The Role of Real Estate Asset Management Companies in Property Investment

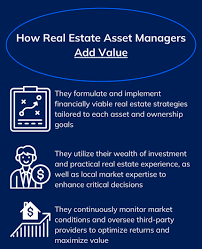

Real estate asset management companies play a crucial role in maximizing the value of real estate investments for property owners. These companies specialize in managing and overseeing properties on behalf of their clients, ensuring that the assets are well-maintained and profitable.

One of the key responsibilities of real estate asset management companies is to develop and implement strategies to enhance the performance of the properties under their management. This includes conducting market research, analyzing trends, and identifying opportunities for growth and improvement.

Asset managers work closely with property owners to set investment goals and objectives, such as maximizing rental income, increasing property value, or optimizing operational efficiency. They then develop tailored plans to achieve these goals, which may involve leasing strategies, renovation projects, or financial restructuring.

In addition to day-to-day management tasks like rent collection and maintenance coordination, real estate asset management companies also provide valuable insights and guidance to their clients. They monitor market conditions, assess risks, and recommend adjustments to investment strategies as needed to ensure long-term success.

Overall, partnering with a real estate asset management company can help property owners navigate the complexities of the real estate market and make informed decisions that drive value and profitability. By leveraging their expertise and resources, investors can achieve their financial objectives while mitigating risks associated with property ownership.

7 Key Advantages of Partnering with Real Estate Asset Management Companies

- Expertise in property management and market analysis

- Maximization of property value through strategic planning

- Professional handling of day-to-day operations and tenant relations

- Risk mitigation through comprehensive asset monitoring

- Access to a network of industry professionals and service providers

- Customized investment strategies tailored to individual client goals

- Efficient utilization of resources for optimal financial performance

7 Drawbacks of Hiring Real Estate Asset Management Companies

- Costly fees and expenses associated with hiring asset management services.

- Lack of direct control over day-to-day property management decisions.

- Potential conflicts of interest between the asset manager and property owner.

- Limited transparency in reporting and communication from the asset management company.

- Risk of underperformance or failure to meet expected investment returns.

- Difficulty in finding a reputable and trustworthy asset management firm.

- Possible challenges in aligning investment goals and strategies with those of the asset management company.

Expertise in property management and market analysis

Real estate asset management companies offer invaluable expertise in property management and market analysis, providing property owners with a competitive edge in the real estate market. By leveraging their deep understanding of property trends, market dynamics, and investment strategies, these companies can optimize property performance and maximize returns for their clients. Their proficiency in managing properties efficiently and conducting thorough market analysis enables them to make informed decisions that drive value and ensure long-term success for property investments.

Maximization of property value through strategic planning

Real estate asset management companies excel in maximizing property value through strategic planning. By conducting thorough market research, analyzing trends, and identifying growth opportunities, these companies develop tailored strategies that enhance the performance and profitability of properties under their management. Through effective planning and execution, they can optimize rental income, increase property value, and improve operational efficiency, ultimately ensuring that property owners achieve their investment goals while mitigating risks in the ever-evolving real estate market.

Professional handling of day-to-day operations and tenant relations

Real estate asset management companies excel in providing professional handling of day-to-day operations and tenant relations, offering property owners peace of mind and efficient management of their real estate investments. By overseeing tasks such as rent collection, maintenance coordination, and addressing tenant inquiries and concerns promptly, these companies ensure that properties are well-maintained and tenants are satisfied. This proactive approach not only enhances the overall value of the property but also fosters positive relationships with tenants, leading to higher retention rates and improved occupancy levels.

Risk mitigation through comprehensive asset monitoring

Real estate asset management companies offer a valuable pro through risk mitigation via comprehensive asset monitoring. By closely monitoring properties under their management, these companies can identify potential risks early on and take proactive measures to address them. This proactive approach helps property owners avoid costly issues and protect their investments. Through regular assessments and strategic planning, real estate asset management companies provide peace of mind to property owners by ensuring that their assets are well-protected and positioned for long-term success in an ever-changing market.

Access to a network of industry professionals and service providers

Real estate asset management companies offer a valuable advantage through their access to a wide network of industry professionals and service providers. By tapping into this network, property owners can benefit from top-tier expertise and resources that can enhance the value and performance of their real estate investments. Whether it’s connecting with skilled contractors for property maintenance, collaborating with experienced real estate agents for leasing and sales, or consulting with legal and financial experts for strategic advice, this access to a diverse pool of professionals enables asset management companies to deliver comprehensive solutions tailored to the unique needs of each property owner.

Customized investment strategies tailored to individual client goals

Real estate asset management companies offer a significant advantage by providing customized investment strategies tailored to individual client goals. By understanding the unique objectives and preferences of each client, these companies can develop personalized plans that align with their specific financial aspirations and risk tolerance. This tailored approach ensures that the investment strategy is not only effective but also reflective of the client’s long-term vision, ultimately maximizing the potential for success in the real estate market.

Efficient utilization of resources for optimal financial performance

Real estate asset management companies excel in the efficient utilization of resources to achieve optimal financial performance for property owners. By leveraging their expertise in market analysis, strategic planning, and operational efficiency, these companies can maximize the return on investment for their clients. Through careful management of expenses, proactive maintenance strategies, and revenue optimization techniques, real estate asset management firms ensure that properties generate consistent income streams while controlling costs effectively. This proactive approach not only enhances the financial performance of assets but also provides peace of mind to property owners by knowing that their investments are being managed with precision and care.

Costly fees and expenses associated with hiring asset management services.

One significant drawback of real estate asset management companies is the considerable cost involved in hiring their services. These companies typically charge fees and expenses for their expertise, which can eat into the overall profitability of a property investment. From management fees to performance-based incentives, the expenses associated with asset management services can add up quickly and impact the bottom line for property owners. This financial burden may deter some investors from seeking professional asset management assistance, especially for smaller-scale or lower-yield properties where the cost-to-benefit ratio may not be favorable.

Lack of direct control over day-to-day property management decisions.

One significant drawback of engaging real estate asset management companies is the lack of direct control over day-to-day property management decisions. Property owners may find themselves removed from the operational aspects of their investments, relying instead on the expertise and discretion of the asset management firm. This loss of hands-on involvement can lead to concerns about transparency, communication gaps, and potential disagreements over strategic direction. As a result, property owners must carefully consider the trade-offs between delegating management responsibilities to professionals and maintaining a level of control over key decision-making processes in their real estate investments.

Potential conflicts of interest between the asset manager and property owner.

One significant con of real estate asset management companies is the potential for conflicts of interest to arise between the asset manager and the property owner. In some cases, the goals and incentives of the asset manager may not align perfectly with those of the property owner, leading to conflicting priorities and decisions that may not always be in the best interest of the property owner. This can create challenges in communication, decision-making, and overall trust between both parties, potentially impacting the performance and success of the property investment. It is essential for property owners to carefully consider these potential conflicts and establish clear expectations and guidelines to mitigate such issues when working with real estate asset management companies.

Limited transparency in reporting and communication from the asset management company.

One significant drawback of real estate asset management companies is the limited transparency in reporting and communication they often exhibit. Property owners may find it challenging to obtain detailed and timely information about the performance of their assets, leading to a lack of clarity and confidence in the management process. Without transparent reporting practices, investors may struggle to assess the effectiveness of strategies implemented by the asset management company, hindering their ability to make informed decisions about their real estate investments. This lack of communication can create a sense of unease and uncertainty among property owners, highlighting the importance of clear and open lines of dialogue between clients and asset managers for a successful partnership.

Risk of underperformance or failure to meet expected investment returns.

One significant con of real estate asset management companies is the risk of underperformance or failure to meet expected investment returns. Despite their expertise and efforts, there is always a possibility that market conditions, unforeseen circumstances, or strategic missteps could lead to subpar results for property owners. This risk underscores the importance of thorough due diligence in selecting a reputable and competent asset management firm, as well as ongoing communication and monitoring to address any potential issues proactively.

Difficulty in finding a reputable and trustworthy asset management firm.

One of the significant challenges associated with real estate asset management companies is the difficulty in finding a reputable and trustworthy firm to entrust with your property investments. With a saturated market and varying levels of expertise and reliability among asset management firms, investors often face the daunting task of distinguishing between credible professionals and less scrupulous operators. The consequences of choosing an unreliable asset management firm can range from financial losses to legal complications, highlighting the importance of thorough due diligence and research before selecting a partner in real estate asset management.

Possible challenges in aligning investment goals and strategies with those of the asset management company.

One significant con of real estate asset management companies is the potential challenge of aligning investment goals and strategies with those of the asset management company. Property owners may face difficulties in ensuring that their specific objectives, such as maximizing returns or minimizing risks, are fully understood and integrated into the management approach proposed by the asset manager. Misalignment in investment philosophies or differing risk tolerance levels between the property owner and the asset management company can lead to conflicts and hinder the achievement of desired outcomes. Effective communication, transparency, and a shared understanding of expectations are essential to navigate this potential challenge and establish a successful partnership between both parties in real estate investment endeavors.

Tags: asset monitoring, day-to-day operations, expertise, market analysis, property management, property value maximization, real estate asset management companies, risk mitigation, strategic planning, tenant relations