The Benefits of Triple Net (NNN) Investment Properties

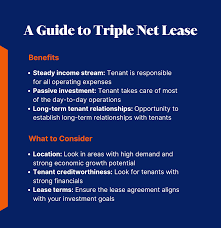

Triple Net (NNN) investment properties have become increasingly popular among investors seeking stable income and minimal management responsibilities. NNN investments involve leasing a property to a tenant who is responsible for paying all property expenses, including property taxes, insurance, and maintenance costs.

Key Advantages of NNN Investments

- Stable Income: NNN leases typically offer long-term agreements with rent payments that are predictable and consistent, providing investors with a reliable source of income.

- Minimal Management: Since tenants are responsible for property expenses, investors can enjoy passive income without the day-to-day management hassles associated with traditional real estate investments.

- Preservation of Capital: NNN properties are often leased to well-established tenants, reducing the risk of vacancy and ensuring a steady stream of rental income.

- Tax Benefits: Investors may benefit from tax advantages associated with owning NNN properties, such as depreciation deductions and potential tax deferral strategies.

Considerations for NNN Investments

While NNN investments offer attractive benefits, investors should carefully evaluate factors such as the creditworthiness of tenants, lease terms, location of the property, and overall market conditions before making investment decisions. Conducting thorough due diligence and seeking advice from real estate professionals can help mitigate risks and maximize returns in NNN investments.

Diversification and Long-Term Strategy

Investing in NNN properties can be an effective way to diversify a real estate portfolio and build long-term wealth. By leveraging the advantages of stable income, minimal management requirements, and potential tax benefits, investors can create a reliable source of passive income while preserving capital over time.

In conclusion, Triple Net (NNN) investment properties offer an appealing opportunity for investors seeking steady cash flow, reduced management responsibilities, and potential tax advantages. With careful consideration and strategic planning, NNN investments can be a valuable addition to a diversified investment portfolio.

Understanding Triple Net (NNN) Investment Properties: Key Questions Answered

- What is a Triple Net (NNN) investment property?

- How does a Triple Net (NNN) lease work?

- What are the benefits of investing in NNN properties?

- What factors should I consider before investing in NNN properties?

- How can I assess the creditworthiness of potential tenants for NNN investments?

- Are there any tax implications or benefits associated with NNN investments?

What is a Triple Net (NNN) investment property?

A Triple Net (NNN) investment property refers to a commercial real estate asset in which the tenant is responsible for paying all property expenses, including property taxes, insurance, and maintenance costs, in addition to the base rent. This type of lease structure shifts the burden of these expenses from the property owner to the tenant, making NNN investments attractive to investors seeking a passive income stream with minimal management responsibilities. By understanding the concept of Triple Net investment properties, investors can leverage this strategy to potentially benefit from stable income, long-term leases, and reduced operational risks associated with property ownership.

How does a Triple Net (NNN) lease work?

A Triple Net (NNN) lease is a type of commercial real estate agreement in which the tenant is responsible for paying all property expenses, including property taxes, insurance, and maintenance costs, in addition to the base rent. This means that the tenant assumes the financial burden of operating and maintaining the property, while the landlord receives a predictable rental income with minimal management responsibilities. NNN leases typically involve long-term agreements that provide stability for both parties and are commonly used in retail, office, and industrial properties. Investors are attracted to NNN leases for their passive income potential and reduced risk exposure, making them a popular choice in the commercial real estate market.

What are the benefits of investing in NNN properties?

Investing in NNN properties offers a range of compelling benefits for investors looking to generate stable income and minimize management responsibilities. One key advantage of NNN investments is the reliable stream of income they provide, thanks to long-term lease agreements with tenants who cover property expenses like taxes, insurance, and maintenance costs. This structure allows investors to enjoy passive income without the day-to-day hassles of property management. Additionally, NNN properties often attract well-established tenants, reducing vacancy risks and preserving capital over time. Furthermore, potential tax benefits, such as depreciation deductions and tax deferral strategies, can enhance the overall financial appeal of investing in NNN properties.

What factors should I consider before investing in NNN properties?

Before investing in Triple Net (NNN) properties, there are several key factors to consider to make an informed decision. Firstly, assess the creditworthiness and stability of the tenant leasing the property, as this will directly impact the reliability of rental income. Additionally, carefully review the terms of the lease agreement, including rent escalations, lease duration, and responsibilities allocated to the tenant. Location plays a crucial role in NNN investments, so evaluate the property’s market demand, growth potential, and overall economic stability of the area. Lastly, consider your investment goals, risk tolerance, and long-term strategy to ensure that NNN properties align with your financial objectives. Conducting thorough due diligence and seeking guidance from real estate professionals can help navigate these factors and maximize the potential returns on NNN investments.

How can I assess the creditworthiness of potential tenants for NNN investments?

Assessing the creditworthiness of potential tenants for Triple Net (NNN) investments is a crucial step in mitigating risk and ensuring a stable income stream. One effective way to evaluate a tenant’s creditworthiness is to review their financial statements, credit reports, and payment history. Look for indicators such as consistent revenue growth, strong cash reserves, low debt levels, and a solid track record of timely payments. Additionally, consider the tenant’s industry reputation, market position, and any relevant news or developments that may impact their financial stability. Conducting thorough due diligence on potential tenants can help investors make informed decisions and select reliable partners for long-term NNN investment success.

Are there any tax implications or benefits associated with NNN investments?

When considering NNN investments, it’s important to understand the tax implications and benefits that come with this type of investment. One significant advantage of NNN investments is the potential tax benefits they offer to investors. These may include depreciation deductions, which can help reduce taxable income, as well as the opportunity for tax-deferred exchanges that allow investors to defer capital gains taxes when reinvesting in similar properties. Additionally, investors may benefit from pass-through tax treatment where income generated from the NNN property passes through to the investor without being taxed at the entity level. It’s advisable for investors to consult with tax professionals or financial advisors to fully grasp the specific tax implications and benefits associated with NNN investments based on their individual circumstances.

Tags: consistent, depreciation deductions, insurance, investment properties, long-term agreements, maintenance costs, minimal management, nnn, nnn investment, passive income, predictable, preservation of capital, property expenses, property taxes, reliable source of income, rent payments, rental income stream, stable income, tax benefits, tax deferral strategies, triple net, vacancy risk reduction, well-established tenants