Multi-Family Investing: Building Wealth and Cash Flow

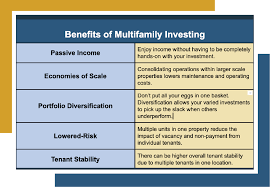

Investing in real estate has long been considered a reliable way to build wealth, and one avenue that has gained significant popularity in recent years is multi-family investing. This strategy involves purchasing properties that contain multiple units, such as duplexes, triplexes, or apartment buildings, and renting them out to tenants. Multi-family investing offers a range of benefits that make it an attractive option for both seasoned investors and those just starting their journey.

One of the key advantages of multi-family investing is the potential for increased cash flow. With multiple units generating rental income, investors can enjoy a steady stream of revenue that can help cover expenses and provide a consistent profit. Compared to single-family properties, where income relies on a single tenant, multi-family investments offer greater stability. Even if one unit becomes vacant or experiences a temporary downturn in occupancy, the other units can continue generating income.

Additionally, multi-family properties often benefit from economies of scale. By consolidating maintenance and management costs across multiple units, investors can reduce their expenses per unit. This scalability allows for more efficient operations and better profit margins over time.

Another advantage of multi-family investing is the potential for long-term appreciation. As population growth continues and demand for housing increases, well-located multi-family properties tend to appreciate in value over time. This appreciation not only builds equity but also provides opportunities for refinancing or selling the property at a higher price down the line.

Furthermore, multi-family investing allows investors to diversify their portfolio. By owning multiple units within one property or across different properties, investors spread their risk across various tenants and locations. This diversification helps mitigate the impact of vacancies or economic downturns in specific areas.

When it comes to financing options, multi-family investing also offers distinct advantages. Lenders often view these properties as less risky compared to commercial investments due to their stable rental income potential. As a result, investors can benefit from more favorable loan terms, such as lower interest rates and higher loan-to-value ratios.

However, like any investment strategy, multi-family investing requires careful consideration and due diligence. Investors must thoroughly research the local market, analyze rental demand and vacancy rates, and assess the potential for future growth. Additionally, effective property management is crucial to ensure tenant satisfaction and minimize vacancies.

To succeed in multi-family investing, it’s essential to develop a comprehensive business plan that includes financial projections, a marketing strategy, and a solid understanding of local regulations. Working with experienced real estate professionals or joining investor networks can provide valuable insights and guidance throughout the process.

In conclusion, multi-family investing offers an enticing opportunity for investors looking to build wealth and generate consistent cash flow. With its potential for increased cash flow, economies of scale, long-term appreciation, portfolio diversification benefits, and favorable financing options, this strategy has proven to be a successful path for many real estate investors. However, it is important to approach multi-family investing with proper research and planning to maximize its potential rewards.

Unlocking the Benefits of Multi-Family Investing: Exploring Low Maintenance Costs, Tax Advantages, Cash Flow Potential, Leverage Opportunities, Appreciation Potential, and Easier Management

- Low maintenance costs

- Tax benefits

- Cash flow potential

- Leverage opportunities

- Greater appreciation potential

- Easier management

The Challenges of Multi-Family Investing: Higher Risk, Maintenance Costs, and Tenant Turnover

- Higher Risk – Multi-family investments carry a higher risk than single family investments, as there is often more debt involved and multiple tenants to manage.

- Maintenance Costs – With multiple units in one building, the maintenance costs can be expensive if repairs are needed on several units at once.

- Tenant Turnover – Multi-family properties tend to have more tenant turnover than single family homes, which can lead to increased vacancy rates and lost rental income.

Low maintenance costs

Low Maintenance Costs: The Perks of Multi-Family Investing

When it comes to investing in real estate, one of the key advantages of multi-family properties is the ability to spread out maintenance costs. Unlike single-family homes, where the burden of repairs and maintenance falls solely on the owner, multi-family investments allow you to distribute these expenses among multiple tenants, resulting in lower overall costs.

By having multiple units within a single property, you can pool resources and allocate maintenance expenses more efficiently. Whether it’s fixing a leaky faucet, repairing a roof, or conducting routine upkeep, the cost is divided among all the units. This not only reduces the financial strain on individual investors but also provides an opportunity for economies of scale.

With more tenants to share the costs, each individual’s contribution towards maintenance becomes smaller. This can make a significant difference in your bottom line and increase your profit margins. Additionally, having multiple units means that repairs can be scheduled more efficiently, allowing for bulk purchases of materials or services at discounted rates.

Another benefit of reduced maintenance costs in multi-family investing is that it allows investors to allocate resources towards improving and upgrading their properties. By saving on day-to-day repairs, you have more flexibility to invest in renovations or amenities that attract higher-quality tenants and potentially increase rental income.

Furthermore, spreading out maintenance costs across multiple units can help mitigate unexpected financial burdens caused by vacancies or unforeseen repair needs. If one unit becomes vacant or requires extensive repairs, the remaining units continue generating income to cover ongoing expenses. This added stability can provide peace of mind for investors and help weather any temporary setbacks.

It’s important to note that effective property management plays a crucial role in maintaining low maintenance costs. Engaging professional property managers who are experienced in multi-family investments can ensure efficient handling of repairs and proactive maintenance practices. Their expertise can help identify potential issues early on and implement preventive measures that minimize future repair needs.

In conclusion, low maintenance costs are a significant advantage of multi-family investing. By spreading out the expenses among multiple tenants, investors can reduce their overall costs and increase profitability. This not only allows for better financial stability but also provides opportunities to invest in property improvements that enhance tenant satisfaction and attract higher rental rates. When combined with other benefits of multi-family investing, such as cash flow, appreciation potential, and portfolio diversification, this aspect makes it an appealing option for real estate investors seeking long-term success.

Tax benefits

Tax Benefits of Multi-Family Investing: Maximizing Cash Flow and Reducing Tax Liability

When it comes to investing in real estate, one of the significant advantages of multi-family properties is the array of tax benefits they offer. These benefits can have a positive impact on your overall financial strategy, helping to reduce your taxable income and increase your cash flow. Let’s explore how multi-family investing can provide valuable tax advantages.

One key benefit is depreciation. The IRS allows investors to depreciate the value of their investment property over time, considering it as a loss in value due to wear and tear. With multi-family properties, depreciation can be spread across multiple units, potentially resulting in more significant deductions compared to single-family properties. This depreciation expense can be used to offset rental income, reducing your taxable income and ultimately lowering your tax liability.

Another tax advantage associated with multi-family investing is interest deductions. Investors who finance their multi-family properties through mortgages can deduct the interest paid on those loans from their taxable income. This deduction can significantly reduce the amount of taxable income generated by rental earnings, thereby increasing cash flow.

Additionally, multi-family investments often offer opportunities for cost segregation studies. These studies allow investors to allocate property costs into different categories with varying depreciation schedules. By accelerating depreciation on certain components such as appliances or fixtures, investors can further enhance their tax deductions in the earlier years of ownership.

Furthermore, real estate investors may benefit from a 1031 exchange when selling a multi-family property. This provision allows for the deferral of capital gains taxes by reinvesting proceeds from the sale into a like-kind property within a specified timeframe. Utilizing a 1031 exchange enables investors to defer taxes and potentially grow their investment portfolio without immediate tax consequences.

It’s important to note that tax laws and regulations are subject to change, so consulting with a qualified tax professional is crucial for understanding and maximizing these benefits within the current legal framework.

In conclusion, multi-family investing offers compelling tax advantages that can significantly impact an investor’s cash flow and overall financial position. The ability to depreciate the property value, deduct mortgage interest, and utilize cost segregation studies can help reduce taxable income and increase cash flow. Additionally, the potential for a 1031 exchange provides opportunities for tax deferral and continued portfolio growth. By leveraging these tax benefits effectively, multi-family investors can optimize their returns and build long-term wealth in a tax-efficient manner.

Cash flow potential

Cash Flow Potential: Unlocking Income with Multi-Family Investing

When it comes to real estate investing, one of the most appealing aspects of multi-family properties is their cash flow potential. Unlike single-family rentals, where you rely on a single tenant for income, multi-family investing allows you to tap into the power of multiple tenants paying rent each month. This opens up a world of possibilities for generating more income and building long-term wealth.

The key advantage of multi-family investing lies in its ability to create a steady stream of cash flow. With multiple units within a single property or across different properties, you can enjoy the benefits of having several tenants contributing to your rental income. Even if one unit becomes vacant or experiences a temporary downturn in occupancy, the other units continue generating revenue, helping to offset any potential losses.

This consistent cash flow provides stability and peace of mind for investors. It not only covers expenses such as mortgage payments, property taxes, insurance, and maintenance costs but also leaves room for profit. The surplus income can be reinvested into further growing your real estate portfolio or used to fund other investments or personal financial goals.

Moreover, multi-family properties offer economies of scale that enhance their cash flow potential. By consolidating expenses such as property management fees and maintenance costs across multiple units, you can reduce the overall cost per unit. This efficiency helps maximize your profit margins and improve your return on investment.

Another advantage is that multi-family properties often attract higher rental rates compared to single-family homes in the same area. The demand for multi-unit housing is typically higher due to factors such as affordability and shared amenities. With more tenants willing to pay rent for these desirable living arrangements, you have the opportunity to command higher rental rates and increase your cash flow.

It’s important to note that achieving optimal cash flow requires careful consideration during the acquisition phase. Conducting thorough market research and due diligence will help identify areas with strong rental demand and potential for growth. Additionally, selecting properties that offer a good balance between rental income and expenses is crucial to ensure positive cash flow.

While multi-family investing presents an attractive cash flow potential, it’s essential to approach it with a strategic mindset. Effective property management, tenant screening, and proactive maintenance are vital to maintaining high occupancy rates and minimizing vacancies. By providing quality housing and excellent customer service, you can attract reliable tenants who will pay their rent on time, ensuring a steady income stream.

In summary, the cash flow potential of multi-family investing is a significant pro that sets it apart from single-family rental properties. By harnessing the power of multiple tenants paying rent each month, you can generate higher income and build wealth more efficiently. However, success in multi-family investing requires careful planning, market analysis, and diligent property management to fully unlock its cash flow potential.

Leverage opportunities

Leverage Opportunities: Unlocking Real Estate Investment Potential

When it comes to investing in real estate, one significant advantage of multi-family properties is the leverage opportunities they provide. Unlike single-family homes, obtaining financing for multi-family properties tends to be easier, granting investors greater leverage and expanding their investment potential.

The accessibility of financing for multi-family properties can be attributed to several factors. Lenders often view these properties as less risky due to their income-generating potential from multiple units. This perception of stability makes lenders more inclined to offer favorable loan terms, such as lower interest rates and higher loan-to-value ratios.

By leveraging financing options, investors can maximize their purchasing power and acquire larger multi-family properties than they could with cash alone. This increased scale allows for greater potential returns on investment. For instance, by purchasing a 10-unit apartment building instead of a single-family home, an investor not only benefits from rental income from multiple units but also enjoys economies of scale in terms of management and maintenance costs.

Additionally, leveraging financing for multi-family investments enables investors to diversify their portfolios without tying up all their available capital in a single property. By spreading their investments across multiple units within one property or across different properties, investors can mitigate risk and increase the potential for long-term wealth accumulation.

Moreover, leveraging opportunities in multi-family investing can lead to accelerated wealth creation through appreciation. As the market value of the property increases over time, investors gain equity without having invested the full purchase price upfront. This appreciation further strengthens an investor’s financial position and opens up possibilities for refinancing or selling the property at a higher price in the future.

However, it is essential to approach leverage with caution and prudence. Investors must carefully analyze their financial situation and ensure they have a solid plan in place to cover loan payments and expenses associated with the property. Thorough market research and due diligence are crucial when selecting the right multi-family property that aligns with investment goals and offers strong potential for rental income and appreciation.

In conclusion, the leverage opportunities that multi-family investing provides give investors a significant advantage in the world of real estate. Easier access to financing, coupled with the ability to acquire larger properties and diversify portfolios, allows investors to unlock greater potential for wealth accumulation and cash flow generation. However, it is vital to approach leverage responsibly and make informed decisions based on thorough research and analysis. With careful planning and execution, leveraging opportunities in multi-family investing can be a powerful tool for building a successful real estate portfolio.

Greater appreciation potential

Greater Appreciation Potential: The Power of Multi-Family Investing

When it comes to real estate investing, one of the most exciting advantages of multi-family properties is their greater appreciation potential. Unlike single-family homes, multi-family properties tend to appreciate at a faster rate due to the increased demand for rental units in many areas of the country.

The rising popularity of multi-family investing can be attributed to shifting demographics and lifestyle preferences. With an increasing number of people choosing to rent rather than buy, the demand for rental properties has surged. This trend has created a significant opportunity for investors who own multi-family properties.

One of the key factors driving the appreciation potential of multi-family properties is their ability to generate consistent rental income. With multiple units under one roof, investors benefit from diversified income streams, reducing their dependency on a single tenant. This stability and cash flow generation make multi-family properties attractive to investors and contribute to their overall value.

Furthermore, the demand for rental units often outpaces supply in many areas. This scarcity drives up rental prices and increases the desirability of well-maintained multi-family properties. As more individuals and families seek affordable housing options or prefer the flexibility that renting provides, multi-family investments become even more valuable.

Another aspect that contributes to greater appreciation potential is the scalability of multi-family investing. Investors can expand their portfolio by acquiring additional units within existing properties or purchasing new ones altogether. As they grow their holdings, they benefit from economies of scale and increased cash flow, further enhancing the overall value and appreciation potential.

Additionally, multi-family investments offer opportunities for value-add strategies. Investors can renovate or improve existing units to attract higher-paying tenants or reposition underperforming properties in desirable locations. These efforts not only increase rental income but also enhance property value over time.

It’s important to note that while multi-family investing offers greater appreciation potential, market conditions and location still play crucial roles in determining investment success. Conducting thorough market research, analyzing local rental demand, and understanding economic trends are essential steps for maximizing appreciation potential.

In conclusion, multi-family investing presents an enticing opportunity for investors seeking greater appreciation potential. The increased demand for rental units, stable cash flow generation, scalability, and value-add strategies all contribute to the accelerated appreciation of multi-family properties. However, it’s crucial to approach multi-family investing with careful analysis and due diligence to capitalize on this pro effectively. With the right approach and market understanding, investors can unlock the power of multi-family investing and enjoy the benefits of faster property value appreciation.

Easier management

Easier Management: The Advantage of Multi-Family Investing

When it comes to real estate investments, one significant advantage of multi-family investing is the ease of management. Managing multiple units within a single building is far more convenient than overseeing several individual properties scattered across town or different neighborhoods.

With multi-family investments, property owners can consolidate their management efforts into a centralized location. This means fewer trips between properties and less time spent coordinating maintenance and repairs. By having all units in close proximity, investors can streamline their operations and optimize efficiency.

Furthermore, managing multiple units in one building allows for better allocation of resources. Property owners can hire on-site staff or property managers who can oversee day-to-day operations, handle tenant inquiries, and address maintenance issues promptly. This dedicated presence ensures that tenants receive quick responses and efficient service, leading to higher tenant satisfaction and retention rates.

Another benefit of easier management in multi-family investing is the ability to leverage economies of scale. Consolidating maintenance tasks such as landscaping, snow removal, or common area upkeep across multiple units reduces costs per unit. This cost-saving advantage contributes to improved profitability for investors.

Moreover, managing multiple units within a single building provides greater control over the overall tenant mix. Property owners have the opportunity to curate a diverse group of tenants that complement each other’s lifestyles and needs. This curated environment fosters a sense of community among residents and can lead to longer-term tenancies.

From an administrative standpoint, multi-family investing simplifies record-keeping and financial management. With all rental income coming from one property or building, it becomes easier to track expenses, monitor cash flow, and prepare financial statements for tax purposes. This streamlined approach saves time and effort when compared to managing numerous individual properties with separate financial records.

In summary, easier management is a compelling pro of multi-family investing. Consolidating multiple units within one building offers convenience, efficiency, cost savings through economies of scale, better control over tenant mix, and simplified administrative tasks. By reducing the complexities associated with managing multiple scattered properties, multi-family investing allows property owners to focus on maximizing returns and building long-term wealth.

Higher Risk – Multi-family investments carry a higher risk than single family investments, as there is often more debt involved and multiple tenants to manage.

Higher Risk: Managing Debt and Multiple Tenants in Multi-Family Investing

While multi-family investing offers numerous advantages, it is important to acknowledge that this strategy also comes with its share of risks. One significant con of multi-family investing is the higher level of risk involved compared to single-family investments.

One aspect that contributes to the increased risk is the potential for higher debt. Multi-family properties often require larger initial investments due to their size and the number of units involved. This means investors may need to take on more debt or secure larger loans to finance the purchase. With greater debt comes increased financial responsibility and a higher level of risk if market conditions or rental income fluctuate.

Furthermore, managing multiple tenants can be more challenging than dealing with a single tenant in a single-family property. Each unit within a multi-family property requires individual attention, from finding and screening tenants to addressing maintenance issues and resolving disputes. The more tenants involved, the greater the likelihood of encountering various challenges, such as late payments, vacancies, or conflicts between tenants.

Additionally, turnover rates can be higher in multi-family properties compared to single-family homes. When one unit becomes vacant, it may take time and resources to find a new tenant while still covering expenses related to that unit. This turnover can impact cash flow and potentially increase vacancy periods if not managed effectively.

Moreover, multi-family properties are subject to regulations and zoning requirements specific to their classification as rental units. Investors must navigate these laws diligently and ensure compliance with local ordinances related to safety standards, occupancy limits, and other relevant regulations. Failure to do so can result in legal consequences or fines.

To mitigate these risks, investors should conduct thorough due diligence before purchasing a multi-family property. This includes analyzing market trends, assessing the financial viability of the investment, evaluating potential cash flow scenarios under different circumstances (such as vacancies), and carefully reviewing lease agreements.

Having a solid property management plan is also crucial for successful multi-family investing. Engaging professional property management services or developing a comprehensive management strategy can help navigate tenant-related challenges, streamline operations, and ensure compliance with regulations.

In conclusion, while multi-family investing offers numerous benefits, it is essential to recognize the higher level of risk associated with this strategy. Managing larger debts and multiple tenants can pose challenges that require careful planning and diligent execution. By conducting thorough research, implementing effective property management practices, and staying informed about local regulations, investors can minimize these risks and maximize the potential rewards of multi-family investing.

Maintenance Costs – With multiple units in one building, the maintenance costs can be expensive if repairs are needed on several units at once.

Maintenance Costs: A Consideration in Multi-Family Investing

While multi-family investing offers numerous advantages, it’s important to consider potential drawbacks as well. One notable challenge that investors may face is the maintenance costs associated with managing multiple units within a single building.

In any property investment, maintenance is a necessary expense to ensure the property remains in good condition and attracts quality tenants. However, in multi-family investing, the scale of maintenance can be more significant compared to single-family properties.

When repairs or renovations are needed in a multi-family property, such as fixing plumbing issues or replacing appliances, the costs can quickly add up. Unlike single-family homes where repairs typically affect only one unit at a time, multi-family properties may require simultaneous repairs across several units. This can result in higher expenses and potentially strain an investor’s budget.

Furthermore, coordinating and scheduling repairs for multiple units can be more complex and time-consuming compared to managing a single residential property. Investors must ensure that tenants are inconvenienced as little as possible during repair work while also addressing issues promptly to maintain tenant satisfaction.

To mitigate the impact of maintenance costs in multi-family investing, investors should factor these expenses into their financial projections and budget accordingly. It’s essential to set aside funds specifically for ongoing maintenance and unexpected repairs. Conducting regular inspections and implementing preventive maintenance measures can also help minimize the need for major repairs down the line.

Additionally, working with reliable contractors who offer competitive pricing and efficient service can help control costs without compromising on quality. Building long-term relationships with trusted professionals can streamline the repair process and potentially lead to discounted rates for repeat business.

Investors should also consider implementing effective property management strategies to proactively address maintenance needs. Timely response to tenant complaints or repair requests can prevent minor issues from escalating into major problems that require costly solutions.

Despite the potential challenges associated with maintenance costs in multi-family investing, it’s important to remember that this con is not insurmountable. With proper planning, budgeting, and proactive management, investors can navigate these expenses and still reap the benefits of multi-family investing.

Ultimately, weighing the pros and cons of multi-family investing is crucial for making informed investment decisions. By carefully considering maintenance costs alongside the numerous advantages this investment strategy offers, investors can determine whether multi-family investing aligns with their financial goals and risk tolerance.

Tenant Turnover – Multi-family properties tend to have more tenant turnover than single family homes, which can lead to increased vacancy rates and lost rental income.

Tenant Turnover: A Challenge in Multi-Family Investing

While multi-family investing offers numerous advantages, it is important to acknowledge the potential challenges that come with this investment strategy. One significant con that investors should be aware of is tenant turnover, which can lead to increased vacancy rates and lost rental income.

Unlike single-family homes, where tenants tend to stay for longer periods, multi-family properties often experience higher turnover rates. There are several reasons for this phenomenon. Firstly, the nature of multi-family living means that tenants may have different needs or circumstances that prompt them to move more frequently. For example, a growing family may require a larger space or a job relocation may necessitate a change in residence.

Secondly, the turnover rate in multi-family properties can also be influenced by factors outside of an investor’s control. Economic fluctuations and market conditions can impact individuals’ ability to pay rent or maintain their current housing situation. Additionally, changes in local demographics or employment opportunities can affect tenant stability.

The consequence of tenant turnover is increased vacancy rates, which directly impacts rental income. When a unit becomes vacant, it takes time and effort to find new tenants and complete necessary repairs or renovations before they can move in. During this period of vacancy, investors face the challenge of covering mortgage payments and other expenses without the benefit of rental income.

Furthermore, frequent tenant turnover also leads to additional costs associated with marketing the property and screening potential tenants. Each time a unit becomes vacant, investors must allocate resources towards advertising vacancies, conducting viewings, and screening applicants to ensure they find reliable tenants who meet their criteria.

To mitigate the impact of tenant turnover on multi-family investments, there are several strategies that investors can employ. Firstly, maintaining good relationships with existing tenants by providing excellent customer service and addressing their concerns promptly can help encourage longer tenancy periods. Offering incentives such as lease renewals with fixed rental rates or loyalty programs can also incentivize tenants to stay.

Secondly, implementing effective tenant screening processes can help identify reliable applicants who are more likely to stay long-term. Conducting thorough background checks, verifying employment and income, and checking references can provide valuable insights into a potential tenant’s stability and reliability.

Lastly, setting aside a portion of rental income for vacancy reserves can help investors manage the financial impact of turnover. Having funds readily available to cover expenses during periods of vacancy can alleviate some of the stress associated with lost rental income.

In conclusion, while tenant turnover is a con of multi-family investing, it is not an insurmountable challenge. By implementing strategies to reduce turnover rates, conducting thorough tenant screening, and maintaining vacancy reserves, investors can mitigate the negative impact on rental income and maximize the profitability of their multi-family investments.

Tags: multi family investing