The Benefits of IRA Real Estate Investment

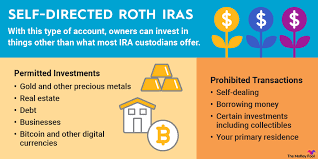

Individual Retirement Accounts (IRAs) are commonly associated with stocks, bonds, and mutual funds. However, many people are unaware that IRAs can also be used to invest in real estate. Investing in real estate through an IRA can provide unique advantages and diversify your retirement portfolio.

Benefits of Investing in Real Estate with an IRA:

- Diversification: Adding real estate to your IRA holdings can help diversify your investment portfolio and reduce risk.

- Tax Advantages: Depending on the type of IRA you have, you may enjoy tax benefits such as tax-deferred or tax-free growth.

- Potential for Growth: Real estate has the potential to generate rental income and appreciate in value over time, providing a source of retirement income.

- Hedge Against Inflation: Real estate is often considered a hedge against inflation as property values tend to increase over the long term.

- Control Over Investments: With a self-directed IRA, you have more control over your investment decisions and can choose the properties that best align with your financial goals.

Considerations for Investing in Real Estate with an IRA:

While investing in real estate through an IRA offers numerous benefits, there are some important considerations to keep in mind. It’s crucial to understand the rules and regulations governing real estate investments within an IRA, as well as any restrictions on transactions and property management.

Additionally, managing real estate within an IRA requires careful planning and oversight to ensure compliance with IRS guidelines. Working with a reputable custodian or financial advisor experienced in self-directed IRAs can help navigate the complexities of real estate investing within a retirement account.

In conclusion, investing in real estate with an IRA can be a valuable strategy to enhance your retirement savings and build wealth over time. By diversifying your portfolio with tangible assets like real estate, you can create a more robust financial future for yourself. Consider exploring the possibilities of IRA real estate investment to maximize your retirement planning efforts.

7 Essential Tips for Successful Real Estate Investment with Your IRA

- Research and understand the rules and regulations regarding using an IRA for real estate investment.

- Consider the potential risks and rewards associated with real estate investments within an IRA.

- Consult with a financial advisor or tax professional to ensure compliance with IRS guidelines.

- Diversify your IRA investments to reduce risk, including both real estate and other asset classes.

- Be aware of any restrictions on personally using or benefiting from the real estate held in your IRA.

- Regularly review and monitor the performance of your real estate investments within your IRA.

- Stay informed about market trends and economic factors that may impact your real estate holdings.

Research and understand the rules and regulations regarding using an IRA for real estate investment.

It is crucial to thoroughly research and comprehend the rules and regulations associated with utilizing an IRA for real estate investment. Understanding the specific guidelines governing real estate transactions within an IRA is essential to ensure compliance with IRS regulations and avoid potential penalties. By familiarizing yourself with the intricacies of using an IRA for real estate, you can make informed investment decisions and navigate the process effectively, ultimately maximizing the benefits of incorporating real estate into your retirement portfolio.

Consider the potential risks and rewards associated with real estate investments within an IRA.

When considering real estate investments within an IRA, it is essential to weigh the potential risks and rewards carefully. While real estate can offer significant growth and income potential, it also comes with inherent risks such as market fluctuations, property maintenance costs, and vacancy issues. Understanding these risks and conducting thorough due diligence on potential properties can help mitigate potential downsides. On the flip side, the rewards of real estate investment within an IRA can include long-term appreciation, rental income streams, and portfolio diversification. By carefully evaluating the risk-reward balance, investors can make informed decisions to optimize their IRA real estate investments for long-term financial success.

Consult with a financial advisor or tax professional to ensure compliance with IRS guidelines.

To ensure compliance with IRS guidelines when considering IRA real estate investment, it is highly recommended to consult with a financial advisor or tax professional. These experts can provide valuable insights into the rules and regulations governing real estate investments within an IRA, helping you navigate the complexities of managing properties within a retirement account. By seeking professional guidance, you can make informed decisions that align with IRS guidelines and maximize the benefits of investing in real estate through your IRA.

Diversify your IRA investments to reduce risk, including both real estate and other asset classes.

Diversifying your IRA investments is a smart strategy to mitigate risk and enhance long-term growth potential. By incorporating a mix of asset classes, such as real estate alongside stocks, bonds, and other investments, you can spread risk across different sectors and market conditions. Including real estate in your IRA portfolio not only adds a tangible asset with the potential for appreciation and income but also helps safeguard your savings against the volatility of traditional financial markets. Embracing diversification within your IRA can lead to a more resilient and balanced investment approach, setting the stage for a secure financial future.

Be aware of any restrictions on personally using or benefiting from the real estate held in your IRA.

When considering investing in real estate through your IRA, it is essential to be mindful of any limitations regarding personal use or benefits derived from the properties held within your retirement account. Restrictions may apply to prevent you or certain disqualified persons from using the real estate for personal gain, such as residing in or using it for vacation purposes. Understanding and adhering to these rules is crucial to maintain the tax-advantaged status of your IRA investments and ensure compliance with IRS regulations governing self-directed IRAs. By staying informed about these restrictions, you can make informed decisions that align with your long-term financial goals while safeguarding the integrity of your retirement savings strategy.

Regularly review and monitor the performance of your real estate investments within your IRA.

It is essential to regularly review and monitor the performance of your real estate investments within your IRA. By staying informed about how your properties are performing, you can make informed decisions about potential adjustments or improvements to maximize returns. Monitoring factors such as rental income, property appreciation, expenses, and market trends can help you proactively manage your real estate portfolio within your IRA and ensure that it continues to align with your long-term financial goals.

Stay informed about market trends and economic factors that may impact your real estate holdings.

Staying informed about market trends and economic factors is crucial when investing in real estate through an IRA. By keeping a close eye on the market, you can make informed decisions about your real estate holdings and adapt your investment strategy as needed. Understanding how economic factors such as interest rates, housing demand, and local market conditions can impact your investments allows you to proactively manage risks and capitalize on opportunities for growth. Stay vigilant and stay informed to ensure the long-term success of your IRA real estate investments.

Tags: benefits, compliance, considerations, control over investments, diversification, growth potential, inflation hedge, investment, ira, ira real estate investment, penalties, real estate, rewards, risks, rules and regulations, tax advantages