investment, including maintenance costs and property management fees.

When considering turnkey real estate investing, it is crucial to thoroughly understand all the fees associated with the investment. This includes not only the initial purchase price but also ongoing expenses such as maintenance costs and property management fees. By having a clear understanding of these fees upfront, investors can accurately assess the potential return on investment and ensure that they have a comprehensive financial plan in place to cover all costs involved in owning and managing a turnkey property.

Diversify your investments across different properties or locations to reduce risk.

Diversifying your investments across different properties or locations is a smart strategy in turnkey real estate investing to minimize risk and maximize potential returns. By spreading your investments across various properties or locations, you can reduce the impact of market fluctuations in any single area. Diversification helps to safeguard your investment portfolio against unforeseen events that may affect a specific property or location, ensuring a more stable and resilient investment strategy in the long run.

Tags: benefits, expected returns, financial projections, growth potential, higher returns, investment strategy, location, passive income, property management, property management services, rental property, turnkey company, turnkey real estate investing