DST Real Estate: The Future of Investing

In today’s ever-changing investment landscape, finding secure and lucrative opportunities can be a challenge. However, a new investment strategy has emerged that is revolutionizing the real estate market – DST (Delaware Statutory Trust) real estate.

DST real estate offers investors a unique way to diversify their portfolios while enjoying the benefits of passive income and potential tax advantages. By pooling funds with other investors, individuals can gain access to high-quality commercial properties that would otherwise be out of reach.

One of the key advantages of DST real estate is its ability to provide investors with a hands-off approach. Unlike traditional real estate investments that require active management and maintenance, DST properties are managed by professional asset managers. This allows investors to enjoy the benefits of property ownership without the day-to-day responsibilities.

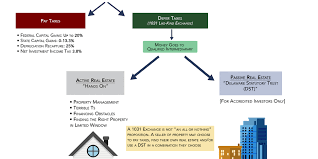

Additionally, DST investments offer potential tax advantages. By utilizing the 1031 exchange provision in the Internal Revenue Code, investors can defer capital gains taxes when selling appreciated properties and reinvesting in DSTs. This tax deferral strategy can significantly enhance an investor’s overall return on investment.

DST real estate also provides diversification benefits by allowing investors to spread their investments across multiple properties and markets. This mitigates risk and reduces exposure to any single property or geographic area. With DSTs, investors have access to a wide range of property types including retail centers, office buildings, multifamily residences, and more.

Another notable feature of DST real estate is its accessibility. Unlike traditional real estate investments that often require substantial capital or extensive knowledge of the market, DSTs have lower minimum investment requirements and are professionally managed by experienced teams. This makes it an attractive option for both seasoned investors and those new to real estate investing.

It’s important to note that while DST real estate offers numerous advantages, it is still essential for investors to conduct thorough due diligence. Understanding the specific terms of each DST offering, including the property details, financial projections, and potential risks, is crucial in making informed investment decisions.

As the real estate market continues to evolve, DST investments are gaining popularity among savvy investors seeking stable income streams and potential tax benefits. With its passive nature, diversification opportunities, and accessibility, DST real estate is shaping the future of investing.

If you’re interested in exploring DST real estate opportunities or learning more about how it can fit into your investment strategy, contact us at DST Real Estate today. Our experienced team is here to guide you through the process and help you make informed investment decisions.

6 Essential Tips for Smart Investing in DST Real Estate

- Research the local market trends before investing in DST real estate.

- Consider working with a qualified financial advisor who specializes in DST investments.

- Evaluate the reputation and track record of the DST sponsor or operator.

- Understand the potential tax implications associated with DST real estate investments.

- Diversify your investment portfolio by including different types of properties within a DST structure.

- Review the offering documents and legal agreements carefully before committing to a DST investment.

Research the local market trends before investing in DST real estate.

Before making any investment in DST real estate, it is crucial to research and understand the local market trends. Local market conditions can greatly impact the performance and potential returns of a DST property. By analyzing factors such as supply and demand, rental rates, vacancy rates, and economic indicators specific to the area, investors can make informed decisions about the viability of a particular DST investment. This research provides valuable insights into the potential growth prospects and stability of the local real estate market, helping investors mitigate risks and maximize their returns.

Consider working with a qualified financial advisor who specializes in DST investments.

When delving into the world of DST real estate investments, it is highly recommended to consider working with a qualified financial advisor who specializes in this specific area. DST investments can be complex, and having an expert by your side can provide valuable insights and guidance throughout the process. A knowledgeable financial advisor will possess a deep understanding of DST structures, tax implications, risk assessment, and market trends. Their expertise can help you make informed investment decisions tailored to your financial goals and risk tolerance. By partnering with a specialized financial advisor, you can navigate the intricacies of DST real estate with confidence and maximize your investment potential.

Evaluate the reputation and track record of the DST sponsor or operator.

When considering investing in DST real estate, it is crucial to thoroughly evaluate the reputation and track record of the DST sponsor or operator. The sponsor plays a pivotal role in the success of the investment, as they are responsible for selecting and managing the properties within the DST. By researching their reputation and track record, investors can gain valuable insights into their experience, expertise, and ability to deliver on promised returns. A reputable and experienced sponsor will have a proven track record of successful investments, transparent communication with investors, and a solid understanding of the market. This evaluation process helps investors make informed decisions and ensures they are entrusting their funds to a reliable and knowledgeable partner in their DST investment journey.

Understand the potential tax implications associated with DST real estate investments.

When considering DST real estate investments, it is crucial to understand the potential tax implications that come with them. One of the significant advantages of DST investments is the ability to defer capital gains taxes through the 1031 exchange provision. This provision allows investors to sell appreciated properties and reinvest the proceeds into DSTs while deferring taxes on the capital gains. However, it is important to consult with a tax professional or financial advisor to fully comprehend the specific tax implications and ensure compliance with relevant regulations. Understanding the potential tax benefits and obligations associated with DST real estate investments empowers investors to make informed decisions and maximize their financial outcomes.

Diversify your investment portfolio by including different types of properties within a DST structure.

Diversifying your investment portfolio is a fundamental strategy to minimize risk and maximize potential returns. When it comes to DST real estate, one effective way to achieve diversification is by including different types of properties within the DST structure. By investing in a mix of property types such as retail centers, office buildings, multifamily residences, and more, you can spread your investments across various sectors and markets. This approach helps mitigate the risk associated with any single property type or geographic area, ensuring that your investment portfolio remains well-balanced and resilient to market fluctuations. With a diversified DST portfolio, you can enjoy the benefits of passive income and potential tax advantages while minimizing exposure to any specific segment of the real estate market.

Review the offering documents and legal agreements carefully before committing to a DST investment.

Before committing to a DST (Delaware Statutory Trust) investment, it is crucial to review the offering documents and legal agreements meticulously. These documents provide essential information about the investment, including property details, financial projections, potential risks, and legal obligations. By thoroughly examining these documents, investors can gain a comprehensive understanding of the investment opportunity and make informed decisions. It is advisable to seek professional guidance or consult with a financial advisor to ensure clarity and mitigate any potential misunderstandings before committing to a DST investment. Taking the time to review these materials carefully can help investors safeguard their interests and make confident choices in the realm of DST real estate.

Tags: 1031 exchange provision, accessibility, complexity of dst investments, delaware statutory trust, diversification benefits, diversify portfolios, dst real estate, due diligence, economic indicators, financial projections, hands-off approach, high-quality commercial properties, investing, investment strategy, local market trends, lower minimum investment requirements, market trends, mitigate risk, multifamily residences, office buildings, passive income, performance, pooling funds, potential returns, professional asset managers, property ownership, qualified financial advisor, real estate market, rental rates, research, retail centers, revolutionizing, risk assessment, specializes in dst investments, spread investments, supply and demand, tax advantages, tax deferral strategy, tax implications, vacancy rates, viability