The Benefits of Investment Property Exchange

Investment property exchange, also known as a 1031 exchange, is a tax-deferred strategy that allows real estate investors to sell a property and reinvest the proceeds in a new property without paying capital gains taxes on the sale. This powerful tool offers several benefits for investors looking to grow their real estate portfolios.

Tax Deferral

One of the primary advantages of investment property exchange is the ability to defer capital gains taxes. By reinvesting the proceeds from the sale into a like-kind property, investors can postpone paying taxes on their gains, allowing them to leverage more funds for further investments.

Portfolio Diversification

Exchange allows investors to diversify their real estate holdings by exchanging properties in different locations or asset classes. This diversification can help mitigate risk and enhance long-term returns by spreading investments across various markets and property types.

Increased Cash Flow

By exchanging into properties with higher income potential, investors can boost their cash flow and generate greater returns on their investments. This increased cash flow can provide financial stability and support future acquisitions or developments.

Wealth Building

Investment property exchange is a powerful wealth-building tool that enables investors to compound their gains over time. By continuously reinvesting in new properties through exchanges, investors can accelerate the growth of their real estate portfolios and build long-term wealth.

Estate Planning Benefits

In addition to tax advantages, investment property exchange offers estate planning benefits by allowing investors to pass on properties to heirs with a stepped-up basis, potentially reducing future tax liabilities for beneficiaries.

In conclusion, investment property exchange is a valuable strategy for real estate investors seeking tax advantages, portfolio diversification, increased cash flow, wealth building, and estate planning benefits. By leveraging this powerful tool effectively, investors can optimize their real estate investments and achieve long-term financial success.

Top 8 Benefits of Investment Property Exchange: Maximizing Wealth and Minimizing Taxes

- Tax deferral on capital gains

- Opportunity for portfolio diversification

- Increased cash flow potential

- Ability to upgrade to higher-value properties

- Wealth-building through property appreciation

- Estate planning benefits for future generations

- Flexibility in reinvestment options

- Potential reduction of overall tax burden

7 Drawbacks of Investment Property Exchange to Consider

- Strict time constraints for identifying and acquiring replacement properties.

- Limited flexibility in terms of property types that qualify for exchange.

- Potential difficulty in finding suitable like-kind properties for exchange.

- Risk of overpaying for replacement properties due to time pressure.

- Complex rules and regulations governing 1031 exchanges may be challenging to navigate.

- Transaction costs associated with investment property exchange can be significant.

- Dependence on market conditions may impact the availability and pricing of suitable replacement properties.

Tax deferral on capital gains

One of the key advantages of investment property exchange, also known as a 1031 exchange, is the ability to defer capital gains taxes. By reinvesting the proceeds from the sale of a property into a like-kind property, investors can postpone paying taxes on their gains. This tax deferral feature allows investors to maximize their investment capital by avoiding immediate tax liabilities, enabling them to leverage more funds for further real estate acquisitions and potentially accelerate the growth of their portfolios over time.

Opportunity for portfolio diversification

Investment property exchange provides investors with the opportunity for portfolio diversification, allowing them to spread their investments across different locations or asset classes. By exchanging properties into diverse real estate holdings, investors can mitigate risk and enhance their long-term returns. Diversification through exchange enables investors to adapt their portfolios to changing market conditions and capitalize on opportunities in various markets, ultimately strengthening their overall investment strategy and maximizing potential gains.

Increased cash flow potential

One significant advantage of investment property exchange is the potential for increased cash flow. By exchanging into properties with higher income potential, investors can enhance their cash flow and generate greater returns on their investments. This improved cash flow not only provides financial stability but also opens up opportunities for reinvestment, further expanding the investor’s real estate portfolio. Ultimately, the increased cash flow potential through property exchange can contribute to long-term financial growth and success in real estate investing.

Ability to upgrade to higher-value properties

One significant advantage of investment property exchange is the ability for investors to upgrade to higher-value properties without incurring immediate tax liabilities. By leveraging the 1031 exchange, investors can sell their current properties and reinvest the proceeds into more valuable assets, thereby enhancing their portfolio and potentially increasing rental income or property appreciation. This strategy allows investors to capitalize on market opportunities and improve the overall quality and performance of their real estate holdings, ultimately leading to greater long-term wealth accumulation.

Wealth-building through property appreciation

One significant advantage of investment property exchange is the potential for wealth-building through property appreciation. As real estate values tend to increase over time, investors can capitalize on this appreciation by exchanging properties strategically. By reinvesting in properties with higher growth potential or in emerging markets, investors can maximize their returns and accelerate the growth of their real estate portfolios. This continuous cycle of exchanging properties based on appreciation can lead to significant wealth accumulation over the long term, making investment property exchange a powerful tool for building financial prosperity through real estate investments.

Estate planning benefits for future generations

Investment property exchange offers significant estate planning benefits for future generations. By utilizing this tax-deferred strategy, investors can pass on properties to their heirs with a stepped-up basis, potentially reducing future tax liabilities for beneficiaries. This not only ensures a smoother transfer of assets but also provides an opportunity for heirs to inherit valuable real estate investments without the burden of immediate tax implications. Through investment property exchange, investors can create a lasting legacy and secure the financial well-being of their loved ones for generations to come.

Flexibility in reinvestment options

One key advantage of investment property exchange is the flexibility it offers in reinvestment options. Investors have the freedom to exchange their property for a wide range of like-kind properties, enabling them to tailor their investment strategy to meet their specific goals and preferences. Whether they choose to diversify into different asset classes, upgrade to higher-income properties, or consolidate their portfolio for better management, the flexibility in reinvestment options provided by property exchange empowers investors to make strategic decisions that align with their financial objectives and maximize their returns in the real estate market.

Potential reduction of overall tax burden

One significant advantage of investment property exchange is the potential reduction of the overall tax burden for investors. By deferring capital gains taxes through a 1031 exchange, investors can retain more funds to reinvest in new properties, leading to greater wealth accumulation over time. This tax-saving strategy not only allows investors to defer taxes on their gains but also provides opportunities to strategically manage their tax liabilities, ultimately contributing to a more efficient and effective investment portfolio.

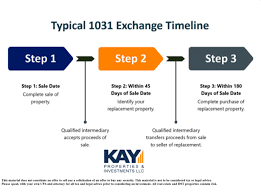

Strict time constraints for identifying and acquiring replacement properties.

One significant con of investment property exchange is the strict time constraints imposed on identifying and acquiring replacement properties. Investors participating in a 1031 exchange must adhere to specific deadlines for identifying potential replacement properties and completing the acquisition process. These tight timelines can create pressure and limit the flexibility of investors, potentially leading to rushed decisions or missed opportunities. Failure to meet these deadlines can result in disqualification from the exchange, triggering immediate tax liabilities on capital gains. As such, the stringent time constraints associated with investment property exchange pose a challenge for investors in effectively navigating the process and maximizing their investment outcomes.

Limited flexibility in terms of property types that qualify for exchange.

One significant con of investment property exchange is the limited flexibility in terms of property types that qualify for exchange. The IRS imposes strict guidelines on what properties can be exchanged under Section 1031, requiring them to be like-kind. This limitation can restrict investors from diversifying into different asset classes or types of real estate, potentially hindering their ability to optimize their investment strategy and capitalize on emerging opportunities in the market.

Potential difficulty in finding suitable like-kind properties for exchange.

One significant challenge of investment property exchange is the potential difficulty in finding suitable like-kind properties for exchange. Identifying properties that meet the criteria for a 1031 exchange, such as being of similar value and type, in a timely manner can be a daunting task. Limited availability of desirable properties or specific market conditions may further complicate the process, potentially leading to delays or missed opportunities for investors looking to reinvest their proceeds efficiently. This hurdle underscores the importance of thorough research, strategic planning, and working with experienced professionals to navigate the complexities of property exchanges successfully.

Risk of overpaying for replacement properties due to time pressure.

One significant con of investment property exchange is the risk of overpaying for replacement properties due to time pressure. Investors participating in a 1031 exchange must identify potential replacement properties within strict timelines, typically 45 days after selling their initial property. This sense of urgency can lead investors to make hasty decisions and potentially pay more than the fair market value for a replacement property in order to meet the exchange deadlines. This increased pressure to find suitable properties within a limited timeframe can compromise thorough due diligence and strategic decision-making, ultimately resulting in a higher risk of overpaying and potentially diminishing the overall return on investment.

Complex rules and regulations governing 1031 exchanges may be challenging to navigate.

One significant con of investment property exchange, such as a 1031 exchange, is the complex rules and regulations that govern these transactions. Navigating the intricate requirements and guidelines associated with 1031 exchanges can be challenging for investors, especially those who are not well-versed in tax laws and real estate regulations. The strict timelines, specific property criteria, identification rules, and other intricacies involved in a 1031 exchange may pose hurdles for investors looking to take advantage of this tax-deferral strategy. Seeking professional guidance from experts familiar with 1031 exchanges is crucial to ensure compliance and successful execution of the exchange process.

Transaction costs associated with investment property exchange can be significant.

Transaction costs associated with investment property exchange can be a significant drawback for investors considering this strategy. These costs include fees for intermediaries, legal expenses, and other administrative charges that can eat into the potential tax savings and returns from the exchange. Additionally, the complexities involved in navigating the exchange process may require professional assistance, further adding to the overall transaction costs. As such, investors should carefully weigh these expenses against the benefits of tax deferral and portfolio diversification before deciding to pursue an investment property exchange.

Dependence on market conditions may impact the availability and pricing of suitable replacement properties.

One significant drawback of investment property exchange is the reliance on market conditions, which can influence the availability and pricing of suitable replacement properties. Fluctuations in the real estate market can affect the options investors have when identifying potential properties for exchange. In times of high demand or limited inventory, finding suitable replacement properties that meet the investor’s criteria may become challenging. Additionally, market conditions can impact the pricing of these replacement properties, potentially leading to higher costs or reduced profitability for investors participating in property exchanges. As a result, investors must carefully consider market trends and conditions when engaging in investment property exchange to mitigate the risks associated with fluctuating market dynamics.

Tags: 1031 exchange, capital gains taxes, estate planning benefits, financial stability, increased cash flow, investment property exchange, like-kind property, portfolio diversification, risk mitigation, tax deferral, wealth building