The World of Real Estate Private Equity Firms

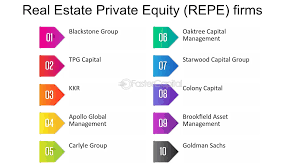

Real estate private equity firms play a significant role in the global real estate market, with some of the largest firms wielding substantial influence and capital. These firms specialize in raising funds from high-net-worth individuals, institutional investors, and pension funds to invest in real estate properties and projects.

One of the largest real estate private equity firms is Blackstone Group, known for its extensive portfolio of properties across various sectors such as residential, commercial, and hospitality. With a focus on strategic acquisitions and value creation, Blackstone has established itself as a powerhouse in the industry.

Another major player is Brookfield Asset Management, which operates one of the largest real estate portfolios globally. Brookfield’s diversified approach includes investments in office buildings, retail centers, multifamily properties, and infrastructure projects.

Carlyle Group is also a prominent name in the realm of real estate private equity. The firm’s investment strategy emphasizes opportunistic acquisitions and development projects that offer high returns to investors.

These firms leverage their expertise, market knowledge, and financial resources to identify lucrative investment opportunities and optimize returns for their stakeholders. Their ability to navigate complex transactions and manage risk effectively sets them apart in the competitive landscape of real estate investing.

In conclusion, real estate private equity firms like Blackstone Group, Brookfield Asset Management, and Carlyle Group are key players shaping the dynamics of the global real estate market. Their strategic investments drive innovation, growth, and profitability in the industry while offering investors access to diversified portfolios with attractive returns.

Top 5 Tips for Choosing the Largest Real Estate Private Equity Firms

- Research the track record and reputation of the firm in the real estate market.

- Consider the firm’s investment strategy and focus areas to ensure alignment with your goals.

- Evaluate the size and diversification of the firm’s real estate portfolio for risk management.

- Review the fee structure and terms of engagement with the firm before making any commitments.

- Seek recommendations or references from other investors who have worked with the firm previously.

Research the track record and reputation of the firm in the real estate market.

When considering investing in the largest real estate private equity firms, it is crucial to thoroughly research the track record and reputation of the firm in the real estate market. Understanding how successful and reliable a firm has been in previous investments can provide valuable insights into their expertise, performance, and risk management practices. By assessing their track record, investors can make informed decisions about partnering with a firm that aligns with their investment goals and risk tolerance. Additionally, evaluating the reputation of a real estate private equity firm within the industry can offer valuable perspectives on their integrity, transparency, and commitment to delivering results for their investors.

Consider the firm’s investment strategy and focus areas to ensure alignment with your goals.

When evaluating the largest real estate private equity firms, it is crucial to consider the firm’s investment strategy and focus areas to ensure alignment with your goals. Understanding how the firm approaches investments, whether through opportunistic acquisitions, value-add projects, or long-term holdings, can help you determine if their strategies align with your risk tolerance and investment objectives. Additionally, examining their focus areas, such as property types (residential, commercial, industrial) or geographic regions, can provide insight into whether they target markets that resonate with your investment preferences. By carefully assessing these factors, you can make informed decisions that align with your goals and maximize the potential for a successful partnership with a real estate private equity firm.

Evaluate the size and diversification of the firm’s real estate portfolio for risk management.

When assessing the largest real estate private equity firms, it is crucial to evaluate the size and diversification of their real estate portfolios as a key aspect of risk management. A well-diversified portfolio spread across various property types, geographic locations, and market segments can help mitigate risks associated with market fluctuations and economic downturns. By analyzing the breadth and depth of a firm’s real estate holdings, investors can gain insights into its risk exposure and resilience to external factors. Understanding the composition of the portfolio enables stakeholders to make informed decisions and assess the firm’s ability to weather uncertainties in the real estate market.

Review the fee structure and terms of engagement with the firm before making any commitments.

Before committing to any of the largest real estate private equity firms, it is crucial to thoroughly review their fee structure and terms of engagement. Understanding how fees are structured, including management fees, performance fees, and other charges, is essential for assessing the potential costs associated with investing with the firm. Additionally, carefully examining the terms of engagement can help clarify expectations regarding investment timelines, exit strategies, and overall transparency. By conducting due diligence on these aspects upfront, investors can make informed decisions and ensure alignment with their financial goals and risk tolerance.

Seek recommendations or references from other investors who have worked with the firm previously.

When considering investing in one of the largest real estate private equity firms, seeking recommendations or references from other investors who have prior experience with the firm can provide valuable insights and perspectives. Hearing firsthand accounts from individuals who have worked with the firm can offer a glimpse into the firm’s track record, communication style, performance, and overall satisfaction levels. This due diligence step can help potential investors make informed decisions and gain a better understanding of what to expect when partnering with a particular real estate private equity firm.

Tags: blackstone group, brookfield asset management, carlyle group, diversification, focus areas, investment strategy, investments, largest real estate private equity firms, real estate portfolio, real estate private equity firms, reputation, risk management, track record