The Ins and Outs of Real Estate Bonds

Real estate bonds are a unique investment opportunity that allows individuals to invest in real estate projects without directly owning property. These bonds are issued by real estate developers or companies to raise funds for various projects, such as residential developments, commercial properties, or infrastructure projects.

Investing in real estate bonds can offer attractive returns compared to traditional investments like stocks or mutual funds. Investors receive regular interest payments throughout the bond’s term and the principal amount back upon maturity. This makes real estate bonds a compelling option for those seeking stable income streams.

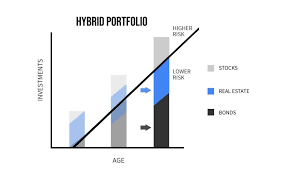

One key advantage of real estate bonds is their relatively low correlation with the stock market. This means that they can provide diversification benefits to an investment portfolio, helping to reduce overall risk.

However, like any investment, real estate bonds come with risks. Market fluctuations, changes in interest rates, and project-specific risks can all impact the performance of these bonds. It’s essential for investors to conduct thorough due diligence before investing in any real estate bond.

Real estate bonds also offer different structures and terms depending on the issuing entity and project type. Some bonds may be secured by specific properties, while others may be unsecured. Understanding these nuances is crucial for making informed investment decisions.

In conclusion, real estate bonds present a compelling opportunity for investors looking to diversify their portfolios and potentially earn attractive returns. By understanding the risks and rewards associated with these investments, individuals can make informed decisions that align with their financial goals.

7 Essential Tips for Investing in Real Estate Bonds: A Guide to Maximizing Returns and Minimizing Risk

- Understand the risk associated with real estate bonds before investing.

- Diversify your investment portfolio to include a mix of real estate bonds from different issuers.

- Consider the credit rating of the bond issuer to assess their financial stability and ability to repay debt.

- Stay informed about market trends and economic factors that can impact real estate bond performance.

- Review the terms and conditions of the bond offering, including maturity date, interest rate, and redemption features.

- Consult with a financial advisor or investment professional for guidance on incorporating real estate bonds into your investment strategy.

- Monitor your real estate bond investments regularly to ensure they align with your financial goals.

Understand the risk associated with real estate bonds before investing.

Before diving into real estate bonds, it’s crucial to grasp the risks that come hand in hand with these investments. Market volatility, interest rate fluctuations, and project-specific uncertainties can all impact the performance of real estate bonds. By conducting thorough due diligence and understanding these risks upfront, investors can make informed decisions and mitigate potential financial setbacks. Remember: knowledge is key when it comes to navigating the world of real estate bonds.

Diversify your investment portfolio to include a mix of real estate bonds from different issuers.

Diversifying your investment portfolio to include a mix of real estate bonds from different issuers is a smart strategy to mitigate risk and maximize returns. By spreading your investments across various real estate bonds, you can reduce the impact of any single issuer’s performance on your overall portfolio. This approach helps ensure that you are not overly exposed to the fortunes of a particular company or project, enhancing the stability of your investment portfolio. Additionally, investing in real estate bonds from different issuers allows you to benefit from a range of projects and property types, further diversifying your exposure within the real estate sector.

Consider the credit rating of the bond issuer to assess their financial stability and ability to repay debt.

When considering investing in real estate bonds, it is crucial to evaluate the credit rating of the bond issuer. The credit rating provides valuable insights into the financial stability and creditworthiness of the issuer, indicating their ability to repay debt obligations. A higher credit rating typically signifies lower risk and a higher likelihood of timely interest payments and principal repayment. By assessing the credit rating of the bond issuer, investors can make more informed decisions to mitigate risks and optimize their investment portfolios.

Stay informed about market trends and economic factors that can impact real estate bond performance.

Staying informed about market trends and economic factors is crucial for maximizing the performance of real estate bonds. By keeping a close eye on changes in interest rates, property values, and overall economic conditions, investors can make more informed decisions about when to buy, sell, or hold onto their real estate bond investments. Being proactive in monitoring these factors can help investors stay ahead of potential risks and capitalize on opportunities in the ever-evolving real estate bond market.

Review the terms and conditions of the bond offering, including maturity date, interest rate, and redemption features.

When considering investing in real estate bonds, it is crucial to review the terms and conditions of the bond offering thoroughly. Pay close attention to key details such as the maturity date, interest rate, and redemption features. Understanding these factors will provide insight into how long your investment will be tied up, the potential returns you can expect, and under what circumstances you can redeem your investment. By carefully assessing the terms and conditions of the bond offering, investors can make informed decisions that align with their financial objectives and risk tolerance.

Consult with a financial advisor or investment professional for guidance on incorporating real estate bonds into your investment strategy.

For those considering real estate bonds as part of their investment strategy, it is highly recommended to consult with a financial advisor or investment professional. Seeking guidance from experts in the field can provide valuable insights into the intricacies of real estate bonds, help assess individual risk tolerance, and tailor an investment plan that aligns with specific financial goals. A professional advisor can offer personalized advice on incorporating real estate bonds into a diversified portfolio, ensuring a well-informed and strategic approach to investing in this asset class.

Monitor your real estate bond investments regularly to ensure they align with your financial goals.

It is crucial to monitor your real estate bond investments regularly to ensure they align with your financial goals. By staying informed about the performance of your bonds, you can make timely adjustments if needed and capitalize on opportunities that may arise. Regular monitoring allows you to assess whether your investments are meeting your expectations and adjust your strategy accordingly to stay on track towards achieving your financial objectives.

Tags: bond issuer, correlation with stock market, credit rating, debt repayment ability, diversification benefits, due diligence, economic factors, financial goals, financial stability, interest rates, investment, investment portfolio, market fluctuations, market trends, project-specific risks, real estate bonds, risks