The Ins and Outs of Property Investment Funds

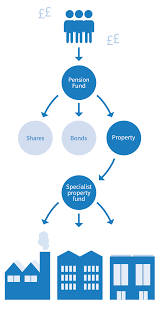

Property investment funds, also known as real estate funds, have become increasingly popular among investors looking to diversify their portfolios. These funds pool money from multiple investors to buy, manage, and sell real estate properties.

How Property Investment Funds Work

Investors can buy shares or units in a property investment fund, giving them exposure to a diversified portfolio of real estate assets. These funds are managed by professional fund managers who make decisions on which properties to invest in based on market trends and investment goals.

Benefits of Property Investment Funds

- Diversification: Property investment funds allow investors to spread their risk across multiple properties rather than investing in a single property.

- Professional Management: Experienced fund managers handle the day-to-day operations of the properties, saving investors time and effort.

- Liquidity: Unlike owning individual properties, investors can easily buy and sell shares in property investment funds.

- Potential for Passive Income: Investors can earn rental income from the properties held within the fund.

Risks of Property Investment Funds

While property investment funds offer many benefits, there are also risks to consider:

- Market Risk: Real estate markets can be volatile, impacting the value of properties held within the fund.

- Liquidity Risk: In times of economic downturn, it may be challenging to sell shares in property investment funds quickly.

- Management Risk: The performance of the fund is dependent on the expertise of the fund managers.

Conclusion

Property investment funds can be a valuable addition to an investor’s portfolio, offering diversification, professional management, and potential for passive income. However, it’s essential for investors to understand the risks involved and conduct thorough research before investing in these funds.

Top 8 FAQs About Investing in Property and REIT Funds

- What is the most profitable investment property?

- Are property funds a good investment?

- Are REIT funds a good investment?

- Is it good to invest in property funds?

- What is an investment property fund?

- Is a REIT a good investment?

- What is a property investment fund?

- Is a REIT a property fund?

What is the most profitable investment property?

When it comes to determining the most profitable investment property, there is no one-size-fits-all answer. The profitability of an investment property can vary depending on various factors such as location, market trends, property type, rental demand, and investment goals. Some investors may find single-family homes in high-demand neighborhoods to be the most profitable, while others may prefer multi-unit buildings for their potential rental income. Ultimately, conducting thorough research, assessing your financial objectives, and seeking advice from real estate professionals can help you identify the investment property that aligns best with your profitability goals.

Are property funds a good investment?

When considering whether property funds are a good investment, it’s essential to weigh the potential benefits and risks. Property funds can offer diversification, professional management, and the opportunity for passive income through rental yields. However, like any investment, property funds come with risks such as market volatility, liquidity challenges, and reliance on fund managers’ expertise. Investors should conduct thorough research, assess their own financial goals and risk tolerance before deciding if property funds align with their investment strategy.

Are REIT funds a good investment?

One frequently asked question regarding property investment funds is whether REIT (Real Estate Investment Trust) funds are a good investment. REIT funds can be a compelling option for investors seeking exposure to the real estate market without directly owning properties. These funds typically offer diversification, potential for income through dividends, and liquidity compared to owning individual properties. However, like any investment, REIT funds come with risks such as market fluctuations and interest rate changes that can affect their performance. It’s crucial for investors to carefully assess their financial goals, risk tolerance, and investment horizon before deciding if REIT funds are a suitable addition to their portfolio.

Is it good to invest in property funds?

Investing in property funds can be a beneficial option for investors seeking exposure to real estate without the hassle of owning and managing individual properties. Property funds offer diversification, professional management, and potential for passive income through rental yields. However, like any investment, there are risks involved, including market volatility, liquidity challenges, and dependence on fund managers’ expertise. It is essential for investors to carefully evaluate their investment goals, risk tolerance, and conduct thorough research before deciding whether investing in property funds aligns with their overall financial strategy.

What is an investment property fund?

An investment property fund is a collective investment vehicle that pools money from multiple investors to invest in a diversified portfolio of real estate properties. These funds are managed by professional fund managers who make decisions on behalf of the investors regarding which properties to acquire, manage, and sell. By investing in an investment property fund, individuals can gain exposure to the real estate market without the need to directly own and manage properties themselves. This type of fund offers investors the benefits of diversification, professional management, and potential for passive income through rental earnings and capital appreciation.

Is a REIT a good investment?

Investing in a Real Estate Investment Trust (REIT) can be a solid option for investors seeking exposure to the real estate market without directly owning physical properties. REITs offer benefits such as diversification, potential for regular income through dividends, and liquidity as they are traded on major stock exchanges. However, like any investment, whether a REIT is a good investment depends on various factors including market conditions, the specific REIT’s performance and management, and an investor’s financial goals and risk tolerance. Conducting thorough research and seeking advice from financial professionals can help investors determine if investing in a REIT aligns with their investment objectives.

What is a property investment fund?

A property investment fund is a collective investment scheme that pools money from multiple investors to acquire, manage, and sell real estate assets. By purchasing shares or units in the fund, investors gain exposure to a diversified portfolio of properties without the need to directly own or manage them. Professional fund managers oversee the selection and management of properties within the fund, aiming to generate returns through rental income, property appreciation, and potential capital gains upon sale. Property investment funds offer investors a convenient way to access the real estate market while benefiting from diversification and professional expertise in property management.

Is a REIT a property fund?

A Real Estate Investment Trust (REIT) is a type of property fund that primarily invests in real estate assets. While REITs and traditional property investment funds both involve pooling investors’ money to invest in real estate, there are some key differences between the two. REITs are publicly traded companies that must distribute a significant portion of their income to shareholders as dividends, whereas property investment funds can be privately held and may offer different structures for investors to participate in real estate investments. Despite these distinctions, both REITs and property funds provide investors with opportunities to access the real estate market without directly owning properties.

Tags: factors, financial objectives, high-demand neighborhoods, investment goals, investment property, location, market trends, multi-unit buildings, profitable, property investment funds, property type, real estate professionals, rental demand, rental income, research, single-family homes