Fractional Real Estate Ownership: Unlocking Opportunities for Investors

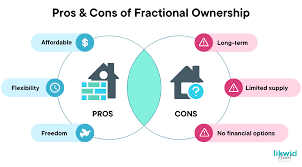

In the world of real estate, fractional ownership is a concept that has gained significant traction in recent years. This innovative approach to property ownership allows individuals to invest in high-value properties, such as vacation homes or luxury apartments, while sharing the costs and responsibilities with other like-minded investors. Let’s delve into the world of fractional real estate ownership and explore the benefits it offers.

Fractional ownership works on the principle of dividing a property into fractions or shares, typically ranging from one-eighth to one-half. Each share represents a specific percentage of ownership and grants the investor exclusive access to the property for a predetermined period each year. This arrangement provides an opportunity for individuals to enjoy all the benefits of owning a luxurious property without bearing the full financial burden.

One of the primary advantages of fractional ownership is cost-sharing. High-end properties often come with hefty price tags, making them unaffordable for many investors on an individual basis. By pooling resources with other investors, fractional ownership allows individuals to gain access to premium properties they may have only dreamed of owning outright.

Furthermore, fractional ownership eliminates many of the hassles associated with traditional property management. Maintenance costs, property taxes, and other expenses are shared among all owners based on their respective shares. This not only reduces financial burdens but also ensures that properties are well-maintained throughout the year.

Flexibility is another key benefit offered by fractional ownership. Unlike timeshare arrangements that restrict usage to specific weeks or seasons, fractional owners typically have more flexibility in choosing when they want to use their allotted time at the property. This provides greater freedom and convenience for owners who may have varying schedules or preferences.

Additionally, fractional ownership often comes with access to amenities and services that would be otherwise inaccessible or cost-prohibitive. From concierge services and housekeeping to golf courses and private beaches, these added perks enhance the overall experience for owners during their stays.

For investors, fractional ownership offers the potential for diversification within their real estate portfolio. Instead of tying up a significant amount of capital in a single property, fractional ownership allows investors to spread their investments across multiple properties and locations, reducing risk and increasing the potential for returns.

It’s worth noting that fractional ownership is not limited to residential properties. Commercial properties, such as office spaces or retail units, can also be owned through this model. This presents an opportunity for business owners or investors to gain access to prime commercial real estate without the need for substantial capital investment.

As with any investment, it is essential to conduct thorough due diligence before entering into a fractional ownership arrangement. Understanding the legal structure, management agreements, and exit options is crucial to ensure a smooth and satisfactory experience.

In conclusion, fractional real estate ownership opens up a world of opportunities for investors seeking access to premium properties without shouldering the full financial burden. With shared costs, reduced management responsibilities, and added flexibility, this innovative approach is revolutionizing the way people invest in real estate. Whether for personal use or as part of an investment strategy, fractional ownership provides an avenue for individuals to enjoy the benefits of luxury properties while maximizing their return on investment.

Benefits of Fractional Real Estate Ownership: Lower Entry Cost, Diversification, Professional Management, Flexibility, and Tax Benefits

Drawbacks of Fractional Real Estate Ownership: Limited Control, Privacy Concerns, and Potential Losses

Lower Entry Cost

Lower Entry Cost: Unlocking Real Estate Investment Opportunities

Investing in real estate has long been considered a lucrative venture, but the high costs associated with purchasing a property outright can be a significant barrier for many individuals. However, fractional ownership of real estate offers a compelling solution by significantly lowering the entry cost and making investment opportunities more accessible and affordable.

Fractional ownership allows investors to purchase a share or fraction of a property, typically ranging from one-eighth to one-half. This means that instead of shouldering the entire financial burden of buying a property, investors can acquire a portion of it at a fraction of the total cost. This lower entry cost opens up avenues for individuals who may have previously been unable to participate in real estate investment due to budget constraints.

By sharing the costs with other like-minded investors, fractional ownership provides an opportunity to invest in high-value properties that would otherwise be beyond reach. Whether it’s an upscale vacation home, a luxury apartment in a prime location, or even commercial real estate, fractional ownership allows individuals to tap into these markets without breaking the bank.

The benefits of lower entry costs extend beyond affordability. Fractional ownership also reduces risk by diversifying investments across multiple properties. Instead of tying up all their capital in one property, investors can spread their funds across various assets, thereby minimizing exposure to market fluctuations and potential downturns.

Moreover, fractional ownership offers flexibility and freedom when it comes to investment strategies. Investors can choose to allocate their resources based on their preferences and goals. For instance, they may decide to invest in multiple fractions within one property or diversify their portfolio by investing in fractions across different properties or locations.

Lower entry costs also make fractional ownership an attractive option for those who wish to dip their toes into real estate investing before committing fully. It allows them to gain firsthand experience and knowledge about the industry without assuming excessive financial risks. As they become more comfortable and confident in their investment abilities, they can gradually expand their portfolio or consider full ownership in the future.

It’s important to note that while fractional ownership offers a more affordable entry into real estate investment, proper due diligence is still crucial. Investors should thoroughly research the property, understand the legal agreements and terms of ownership, and evaluate the potential returns on their investment.

In conclusion, fractional ownership’s lower entry cost is a game-changer in the world of real estate investment. It opens doors for aspiring investors who previously found themselves priced out of the market. By sharing costs, reducing risk, and providing flexibility, fractional ownership empowers individuals to participate in real estate ventures and potentially reap substantial rewards.

Diversification

Diversification: Unlocking the Power of Fractional Real Estate Ownership

Investing in real estate has long been recognized as a solid strategy for building wealth. However, putting all your eggs in one basket can be risky. This is where fractional real estate ownership comes into play, offering a valuable benefit: diversification.

Diversification is the practice of spreading investments across different assets to reduce risk. With fractional ownership, investors can achieve this diversification by acquiring shares in multiple properties rather than investing solely in one. This approach allows individuals to mitigate potential losses and maximize their chances of gaining positive returns.

By diversifying their real estate portfolio through fractional ownership, investors can tap into various markets and locations. For instance, they could invest in vacation properties in popular tourist destinations or commercial properties in thriving business districts. This strategy helps to minimize the impact of any downturns or fluctuations specific to a particular market or location.

Moreover, fractional ownership enables investors to spread out financial risks associated with property ownership. Costs such as property taxes, maintenance expenses, and insurance premiums are shared among the co-owners based on their respective shares. By pooling resources with other investors, individuals can reduce the financial burden that would otherwise fall solely on their shoulders.

Another advantage of diversifying through fractional ownership is the potential for increased cash flow and returns on investment. By having stakes in multiple properties, investors have more opportunities to generate income from rental yields or capital appreciation across different markets. This income stream from various sources helps balance the overall performance of an investor’s real estate portfolio.

Additionally, diversification through fractional ownership provides flexibility and adaptability to changing market conditions. If one property underperforms due to factors beyond an investor’s control, the impact on their overall portfolio is mitigated by other investments that may be performing well. This flexibility allows investors to adjust their strategies and allocate resources accordingly without facing significant losses.

It’s important to note that while diversification can reduce risk, it does not guarantee profits or eliminate the possibility of losses entirely. Real estate markets can be influenced by various factors, including economic conditions and unforeseen events. Therefore, thorough research and due diligence are crucial when selecting properties for fractional ownership to maximize the potential benefits.

In conclusion, diversification is a key advantage offered by fractional real estate ownership. By spreading investments across multiple properties, investors can minimize risk and maximize their chances of achieving positive returns. This approach allows individuals to tap into different markets, locations, and income streams while sharing costs and responsibilities with co-owners. As with any investment strategy, careful planning and evaluation are vital to ensure that fractional ownership aligns with an investor’s goals and risk tolerance.

Professional Management

Professional Management: Simplifying Property Ownership with Fractional Real Estate

One of the notable advantages of fractional real estate ownership is the access to professional management services. For investors looking to enjoy the benefits of property ownership without the hassle of day-to-day tasks, this aspect is particularly appealing.

Owning a property, whether it’s a vacation home or a rental property, comes with various responsibilities. From routine maintenance and repairs to tenant screening and management, these tasks can be time-consuming and demanding. However, with fractional real estate ownership, investors can rely on professional management services to handle these responsibilities efficiently.

Professional property management companies have the expertise and resources to ensure that properties are well-maintained and in optimal condition. They take care of routine maintenance tasks, such as landscaping, cleaning, and repairs, ensuring that the property remains attractive and functional for all owners.

In addition to maintenance, fractional ownership also benefits from professional tenant screening services. For those investing in rental properties, finding reliable tenants is crucial for long-term success. Property management companies have established screening processes in place to thoroughly vet potential tenants based on credit checks, background verification, and rental history. This helps minimize risks associated with problematic tenants and ensures a smooth rental experience for all owners.

Another advantage of professional management is their ability to handle financial matters related to the property. They collect rent payments from tenants on behalf of all owners and distribute the income accordingly. This eliminates the need for individual owners to deal with rent collection or manage financial transactions related to their share of ownership.

Moreover, professional management services offer convenience for fractional owners who may not reside near the property or have limited availability due to other commitments. With a dedicated team overseeing day-to-day operations, owners can have peace of mind knowing that their investment is being well-managed even when they are not physically present.

By entrusting property management duties to professionals, fractional real estate owners can focus on enjoying their investment rather than getting caught up in the nitty-gritty details. This allows investors to reap the benefits of property ownership without the stress and time commitment typically associated with it.

In conclusion, professional management services are a significant advantage of fractional real estate ownership. They provide investors with peace of mind, convenience, and expert assistance in maintaining and managing their properties. With professional property management companies taking care of day-to-day tasks, fractional owners can fully enjoy the benefits of their investment while leaving the operational responsibilities in capable hands.

Flexibility

Flexibility: The Key Advantage of Fractional Real Estate Ownership

In the realm of real estate investment, flexibility is a highly sought-after trait. Traditional forms of property ownership, such as buying a home or apartment building outright, often require long-term commitments. However, fractional real estate ownership offers a unique advantage in this regard – the ability to choose the duration of investment in each property.

Fractional ownership allows individuals to invest in high-value properties while sharing costs and responsibilities with other investors. Unlike traditional ownership models where one is tied to a property for an extended period, fractional owners have the freedom to decide how long they want to stay invested in each property.

This flexibility is particularly beneficial for those who prefer variety or have changing needs and preferences over time. Fractional owners can enjoy the benefits of owning luxurious properties without being confined to a single location or type of property indefinitely.

For instance, imagine owning a fraction of a vacation home in an exotic location. With fractional ownership, you have the freedom to decide how long you want to retain your share in that particular property. If you find yourself desiring new experiences or exploring different destinations, you can choose to sell your share or exchange it for another property within the fractional ownership network.

This level of flexibility is unmatched by traditional real estate investments. Buying a home outright limits your options and ties up your capital in one place for an extended period. Fractional ownership allows you to adapt your investments according to changing circumstances and personal preferences.

Additionally, fractional owners can also take advantage of rental income when they are not using their allotted time at the property. By placing their shares into rental programs managed by professional companies, owners can generate income during periods when they are not personally utilizing the property. This added flexibility provides an opportunity for financial gain while still retaining control over how long they want to remain invested in each specific property.

In conclusion, flexibility is a significant pro of fractional real estate ownership that sets it apart from traditional forms of real estate investment. The ability to choose how long to stay invested in each property provides individuals with the freedom to adapt their investments to changing circumstances, explore new opportunities, and enjoy a diverse portfolio of luxurious properties. Whether for personal use or financial gain, fractional ownership offers a level of flexibility that is highly valued by investors seeking greater control over their real estate assets.

Tax Benefits

Tax Benefits: Unlocking Financial Advantages with Fractional Real Estate Ownership

When it comes to investing in real estate, one of the significant advantages of fractional ownership is the array of tax benefits it offers. Investors who opt for this innovative approach can take advantage of various tax incentives, including depreciation deductions and favorable capital gains tax treatment. Let’s explore how fractional real estate ownership can unlock valuable tax benefits for savvy investors.

One key tax benefit associated with fractional ownership is depreciation deductions. Depreciation allows investors to deduct a portion of the property’s value over time as it wears down or becomes obsolete. This deduction can significantly reduce taxable income, resulting in lower overall tax liability for investors. By spreading the cost of the property across multiple owners, each investor can claim their share of depreciation deductions based on their ownership percentage.

Moreover, when fractional property owners decide to sell their shares at a profit, they may be eligible for favorable capital gains tax treatment. Capital gains taxes are typically applied to the difference between the purchase price and the selling price of an asset. However, with fractional ownership, investors may enjoy certain advantages when it comes to capital gains taxes.

If an investor holds their shares in a property for more than one year before selling them, they may qualify for long-term capital gains tax rates, which are generally lower than ordinary income tax rates. This can result in significant savings when compared to short-term capital gains taxes that apply to assets held for less than one year.

Furthermore, fractional ownership allows investors to diversify their real estate portfolio without triggering immediate capital gains taxes. Instead of selling an entire property and incurring substantial taxes on any profits made, investors have the flexibility to sell only a portion of their shares when needed. This strategy enables them to manage their taxable income more effectively by spreading out potential capital gains over time.

It’s important to note that individual circumstances and local tax laws may vary, so consulting with a qualified tax professional is advisable to fully understand the specific tax benefits available in your jurisdiction.

In conclusion, fractional real estate ownership not only provides investors with the opportunity to enjoy luxurious properties at a fraction of the cost but also unlocks valuable tax benefits. Depreciation deductions and favorable capital gains tax treatment can significantly reduce taxable income and increase overall returns on investment. By taking advantage of these tax incentives, investors can maximize their financial advantages while building a diversified real estate portfolio.

Limited Control

Limited Control: A Consideration in Fractional Real Estate Ownership

While fractional real estate ownership offers numerous advantages, it is important to consider the potential drawbacks before making an investment decision. One such drawback is the limited control that fractional owners may have over the property they own a share of.

Unlike sole property ownership, where individuals have full autonomy over decision-making and management, fractional owners typically have limited say in how the property is managed or used. Important decisions regarding maintenance, renovations, rental agreements, or changes in usage may be made collectively by all owners or by a designated management entity.

This lack of control can be a disadvantage for those who prefer to have a hands-on approach or specific preferences for their property. It may mean that certain decisions are made without their direct input or that they are unable to make changes according to their personal preferences or needs.

Additionally, differing opinions among fractional owners can sometimes lead to challenges in reaching consensus on important matters. Disagreements about property usage, investment strategies, or even cosmetic changes can arise and potentially create tensions among co-owners.

It is essential for prospective fractional owners to thoroughly understand the governance structure and decision-making processes outlined in the ownership agreement. This will help them determine if they are comfortable with relinquishing some control over their investment property.

Despite these limitations, it’s important to note that many fractional ownership arrangements are designed with transparency and fairness in mind. Professional management companies often handle day-to-day operations and ensure that decisions are made in the best interest of all owners involved.

For individuals who prioritize convenience and shared responsibilities over absolute control, fractional ownership can still provide an attractive opportunity. It allows them to enjoy luxury properties without shouldering all the burdens associated with sole ownership.

Ultimately, whether limited control is viewed as a significant con depends on individual preferences and goals. Some investors may find comfort in shared decision-making and professional property management expertise, while others may prefer more direct involvement in every aspect of their investment.

In conclusion, while fractional real estate ownership offers numerous benefits, it is important to weigh the advantages against the potential limitations. Limited control over decision-making and property management is a consideration that prospective fractional owners should carefully evaluate to ensure it aligns with their personal preferences and investment objectives.

Lack of Privacy

Lack of Privacy: A Consideration in Fractional Real Estate Ownership

While fractional real estate ownership offers numerous advantages, it is important to consider potential drawbacks as well. One significant concern that may arise in this type of ownership structure is the potential lack of privacy when it comes to using the property.

In a fractional ownership arrangement, multiple individuals or families own shares of the property and have the right to use it during specific periods. This means that you may not have exclusive access to the property whenever you desire. Depending on the specific agreement, you may need to coordinate with other owners or adhere to a predetermined schedule for your usage.

This shared usage can lead to a lack of privacy, as you may find yourself sharing common areas, amenities, and even living spaces with other owners during your allotted time. While some individuals might not mind this aspect and enjoy interacting with co-owners or building a sense of community, others may prefer more seclusion and solitude during their stays.

Furthermore, differences in preferences and lifestyles among co-owners can also impact privacy. For example, if one owner prefers a quiet retreat while another enjoys hosting gatherings or parties, conflicts over usage and noise levels could arise. It is essential to have open communication and establish clear guidelines regarding expectations and boundaries with fellow owners to mitigate any potential issues.

To address these concerns, some fractional ownership arrangements include provisions for private usage or exclusive access during certain periods. However, such arrangements may come at an additional cost or require advanced planning and coordination among owners.

Before entering into a fractional ownership agreement, it is crucial to carefully review all terms and conditions related to usage rights and privacy. Consider your personal preferences for privacy and evaluate whether the shared nature of fractional ownership aligns with your expectations.

Despite the potential challenges concerning privacy in fractional real estate ownership, many individuals find that the benefits outweigh this particular con. The opportunity to invest in high-value properties at a fraction of the cost, access to luxurious amenities, and the ability to diversify one’s real estate portfolio are compelling reasons that attract investors to fractional ownership.

Ultimately, it is essential to weigh the pros and cons of fractional ownership and determine what matters most to you as an investor or property user. By doing so, you can make an informed decision that aligns with your lifestyle, financial goals, and desire for privacy.

Potential for Losses

Potential for Losses: A Consideration in Fractional Real Estate Ownership

While fractional real estate ownership offers numerous benefits, it is essential to consider the potential risks involved. One significant con of this investment model is the potential for financial losses. Investors should be aware that market fluctuations and the actions of other owners can impact their returns and even result in a loss of money.

Market volatility is an inherent risk in any real estate investment, and fractional ownership is no exception. Property values can fluctuate due to various factors such as economic conditions, changes in local regulations, or shifts in demand. If the market turns against you, the value of your fractional ownership share may decrease, potentially leading to a loss if you decide to sell.

Furthermore, the financial stability and commitment of other owners can influence your investment. In a fractional ownership arrangement, all owners are responsible for sharing costs associated with the property’s maintenance, taxes, and other expenses. If some owners fail to fulfill their financial obligations, it can place additional burdens on the remaining investors.

For instance, if one owner fails to pay their share of costs or becomes financially unable to contribute, the remaining owners may need to cover those expenses. This situation could strain finances and potentially impact returns on investment for all involved parties.

To mitigate these risks, it is crucial for potential investors to conduct thorough due diligence before entering into a fractional ownership agreement. Understanding the financial stability and commitment of fellow owners can provide insight into how reliable they are likely to be in meeting their obligations.

Additionally, staying informed about market trends and seeking professional advice from real estate experts can help investors make well-informed decisions regarding their fractional ownership investments. Diversifying one’s portfolio across different properties or locations may also help reduce exposure to potential losses.

It’s important to note that while there are risks associated with fractional real estate ownership, these risks exist in various forms of investment. By carefully considering these potential downsides and taking appropriate precautions, investors can make informed choices and potentially mitigate the risks involved.

In conclusion, the potential for financial losses is a con to consider when exploring fractional real estate ownership. Market fluctuations and the actions of fellow owners can impact investment returns, and there is a risk of loss if the market turns against you or if other owners fail to meet their financial obligations. However, with careful research, due diligence, and proactive risk management strategies, investors can navigate these risks and potentially reap the benefits of fractional ownership in real estate.

Tags: allotted time, amenities, benefits, capital investment, cost-sharing, costs, diversification, due diligence, exclusive access, exit options, expenses, financial burden, flexibility, fractional real estate ownership, fractions, high-value properties, investment strategy, investors, legal structure, like-minded investors, lower entry cost, lucrative venture, luxury apartments, maintenance costs, management agreements, percentage of ownership, pooling resources, premium properties, price tags, property ownership, property taxes, purchasing a, real estate investment opportunities, real estate portfolio, reduced management responsibilities, responsibilities, services, shared costs, shares, timeshare arrangements, traditional property management, unaffordable, vacation homes, well-maintained properties