The Rise of Fractional Investing in Real Estate

Traditional real estate investing often requires a substantial amount of capital, making it out of reach for many individuals. However, fractional investing has emerged as a game-changer in the real estate industry, allowing investors to own a fraction of a property without the need for a large upfront investment.

So, what exactly is fractional investing in real estate? In simple terms, it involves pooling resources with other investors to collectively invest in properties. This model offers several advantages, including diversification of investment portfolios, lower entry barriers, and access to premium properties that would otherwise be unattainable.

One of the key benefits of fractional investing is the ability to spread risk across multiple properties. By owning fractions of different properties, investors can reduce their exposure to market fluctuations and potential losses associated with owning a single property.

Moreover, fractional investing opens up opportunities for passive income generation. Investors can earn rental income and potential capital appreciation without the responsibilities of property management or maintenance.

Technology has played a significant role in fueling the growth of fractional investing platforms. Online platforms now allow investors to browse and select investment opportunities, track their portfolio performance, and manage transactions seamlessly from anywhere in the world.

While fractional investing offers numerous benefits, it’s essential for investors to conduct thorough due diligence before committing funds. Understanding the terms of the investment, assessing the credibility of the platform or sponsor, and evaluating the potential risks are crucial steps in making informed investment decisions.

In conclusion, fractional investing in real estate represents a democratization of property ownership, providing individuals with access to lucrative investment opportunities previously reserved for institutional investors. As this trend continues to gain momentum, more investors are likely to explore this innovative approach to building wealth through real estate.

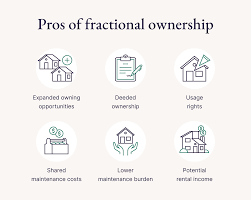

Unlocking Wealth: 6 Benefits of Fractional Real Estate Investing

- Diversification

- Lower Entry Barriers

- Passive Income

- Access to Premium Properties

- Liquidity

- Professional Management

Challenges of Fractional Real Estate Investing: Control, Conflicts, Market Dependency, and Insolvency Risks

- Limited control over property management decisions

- Potential for conflicts among co-owners

- Dependency on the performance of the overall real estate market

- Risk of platform or sponsor insolvency impacting investments

Diversification

Fractional investing in real estate offers a significant advantage in diversification by enabling investors to spread their risk across multiple properties. By owning fractions of different properties, investors can mitigate the impact of market fluctuations on their overall investment portfolio. This diversification strategy not only helps reduce risk but also enhances the potential for stable returns over time, making fractional investing a compelling option for those seeking to build a diversified real estate investment portfolio.

Lower Entry Barriers

Fractional investing in real estate offers the significant advantage of lower entry barriers, enabling investors to access premium properties without the requirement for a substantial upfront investment. This accessibility allows individuals with limited capital to diversify their portfolios and benefit from potential returns associated with high-value real estate assets that would typically be out of reach. By owning a fraction of these premium properties, investors can participate in lucrative real estate opportunities and build wealth without the financial constraints of traditional property ownership.

Passive Income

One significant advantage of fractional investing in real estate is the opportunity for passive income generation. By owning fractions of properties, investors can benefit from rental income and potential capital appreciation without the burdens of day-to-day property management. This hands-off approach allows investors to enjoy the financial rewards of real estate ownership while leaving the responsibilities of tenant management, maintenance, and other operational tasks to experienced professionals. Passive income through fractional investing offers a convenient way for individuals to build wealth and diversify their investment portfolios without the time and effort typically associated with traditional property ownership.

Access to Premium Properties

Fractional investing in real estate offers individual investors the unique opportunity to access premium properties that would typically be out of reach due to high costs. By pooling resources with other investors, individuals can own a fraction of high-quality real estate assets such as luxury condos, commercial buildings, or vacation homes. This access allows investors to diversify their portfolios with top-tier properties, potentially benefiting from rental income and capital appreciation that these exclusive assets can offer. Fractional investing opens doors to a world of upscale real estate opportunities that may have been inaccessible to individual investors operating on their own.

Liquidity

One significant advantage of fractional investing in real estate is the enhanced liquidity it provides. Unlike traditional real estate investments that can be illiquid and tie up capital for extended periods, some fractional investing platforms offer liquidity options. This means that investors have the flexibility to buy and sell fractions of properties more easily, providing them with greater control over their investment portfolios and the ability to access funds when needed. This increased liquidity can be particularly appealing to investors looking for more agile and dynamic investment opportunities in the real estate market.

Professional Management

Investors engaging in fractional investing in real estate enjoy the advantage of professional property management services offered by the platform or sponsor. This perk alleviates investors from the burden of handling day-to-day operational tasks associated with property ownership. By entrusting experienced professionals to manage the property, investors can rest assured that their investment is being efficiently and effectively managed, leading to potential income generation and capital appreciation without the need for direct involvement in property maintenance or tenant interactions.

Limited control over property management decisions

One significant con of fractional investing in real estate is the limited control investors have over property management decisions. Since multiple investors collectively own a fraction of the property, major decisions regarding property management, such as renovations, tenant selection, or rental pricing, may require consensus among all co-owners. This lack of autonomy can lead to potential conflicts of interest and delays in implementing crucial management strategies that could impact the overall performance and profitability of the investment.

Potential for conflicts among co-owners

One significant con of fractional investing in real estate is the potential for conflicts among co-owners. When multiple investors own fractions of a property, differing opinions on property management, rental agreements, maintenance decisions, or even the timing of selling the property can lead to disagreements and disputes. These conflicts can not only strain relationships among co-owners but also impact the overall performance and profitability of the investment. Resolving such conflicts may require time-consuming negotiations and compromise, which can hinder the smooth operation of the investment and potentially result in financial losses for all parties involved.

Dependency on the performance of the overall real estate market

One significant con of fractional investing in real estate is the dependency on the performance of the overall real estate market. Since fractional investors hold fractions of properties, their returns are directly impacted by market trends and fluctuations. A downturn in the real estate market can lead to decreased property values, rental income, and potential returns for investors. This lack of control over external market forces can expose investors to higher levels of risk compared to owning individual properties outright. It underscores the importance of thorough market research and risk assessment before engaging in fractional real estate investing to mitigate potential losses during market downturns.

Risk of platform or sponsor insolvency impacting investments

One significant con of fractional investing in real estate is the risk of platform or sponsor insolvency directly affecting investments. In this scenario, if the platform or sponsor managing the fractional investment goes bankrupt or faces financial difficulties, investors may face challenges in accessing their funds or maintaining ownership of their fractional shares in properties. This risk highlights the importance of conducting thorough due diligence on the platform or sponsor’s financial stability and reputation before committing to any fractional real estate investment to mitigate potential losses.

Tags: capital appreciation, diversification, entry barriers, fractional investing, fractional investing real estate, investment portfolios, market fluctuations, passive income, premium properties, properties, property management, real estate, rental income, returns, risk