Investing in Real Estate Using a Self-Directed IRA

When it comes to retirement planning, many individuals think of traditional investment options such as stocks, bonds, and mutual funds. However, there is another avenue that can potentially provide significant returns and diversification: real estate. One way to invest in real estate for retirement is through a self-directed Individual Retirement Account (IRA).

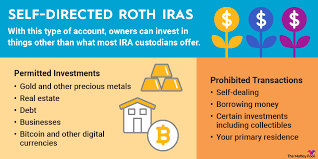

A self-directed IRA allows individuals to take control of their retirement savings and invest in a wide range of assets, including real estate. Unlike traditional IRAs that limit investment options to stocks and bonds, a self-directed IRA gives investors the freedom to choose from various real estate opportunities.

One of the primary advantages of investing in real estate through an IRA is the potential for tax advantages. With a self-directed IRA, contributions are typically tax-deductible, and any earnings generated from the investments grow tax-deferred or even tax-free if it’s a Roth IRA. This can be especially beneficial for those who anticipate being in a higher tax bracket during retirement.

Another benefit of using a self-directed IRA for real estate investing is the ability to diversify one’s portfolio. Real estate has historically shown low correlation with other asset classes like stocks and bonds, making it an attractive option for investors looking to reduce risk and increase potential returns.

Investing in real estate through an IRA also provides flexibility in terms of property types. Investors can choose from residential properties, commercial buildings, rental properties, or even participate in real estate crowdfunding platforms. This flexibility allows investors to tailor their portfolio according to their risk tolerance and investment goals.

However, investing in real estate using an IRA does come with certain rules and regulations that must be followed. For example, all transactions must be made through the IRA custodian or administrator to ensure compliance with IRS regulations. Additionally, any income generated from the property must flow back into the IRA account.

Due diligence is crucial when considering real estate investments within an IRA. It is essential to thoroughly research and analyze potential properties, taking into account factors such as location, market trends, rental demand, and potential cash flow. Working with experienced real estate professionals can provide valuable guidance throughout the investment process.

In conclusion, a self-directed IRA offers individuals the opportunity to diversify their retirement portfolio by investing in real estate. With potential tax advantages, diversification benefits, and flexibility in property choices, real estate IRAs can be an excellent option for those looking to maximize their retirement savings. However, it is crucial to understand the rules and regulations surrounding this type of investment and conduct thorough due diligence before making any decisions. Consulting with financial advisors or tax professionals who specialize in self-directed IRAs can provide further guidance on how to navigate this exciting investment avenue.

7 Essential Tips for Maximizing Your Real Estate IRA Investments

- Educate Yourself

- Choose a Self-Directed IRA Custodian

- Diversify Your Investments

- Conduct Thorough Due Diligence

- Maintain Sufficient Liquidity

- Understand Prohibited Transactions

- Regularly Review Your Portfolio

Educate Yourself

When it comes to investing in real estate using a self-directed IRA, one of the most important tips is to educate yourself. While the idea of investing in real estate for retirement may sound enticing, it’s essential to have a solid understanding of how it works and the potential risks involved.

Start by learning about the rules and regulations surrounding self-directed IRAs. Familiarize yourself with the IRS guidelines and restrictions that apply to real estate investments within an IRA. This includes knowing what types of properties are eligible for investment, how income generated from the property should be handled, and any reporting requirements.

Next, dive into real estate investment strategies and market trends. Understand different property types, such as residential, commercial, or rental properties, and their potential risks and rewards. Explore various investment approaches like fix-and-flip, buy-and-hold, or real estate crowdfunding. Stay updated on market conditions and factors that can impact property values and rental demand.

Consider seeking guidance from professionals who specialize in self-directed IRAs and real estate investments. Financial advisors with expertise in this area can provide valuable insights tailored to your specific goals and risk tolerance. They can help you navigate complex tax implications and ensure compliance with IRS regulations.

Additionally, networking with experienced real estate investors can offer valuable knowledge and insights. Attend industry events or join online communities where you can connect with like-minded individuals who have successfully invested in real estate using their IRAs. Learn from their experiences, ask questions, and gain practical advice.

Lastly, never stop learning. Real estate markets are dynamic, so staying informed about industry trends is crucial. Continuously educate yourself through books, podcasts, webinars, or courses dedicated to real estate investing. The more you know about the market dynamics and strategies employed by successful investors, the better equipped you’ll be to make informed decisions.

Remember that education is an ongoing process when it comes to investing in real estate using a self-directed IRA. By arming yourself with knowledge, you can confidently navigate the world of real estate investments and make informed decisions that align with your retirement goals.

Choose a Self-Directed IRA Custodian

When it comes to investing in real estate using a self-directed IRA, one crucial decision you’ll need to make is choosing a self-directed IRA custodian. The custodian plays a vital role in facilitating your real estate investments within the IRA and ensuring compliance with IRS regulations.

A self-directed IRA custodian is responsible for holding and administering the assets within your retirement account. Unlike traditional IRA custodians, self-directed IRA custodians specialize in alternative investments like real estate, giving you more freedom and control over your investment choices.

When selecting a self-directed IRA custodian, there are several factors to consider. First and foremost, you’ll want to ensure that the custodian has experience and expertise in handling real estate transactions within IRAs. Look for a custodian with a solid track record and positive reviews from other investors who have used their services.

Another critical factor to consider is the level of customer service provided by the custodian. Investing in real estate can be complex, so having access to knowledgeable professionals who can answer your questions and guide you through the process is invaluable. Look for a custodian that offers responsive customer support and is readily available when you need assistance.

Fees are another important consideration when choosing a self-directed IRA custodian. Different custodians may have varying fee structures, including account setup fees, transaction fees, annual maintenance fees, etc. It’s essential to understand these fees upfront and evaluate how they may impact your investment returns over time.

Additionally, it’s worth considering the technology and online platform offered by the custodian. A user-friendly interface that allows you to easily view your account details, track investments, and initiate transactions can greatly enhance your investing experience.

Lastly, don’t forget to review any additional services or resources provided by the custodian. Some may offer educational materials or networking opportunities that can help you stay informed about real estate investing trends and connect with other like-minded investors.

Choosing the right self-directed IRA custodian is a crucial step in successfully navigating real estate investments within your retirement account. By conducting thorough research, considering factors such as experience, customer service, fees, technology, and additional resources, you can find a custodian that aligns with your investment goals and provides the support you need to make informed decisions.

Diversify Your Investments

Diversify Your Investments: A Key Tip for Real Estate IRAs

When it comes to investing in real estate through a self-directed Individual Retirement Account (IRA), one crucial tip stands out: diversify your investments. Diversification is a strategy that spreads investment risk across different assets, sectors, or markets. By diversifying your real estate portfolio within your IRA, you can potentially enhance returns and mitigate potential risks.

Investing solely in one type of property or location can leave your portfolio vulnerable to market fluctuations and specific risks associated with that particular asset. By diversifying, you can spread your investments across various property types, such as residential, commercial, or even vacant land. This way, you can benefit from different market cycles and potentially capture growth opportunities in multiple sectors.

Additionally, geographic diversification is equally important. Investing in properties located in different regions or cities can shield your portfolio from localized economic downturns or market-specific risks. It allows you to tap into the growth potential of different markets and reduces the impact of any single region’s challenges on your overall returns.

Furthermore, consider diversifying your investment strategy within real estate itself. For instance, you could explore rental properties for passive income generation or participate in real estate crowdfunding platforms that offer fractional ownership opportunities. By incorporating different investment approaches within real estate, you can further spread risk and potentially maximize returns.

Remember that diversification does not guarantee profits or protect against losses entirely; it is a risk management strategy. However, by spreading investments across various real estate assets and markets within your IRA, you are positioning yourself for potential long-term success.

It’s important to consult with financial advisors or professionals experienced in self-directed IRAs to ensure compliance with IRS regulations when diversifying your real estate holdings within an IRA. They can provide valuable guidance on how to navigate the process while adhering to the necessary rules and regulations.

In conclusion, diversifying your investments is a key tip for real estate IRAs. By spreading your investments across different property types, locations, and investment strategies, you can potentially enhance your portfolio’s performance and reduce exposure to specific risks. Remember to seek professional advice and conduct thorough research before making any investment decisions. With a diversified real estate IRA, you can position yourself for long-term growth and potentially achieve your retirement goals.

Conduct Thorough Due Diligence

Conduct Thorough Due Diligence: A Key Tip for Real Estate IRA Investors

When it comes to investing in real estate using a self-directed Individual Retirement Account (IRA), one crucial tip that cannot be emphasized enough is the need to conduct thorough due diligence. While real estate can be a lucrative investment, it also carries inherent risks, and careful research is essential to mitigate those risks and make informed decisions.

Due diligence refers to the process of gathering all relevant information and assessing the potential risks and rewards associated with a particular investment. In the context of real estate IRAs, conducting thorough due diligence involves examining various aspects of the property or investment opportunity before committing your IRA funds.

One critical aspect of due diligence is researching the property’s location. Understanding local market conditions, economic trends, and demographic factors can help determine whether an investment property is situated in an area with growth potential or stability. Factors such as job growth, population trends, infrastructure development, and proximity to amenities can significantly impact the property’s long-term value and potential rental income.

Additionally, it is crucial to thoroughly analyze the financials associated with the investment. This includes reviewing historical and projected cash flows, expenses (such as property taxes, insurance, maintenance costs), vacancy rates, rental demand in the area, and any existing leases or tenant agreements. Understanding these financial aspects will give you a clearer picture of the property’s income potential and overall profitability.

Furthermore, conducting a comprehensive inspection of the physical condition of the property is vital. Engaging professional inspectors can help identify any structural issues or maintenance needs that may require significant investments down the line. This step ensures that you are aware of any potential repair or renovation costs upfront.

In addition to these considerations specific to the property itself, it is also essential to research any legal obligations or restrictions that may apply. Familiarize yourself with local zoning laws, building codes, and any other regulations that may impact your ability to use the property as intended. Understanding these legal aspects will help you avoid any potential compliance issues or unexpected expenses.

By conducting thorough due diligence, real estate IRA investors can make more informed decisions and minimize the risks associated with their investments. Taking the time to research and analyze various aspects of the property, including location, financials, physical condition, and legal considerations, will provide a solid foundation for successful real estate investments within an IRA.

Remember, investing in real estate through an IRA can offer significant benefits, but it’s crucial to approach it with a diligent mindset. Seek guidance from professionals in the field if needed and leverage their expertise to ensure that your investment aligns with your financial goals and risk tolerance.

Maintain Sufficient Liquidity

When it comes to investing in real estate using a self-directed IRA, one crucial tip to keep in mind is to maintain sufficient liquidity. While real estate can be a profitable long-term investment, it’s essential to have readily available funds for any unexpected expenses or opportunities that may arise.

Maintaining liquidity means having enough cash or liquid assets within your self-directed IRA to cover potential costs such as property maintenance, repairs, vacancies, or even new investment opportunities. This ensures that you can navigate unforeseen circumstances without having to rely on external sources of funding.

One way to maintain liquidity is by setting aside a portion of your self-directed IRA funds specifically for these purposes. By allocating a percentage of your portfolio towards cash or highly liquid assets like money market funds or short-term bonds, you create a safety net that can be tapped into when needed.

Having liquidity also provides flexibility during market fluctuations. Real estate markets can be unpredictable, and having accessible funds allows you to take advantage of potential buying opportunities when property prices dip. It gives you the ability to seize attractive deals and negotiate favorable terms without being constrained by limited cash flow.

Additionally, maintaining liquidity within your self-directed IRA allows you to handle unexpected expenses associated with your real estate investments promptly. Whether it’s an urgent repair or unexpected vacancy, having readily available funds ensures that you can address these issues without delay, minimizing potential financial strain.

It’s important to strike a balance between investing in real estate and maintaining sufficient liquidity within your self-directed IRA. While real estate can offer attractive returns over time, it’s crucial not to tie up all your funds in illiquid assets. By keeping a portion of your portfolio liquid, you create a cushion that provides peace of mind and financial stability.

In conclusion, maintaining sufficient liquidity is a vital tip when investing in real estate using a self-directed IRA. By setting aside cash or liquid assets within your portfolio, you ensure that you have the necessary funds for unforeseen expenses and opportunities. This liquidity provides flexibility, allows you to take advantage of market fluctuations, and ensures that you can handle unexpected costs associated with your real estate investments. Striking a balance between investing and liquidity is key to a successful real estate IRA strategy.

Understand Prohibited Transactions

When investing in real estate using a self-directed Individual Retirement Account (IRA), it is crucial to understand the concept of prohibited transactions. Prohibited transactions are activities that, if carried out within an IRA, can result in severe tax consequences and penalties.

The Internal Revenue Service (IRS) has established rules and regulations to ensure that IRAs are used for retirement savings purposes rather than personal gain or immediate benefits. These rules aim to prevent individuals from using their IRAs for self-dealing or engaging in transactions with disqualified persons.

Disqualified persons include the IRA owner, their spouse, parents, children, grandchildren, and any entities they control. It is important to note that these rules apply not only to direct transactions but also to indirect ones. For example, purchasing a property from a disqualified person or using IRA funds for personal expenses are considered prohibited transactions.

Engaging in prohibited transactions can lead to the disqualification of the entire IRA account, resulting in immediate taxation of the account balance and potential penalties. Therefore, it is crucial to have a clear understanding of what constitutes a prohibited transaction and diligently adhere to the IRS guidelines.

To navigate this complex landscape successfully, it is advisable to work with professionals experienced in self-directed IRAs and real estate investments. They can provide valuable guidance on structuring transactions within the confines of IRS regulations and help investors avoid costly mistakes.

In conclusion, understanding prohibited transactions is an essential tip for anyone considering real estate investments through a self-directed IRA. By familiarizing yourself with the IRS rules surrounding disqualified persons and avoiding activities that could trigger penalties, you can protect your retirement savings while enjoying the benefits of real estate investment within your IRA. Seek guidance from knowledgeable professionals to ensure compliance with regulations and make informed investment decisions.

Regularly Review Your Portfolio

Regularly Review Your Portfolio: A Key Tip for Real Estate IRAs

When it comes to investing in real estate through a self-directed Individual Retirement Account (IRA), one crucial tip is to regularly review your portfolio. Just like any other investment, staying informed and keeping a close eye on your real estate holdings is essential for long-term success.

Why is regular portfolio review important? Firstly, the real estate market is dynamic and constantly evolving. Economic conditions, local market trends, and even regulatory changes can impact the value and performance of your properties. By regularly reviewing your portfolio, you can identify any emerging opportunities or potential risks.

Additionally, reviewing your portfolio allows you to assess the overall performance of your real estate investments. Are your properties generating the expected returns? Are there any maintenance or management issues that need attention? By monitoring these factors, you can make informed decisions about property management strategies or even consider diversifying your holdings if necessary.

Regular reviews also provide an opportunity to evaluate your investment goals and risk tolerance. As time goes on, your circumstances may change, and so might your objectives. By assessing whether your current real estate investments align with these goals, you can make adjustments as needed to ensure that your IRA continues to work for you.

It’s important not to overlook the tax implications of real estate IRA investments during portfolio reviews. Tax laws and regulations can change over time, impacting how certain transactions or income generated from properties are treated. Staying up-to-date with tax rules will help you optimize the tax advantages associated with investing in real estate through an IRA.

To effectively review your portfolio, consider seeking professional advice from financial advisors or tax professionals who specialize in self-directed IRAs. They can provide valuable insights into market trends, help evaluate property performance, and guide you through any necessary adjustments or strategic decisions.

In conclusion, regularly reviewing your real estate IRA portfolio is a fundamental tip for success in this investment strategy. By staying informed about market trends, assessing property performance, and aligning your investments with your goals and risk tolerance, you can maximize the potential of your real estate holdings. Remember to also consider the tax implications and seek professional guidance when needed. With regular portfolio reviews, you can ensure that your real estate IRA continues to work towards securing a prosperous retirement.

Tags: bonds, commercial buildings, diversification, flexibility in property types, higher tax bracket, increase potential returns, individual retirement account, investment options, low correlation, mutual funds, portfolio diversification, real estate, real estate crowdfunding platforms, real estate ira, reduce risk, rental properties, residential properties, retirement planning, returns, roth ira, rules and regulations, self-directed ira, stocks, tax advantages, tax-deductible contributions, tax-deferred earnings, traditional investment options