Syndicated Real Estate: A Smart Investment Strategy

When it comes to investing in real estate, there are various strategies available to individuals and institutions alike. One such strategy that has gained significant popularity in recent years is syndicated real estate.

So, what exactly is syndicated real estate? In simple terms, it involves pooling funds from multiple investors to collectively invest in a real estate project. These projects can range from residential properties to commercial buildings, apartment complexes, or even large-scale developments.

One of the key benefits of syndicated real estate is the ability to access opportunities that may be otherwise out of reach for individual investors. By pooling resources together, investors can gain exposure to larger and potentially more lucrative properties or projects. This diversification helps spread risk and allows for a more balanced investment portfolio.

Another advantage of syndication is the opportunity for passive income generation. Investors who participate in syndicated real estate deals typically receive regular distributions from rental income or profits generated by the project. This passive income stream can provide a steady cash flow while benefiting from potential appreciation over time.

Syndication also offers the advantage of professional management and expertise. When investing individually, it can be challenging to navigate the complexities of real estate transactions and property management. However, by participating in a syndicate, investors can leverage the knowledge and experience of professional managers who oversee the day-to-day operations of the investment.

Furthermore, syndicated real estate allows for greater flexibility and scalability compared to sole ownership. Investors have the option to invest smaller amounts into multiple projects instead of tying up substantial capital in a single property. This flexibility enables them to diversify their investment portfolio further and potentially mitigate risks associated with any one particular investment.

However, like any investment strategy, there are considerations and risks associated with syndicated real estate. It’s crucial for investors to thoroughly research and understand the terms and conditions of any syndicate they consider joining. Due diligence should include evaluating the track record and reputation of the syndicator, analyzing the projected returns and risks associated with the specific investment, and assessing the legal and financial structures in place.

In conclusion, syndicated real estate can be an attractive investment strategy for those looking to diversify their portfolio, access larger-scale projects, and benefit from professional management. It offers the potential for passive income generation while spreading risk across multiple investments. However, it’s important to approach syndication with caution and conduct thorough due diligence before committing funds. With proper research and a well-managed syndicate, investors can unlock the potential of real estate investments that may have otherwise been out of reach.

Frequently Asked Questions about Syndicated Real Estate: Examples, Definition, Worth, and Earning Potential

- What are examples of real estate syndication?

- What is syndicated real estate?

- Are real estate syndicates worth it?

- Can you make money with real estate syndication?

What are examples of real estate syndication?

Real estate syndication encompasses a wide range of investment opportunities. Here are a few examples of real estate syndication projects:

- Apartment Complexes: Syndicates may pool funds to invest in apartment complexes, which can range from small buildings to large-scale developments. Investors benefit from rental income generated by the units and potential appreciation of the property.

- Office Buildings: Syndicated real estate can involve investing in office buildings, whether it’s a single property or a portfolio of commercial spaces. This allows investors to participate in the income generated by leasing office spaces to businesses.

- Retail Centers: Syndicates may target retail centers, such as shopping malls or strip malls, as investment opportunities. Investors benefit from rental income generated by tenants leasing retail spaces, including shops, restaurants, and other commercial establishments.

- Industrial Properties: Syndication can also involve investing in industrial properties like warehouses, distribution centers, or manufacturing facilities. These types of properties often attract long-term leases from businesses seeking space for their operations.

- Residential Developments: Real estate syndicates may focus on residential developments such as housing communities or condominium projects. Investors participate in the potential profits generated from selling or renting out these residential units.

- Hotel and Hospitality Projects: Syndicated real estate investments can include hotels and hospitality projects where investors gain exposure to the revenue streams generated by room bookings and other hotel services.

- Mixed-Use Developments: Some syndicates invest in mixed-use developments that combine residential, commercial, and recreational elements within a single project. This diversification offers potential income streams from various sources.

These are just a few examples of real estate syndication opportunities available to investors. It’s important to note that each project carries its own unique characteristics and risks, so conducting thorough due diligence is crucial before participating in any syndicated real estate investment opportunity.

What is syndicated real estate?

Syndicated real estate refers to a method of investment where multiple individuals or entities pool their resources together to collectively invest in a real estate project. These projects can include various types of properties such as residential homes, commercial buildings, apartment complexes, or even large-scale developments.

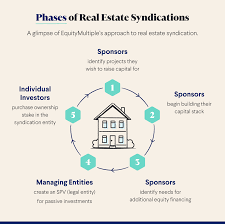

In a syndication arrangement, there is typically a lead investor or group, known as the syndicator or sponsor, who identifies and manages the investment opportunity. The syndicator is responsible for sourcing the property, conducting due diligence, negotiating the purchase terms, and overseeing the ongoing management of the investment.

Individual investors who participate in syndicated real estate deals contribute capital to the project based on their investment amount. This pooled capital is then used to finance the acquisition or development of the property. In return for their investment, participants receive ownership shares or units in the syndicate and are entitled to a portion of any income generated by the property.

Syndicated real estate offers several benefits for investors. Firstly, it provides access to larger and potentially more lucrative investment opportunities that may be beyond the reach of individual investors. By pooling resources together, investors can gain exposure to properties with higher value or greater income potential.

Additionally, syndication allows for risk diversification. Instead of investing all their capital into a single property, participants can spread their investments across multiple projects within a syndicate. This diversification helps mitigate risk and reduces exposure to any one particular investment.

Another advantage is that syndicated real estate offers passive income generation. Investors receive regular distributions from rental income or profits generated by the property without having to actively manage it themselves. This passive income stream can provide financial stability and potentially increase wealth over time.

However, it’s important to note that investing in syndicated real estate also carries risks. The success of an investment depends on factors such as market conditions, property performance, and effective management by the syndicator. Investors should conduct thorough due diligence before participating in any syndicate and carefully evaluate the potential risks and returns associated with the specific investment opportunity.

In summary, syndicated real estate is a strategy that allows multiple investors to pool their resources together to invest in real estate projects. It offers access to larger opportunities, diversification, passive income generation, and professional management. However, investors should exercise caution, conduct proper research, and seek advice from professionals before committing funds to any syndicated real estate investment.

Are real estate syndicates worth it?

Real estate syndicates can be worth it for certain investors, but it ultimately depends on individual circumstances, goals, and risk tolerance. Here are a few factors to consider when evaluating the worthiness of real estate syndicates:

- Diversification: Syndicates allow investors to pool their funds with others, providing access to larger and potentially more profitable real estate projects. This diversification can help spread risk across multiple investments and reduce exposure to any single property.

- Professional Management: Syndicates often have experienced professionals who handle property management and oversee the investment. This can be beneficial for investors who prefer a more hands-off approach or lack expertise in real estate operations.

- Access to Opportunities: Real estate syndicates can provide access to investment opportunities that may be otherwise inaccessible or require significant capital individually. This allows investors to participate in larger-scale projects or properties that offer potential for higher returns.

- Passive Income Generation: Syndicated real estate investments typically generate passive income through rental income or profit distributions. This can provide a steady cash flow for investors seeking regular returns on their investment.

- Potential Risks: Like any investment, real estate syndicates come with risks. It’s important to assess the specific risks associated with each syndicate, such as market fluctuations, property-specific challenges, economic conditions, or changes in regulations.

- Due Diligence: Thorough due diligence is crucial when considering real estate syndicates. Researching the track record and reputation of the syndicator, analyzing projected returns and risks, understanding legal and financial structures, and reviewing past performance are essential steps in making an informed decision.

Ultimately, whether real estate syndicates are worth it depends on an individual’s financial goals, risk tolerance, and comfort level with investing in a pooled structure. It is advisable to consult with financial advisors or professionals familiar with real estate investments before committing funds to any syndicate.

Can you make money with real estate syndication?

Yes, it is possible to make money with real estate syndication. Real estate syndication offers investors the opportunity to participate in larger-scale projects that may generate higher returns compared to individual investments. Here are a few ways in which investors can potentially make money through real estate syndication:

- Rental Income: Syndicated real estate projects often involve income-producing properties such as residential or commercial buildings. Investors can earn money through regular distributions from rental income generated by these properties. The amount of income received depends on factors such as occupancy rates, rental rates, and property expenses.

- Appreciation: Over time, real estate properties have the potential to appreciate in value. When a syndicated property is sold or refinanced at a higher price than its initial acquisition cost, the profits are distributed among the investors based on their ownership percentage. This appreciation can result from factors such as market conditions, property improvements, or area development.

- Profit Sharing: Syndicated real estate deals may involve development or renovation projects where the goal is to increase the value of the property and sell it for a profit. Investors can benefit from this appreciation by receiving a share of the profits when the project is successfully completed and sold.

- Tax Benefits: Real estate investments often offer various tax advantages that can help increase overall returns. These benefits may include depreciation deductions, tax-deferred exchanges, and deductions for expenses related to managing and maintaining the property.

It’s important to note that while real estate syndication presents opportunities for potential profits, there are risks involved as well. Factors such as market fluctuations, economic conditions, and project-specific risks can impact investment returns. It’s crucial for investors to conduct thorough due diligence and work with experienced professionals when considering participation in a real estate syndicate.

As with any investment strategy, success in real estate syndication requires careful analysis, understanding of market dynamics, and proper risk management. Working with reputable syndicators who have a track record of successful projects can increase the likelihood of achieving positive returns.

Tags: access opportunities, apartment complexes, balanced investment portfolio, benefits, cash flow, commercial buildings, complexity of transactions and property management, diversification, flexibility and scalability, investment strategy, large-scale developments, multiple investors, passive income generation, pooling funds, potential appreciation over time, professional management and expertise, profits generated, real estate project, regular distributions, rental income, residential properties, risk spread, smaller amounts invested in multiple projects, syndicated real estate