Investing in Multifamily Properties: A Lucrative Opportunity

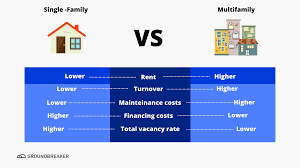

When it comes to real estate investment, multifamily properties have emerged as a popular choice among investors looking for stable returns and long-term growth. Investing in multifamily properties, such as apartment buildings or condominiums, offers a range of benefits that make it an attractive option for both seasoned investors and those new to the real estate market.

Diversification and Scale:

One of the key advantages of investing in multifamily properties is the opportunity for diversification and scale. By owning multiple units within a single property, investors can spread their risk across different tenants and income streams. This diversification can help mitigate the impact of vacancies or economic downturns, providing more stability to your investment portfolio.

Steady Cash Flow:

Another compelling reason to invest in multifamily properties is the potential for steady cash flow. With multiple units generating rental income, investors can enjoy a consistent stream of revenue that can help cover mortgage payments, maintenance costs, and other expenses associated with property ownership. Additionally, rental demand for multifamily units tends to remain strong even during economic fluctuations, providing a reliable source of income over time.

Appreciation and Equity Build-Up:

Investing in multifamily properties also offers the opportunity for appreciation and equity build-up. As property values increase over time and mortgage balances decrease through regular loan payments, investors can benefit from growing equity in their investments. This equity can be leveraged for future purchases or reinvested into existing properties to further enhance their value.

Tax Benefits:

Furthermore, investing in multifamily properties can provide various tax benefits to investors. Deductions for mortgage interest, property depreciation, maintenance expenses, and other costs associated with property ownership can help reduce taxable income and increase overall returns on investment. Consultation with a tax professional is recommended to fully understand the tax advantages available through real estate investment.

Conclusion:

In conclusion, investing in multifamily properties presents a lucrative opportunity for investors seeking stable returns, diversification, and long-term growth potential. With benefits such as steady cash flow, appreciation, equity build-up, and tax advantages, multifamily properties offer a compelling investment option in the real estate market. Whether you are a seasoned investor looking to expand your portfolio or a newcomer exploring investment opportunities, consider the numerous advantages that investing in multifamily properties can offer.

9 Essential Tips for Successful Multifamily Property Investment

- 1. Research the local market to understand demand and rental rates.

- 2. Calculate potential ROI and cash flow before making a purchase.

- 3. Consider hiring a property management company to handle day-to-day operations.

- 4. Evaluate the condition of the property and factor in any necessary repairs or renovations.

- 5. Understand zoning laws and regulations that may affect your investment.

- 6. Network with other real estate investors for advice and potential partnerships.

- 7. Diversify your portfolio by investing in properties in different locations.

- 8. Stay informed about economic trends that could impact the real estate market.

- 9. Have a long-term investment strategy and be prepared for fluctuations in the market.

1. Research the local market to understand demand and rental rates.

Before diving into investing in multifamily properties, it is crucial to research the local market thoroughly to gain insights into demand and rental rates. Understanding the dynamics of the local market will help investors make informed decisions about property acquisition, pricing strategies, and potential returns on investment. By analyzing factors such as population growth, employment trends, and rental vacancy rates, investors can identify areas with high demand for multifamily properties and competitive rental rates, setting the stage for a successful investment venture. Conducting thorough market research is a fundamental step in building a profitable multifamily property portfolio.

2. Calculate potential ROI and cash flow before making a purchase.

Before diving into investing in multifamily properties, it is crucial to follow the tip of calculating potential ROI and cash flow before making a purchase. By conducting a thorough analysis of the expected return on investment and projected cash flow, investors can make informed decisions that align with their financial goals and risk tolerance. Understanding these key metrics can help investors assess the profitability of a multifamily property, evaluate its long-term viability, and determine whether it fits within their investment strategy. Taking the time to crunch the numbers before committing to a purchase can lead to smarter investments and better outcomes in the real estate market.

3. Consider hiring a property management company to handle day-to-day operations.

When investing in multifamily properties, it is essential to consider hiring a property management company to handle day-to-day operations. By entrusting professionals with the management of your property, you can alleviate the burden of dealing with tenant issues, maintenance requests, rent collection, and other responsibilities. A property management company can streamline operations, ensure compliance with regulations, and enhance the overall efficiency of managing a multifamily property. This allows investors to focus on strategic decision-making and long-term growth while benefiting from the expertise and support provided by experienced property managers.

4. Evaluate the condition of the property and factor in any necessary repairs or renovations.

When investing in multifamily properties, it is crucial to thoroughly evaluate the condition of the property and consider any necessary repairs or renovations. Conducting a detailed inspection can help identify potential issues that may require immediate attention or impact the overall value of the investment. By factoring in the cost of repairs and renovations, investors can make informed decisions about the property’s potential return on investment and ensure that they are adequately prepared for any additional expenses that may arise. Prioritizing property maintenance and improvements can not only enhance the property’s appeal to tenants but also contribute to its long-term value and profitability in the real estate market.

5. Understand zoning laws and regulations that may affect your investment.

Understanding zoning laws and regulations that may affect your investment is a crucial tip when considering investing in multifamily properties. Zoning laws dictate how a property can be used and developed, impacting factors such as the type of housing allowed, building height restrictions, parking requirements, and more. By familiarizing yourself with these regulations, you can ensure that your investment aligns with local zoning requirements and avoid potential issues or setbacks down the line. Conducting thorough research and seeking guidance from legal experts can help you navigate zoning laws effectively and make informed decisions to maximize the success of your multifamily property investment.

6. Network with other real estate investors for advice and potential partnerships.

Networking with other real estate investors is a valuable tip when considering investing in multifamily properties. By connecting with experienced investors, you can gain valuable insights, advice, and guidance that can help you navigate the complexities of the real estate market. Additionally, networking opens up opportunities for potential partnerships that can lead to joint investments in multifamily properties, allowing you to leverage shared expertise and resources for mutual benefit. Building relationships within the real estate investment community can provide access to a wealth of knowledge and support that can enhance your success as a multifamily property investor.

7. Diversify your portfolio by investing in properties in different locations.

To maximize the benefits of investing in multifamily properties, it is crucial to diversify your portfolio by considering properties in different locations. By spreading your investments across various geographic areas, you can reduce the risk associated with local economic fluctuations or market conditions. Diversifying geographically also allows you to tap into different rental markets, demographics, and growth potentials, providing a more robust and resilient investment strategy. Additionally, investing in properties in different locations can help you capitalize on emerging real estate trends and opportunities, ensuring a well-rounded portfolio that offers stability and long-term growth prospects.

8. Stay informed about economic trends that could impact the real estate market.

To maximize your success in investing in multifamily properties, it is crucial to stay informed about economic trends that could impact the real estate market. By keeping a close eye on factors such as interest rates, job growth, inflation, and housing supply and demand, you can make informed decisions about when and where to invest. Understanding how these economic trends influence the real estate market can help you anticipate potential risks and opportunities, allowing you to adjust your investment strategy accordingly for long-term success in the multifamily property sector.

9. Have a long-term investment strategy and be prepared for fluctuations in the market.

When investing in multifamily properties, it is crucial to have a long-term investment strategy and be prepared for fluctuations in the market. Real estate markets can be influenced by various factors such as economic conditions, interest rates, and local trends. By adopting a long-term perspective, investors can weather market fluctuations and benefit from the potential growth of their investments over time. Being prepared for ups and downs in the market allows investors to make informed decisions and stay focused on their overall investment goals.

Tags: apartment buildings, benefits, cash flow, condominiums, diversification, economic downturns, investing, investing in multifamily properties, investment portfolio, long-term growth, lucrative opportunity, maintenance costs, mortgage payments, multifamily properties, new investors, real estate investment, rental income, revenue stream, risk mitigation, scale, seasoned investors, stability, stable returns, vacancies