Investment Real Estate: A Lucrative Opportunity

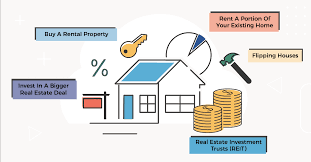

Investing in real estate has long been considered a smart financial move, offering a variety of benefits and opportunities for investors. Whether you’re looking to generate passive income, build wealth, or diversify your investment portfolio, real estate can be a lucrative option.

One of the key advantages of investment real estate is its potential for appreciation. Over time, real estate properties tend to increase in value, providing investors with the opportunity to build equity and see substantial returns on their initial investment.

Rental properties are a popular choice for many investors, as they can provide a steady stream of passive income. By renting out properties to tenants, investors can cover mortgage payments and expenses while potentially earning additional income on top of that.

Real estate also offers tax benefits that can help investors save money. Deductions for mortgage interest, property taxes, depreciation, and other expenses can reduce taxable income and increase overall profitability.

Furthermore, real estate investments can serve as a hedge against inflation. As the cost of living increases over time, so do rental rates and property values, allowing investors to maintain or even increase their purchasing power.

Of course, like any investment opportunity, there are risks involved in real estate investing. Market fluctuations, property damage, vacancies, and unexpected expenses are all factors that investors need to consider when entering the real estate market.

Despite these risks, many savvy investors have found success in the world of real estate investing. With careful research, strategic planning, and expert guidance from professionals in the field, investment real estate can be a rewarding venture that offers long-term financial stability and growth.

If you’re considering entering the world of real estate investing or looking to expand your existing portfolio, now may be the perfect time to explore the opportunities that this dynamic market has to offer.

6 Essential Tips for Successful Real Estate Investment Strategies

- Research the local real estate market thoroughly before making any investment decisions.

- Consider factors such as location, property condition, and potential for rental income when evaluating properties.

- Calculate your expected return on investment (ROI) to ensure the property will generate positive cash flow.

- Diversify your real estate portfolio by investing in different types of properties or in multiple locations.

- Stay informed about tax laws and regulations that may affect your real estate investments.

- Work with experienced professionals, such as real estate agents and property managers, to help you make informed decisions.

Research the local real estate market thoroughly before making any investment decisions.

Before diving into investment real estate, it is crucial to thoroughly research the local real estate market. Understanding the trends, pricing, demand, and potential risks in the specific area where you are considering investing can make a significant difference in the success of your investment. By conducting comprehensive research, you can make informed decisions that align with your financial goals and minimize potential pitfalls, setting yourself up for a more secure and profitable investment journey.

Consider factors such as location, property condition, and potential for rental income when evaluating properties.

When delving into the realm of investment real estate, it is crucial to carefully consider various factors that can significantly impact the success of your investment. Factors such as location, property condition, and potential for rental income play pivotal roles in evaluating properties. A prime location can attract desirable tenants and drive up rental income, while a well-maintained property can increase its value over time. By assessing these key factors thoughtfully, investors can make informed decisions that align with their financial goals and pave the way for a prosperous real estate investment journey.

Calculate your expected return on investment (ROI) to ensure the property will generate positive cash flow.

When considering investment real estate, it is crucial to calculate your expected return on investment (ROI) to ensure that the property will generate positive cash flow. By analyzing factors such as rental income, operating expenses, property appreciation, and potential risks, investors can determine whether the investment is financially viable and aligns with their goals. A positive ROI indicates that the property has the potential to provide a steady income stream and contribute to long-term wealth building, making it a sound investment choice in the competitive real estate market.

Diversify your real estate portfolio by investing in different types of properties or in multiple locations.

To maximize the potential of your investment real estate portfolio, it is advisable to diversify by exploring various types of properties or investing in multiple locations. By spreading your investments across different property types or geographic areas, you can mitigate risks associated with market fluctuations and economic downturns. Diversification not only helps protect your portfolio from localized risks but also opens up opportunities for greater returns and long-term growth. Consider diversifying your real estate holdings to build a robust and resilient investment strategy that can weather changes in the market and provide stability over time.

Stay informed about tax laws and regulations that may affect your real estate investments.

It is crucial for real estate investors to stay informed about tax laws and regulations that could impact their investments. Understanding the tax implications of owning and managing investment properties can help investors maximize their returns and minimize potential liabilities. By staying up-to-date on tax laws, deductions, credits, and other relevant regulations, investors can make informed decisions that align with their financial goals and ensure compliance with legal requirements. Keeping abreast of changes in tax legislation can ultimately contribute to the overall success and profitability of real estate investments.

Work with experienced professionals, such as real estate agents and property managers, to help you make informed decisions.

When delving into investment real estate, it is crucial to work alongside experienced professionals like real estate agents and property managers. These experts bring valuable knowledge and insights to the table, helping you make informed decisions that can maximize your returns and minimize risks. Real estate agents can assist in identifying lucrative investment opportunities, negotiating deals, and navigating the complexities of the market. Property managers, on the other hand, can handle the day-to-day operations of your rental properties, ensuring they are well-maintained and profitable. By leveraging the expertise of these professionals, you can set yourself up for success in the competitive world of investment real estate.

Tags: appreciation, benefits, diversification, equity building, financial stability, growth potential, inflation hedge, investing, investment real estate, lucrative opportunity, market risks, opportunities, passive income, passive income stream, property damage, real estate, rental properties, researching local market, tax benefits, tax deductions, vacancies, wealth building