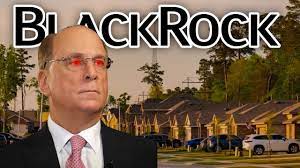

Title: BlackRock’s Venture into Home Buying: A Game-Changer or Cause for Concern?

Introduction:

In recent years, the real estate market has witnessed an unexpected player entering the housing arena: BlackRock, the world’s largest asset management firm. With its vast financial resources and global reach, BlackRock’s foray into buying homes has raised eyebrows and sparked debates. This article aims to explore the implications of BlackRock’s entry into the housing market and its potential impact on homeownership and communities.

The Rise of Institutional Investors:

BlackRock is not alone in this venture; other institutional investors have also been actively purchasing single-family homes as a long-term investment strategy. This trend gained momentum after the 2008 financial crisis when distressed properties were available at attractive prices. These institutional investors saw an opportunity to capitalize on the rental market and generate stable returns.

Pros of Institutional Investment in Housing:

Supporters argue that institutional investors like BlackRock bring much-needed liquidity to the housing market. By purchasing large volumes of homes, they help stabilize prices, reduce inventory, and revitalize neighborhoods that were hit hard by foreclosures during economic downturns. Additionally, these investors often make significant investments in property maintenance and management, improving overall housing conditions.

Critics’ Concerns:

While there are potential benefits, critics express concerns about the consequences of institutional investment in housing. One worry is that these large-scale purchases may inflate home prices, making it harder for individual buyers to enter the market. This can exacerbate existing affordability challenges and widen wealth disparities.

Another concern revolves around rental practices. Critics argue that institutional investors prioritize profit over community well-being, leading to increased rental costs and reduced tenant rights. They fear a shift from homeownership towards long-term renting, which could fundamentally alter traditional notions of stability and wealth accumulation associated with owning a home.

Community Impact:

The impact on local communities is another aspect under scrutiny. Some worry that an influx of institutional investors may disrupt the social fabric of neighborhoods, reducing the sense of community and stability. With absentee landlords and a potential lack of local engagement, concerns arise regarding the long-term well-being of these communities.

Regulatory Response:

As BlackRock and other institutional investors continue to expand their presence in the housing market, regulatory bodies are taking notice. Calls for increased oversight and regulation have grown louder, with policymakers seeking to strike a balance between encouraging investment while safeguarding the interests of homeowners and tenants.

Conclusion:

BlackRock’s entry into home buying signifies a significant shift in the real estate landscape. While it brings potential benefits such as increased liquidity and neighborhood revitalization, concerns about affordability, rental practices, and community impact cannot be ignored. Striking a balance between encouraging institutional investment and protecting the interests of individuals and communities will be crucial as we navigate this evolving housing market.

Ultimately, only time will tell whether BlackRock’s venture into home buying will be a game-changer or cause for concern. As stakeholders continue to assess its impact, it is essential to prioritize inclusive housing policies that ensure both individual homeownership opportunities and sustainable communities for all.

9 Pros of BlackRock Buying Homes: Boosting Financial Stability, Affordability, and Economic Growth

- Increased financial stability for homeowners.

- More affordable housing options available to potential buyers.

- Ability to purchase multiple homes at once, making the process easier and faster.

- Potential for increased rental income from tenants in Blackrock-owned properties.

- Access to a larger pool of potential buyers, giving sellers more bargaining power in negotiations and increasing their chances of selling quickly and profitably.

- Reduced risk of foreclosure due to Blackrock’s ability to buy up troubled mortgages and restructure them into more manageable payments for homeowners in need of assistance with their mortgage payments or other financial issues related to their home ownership status.

- Improved job opportunities as Blackrock expands its presence in local markets through its home purchases, creating new employment opportunities for those living in the area where it operates or invests in real estate assets such as single family homes or apartment buildings/complexes that they own outright or through investments with other partners such as banks, pension funds, etc..

- Increased economic activity resulting from an influx of capital into local communities through the purchase of homes by Blackrock which can result in a boost to local businesses who rely on consumer spending for their survival and growth within a given region or city/town/village/etc..

- Enhanced property values due to the overall increase in demand that comes with having large institutional investors like Blackrock buying up properties within certain neighborhoods which can lead to an overall rise in prices across the board regardless if they are sold directly by Blackrock or not (i.e., increased competition between buyers).

Implications of BlackRock’s Home Purchases: Impact on Affordable Housing, Gentrification, and Low-Income Homeowners

- Reduced Availability of Affordable Housing

- Increased Gentrification

- Disadvantageous to Low-Income Homeowners

Increased financial stability for homeowners.

One of the potential benefits of BlackRock’s entry into the home buying market is the promise of increased financial stability for homeowners. As an institutional investor with substantial financial resources, BlackRock has the capacity to purchase large volumes of homes, particularly distressed properties or those facing foreclosure.

By acquiring these properties, BlackRock can help stabilize local housing markets and prevent further price depreciation. This stability can be a relief for existing homeowners who may have experienced declining property values during economic downturns or faced challenges in selling their homes due to market conditions.

Moreover, BlackRock’s investment in property maintenance and management can contribute to improving overall housing conditions. This can have a positive effect on neighboring properties and enhance the desirability of the community as a whole.

Additionally, BlackRock’s involvement in the rental market provides an alternative housing option for individuals who may not be ready or able to purchase a home. By offering quality rental properties managed by professionals, BlackRock can provide renters with a reliable and well-maintained living environment.

For homeowners who are considering selling their properties, BlackRock’s presence as a potential buyer increases competition in the market. This competition can drive up property prices and allow sellers to negotiate better terms or receive higher offers for their homes.

Overall, BlackRock’s participation in home buying has the potential to bring increased financial stability to homeowners. Through their investments, they contribute to stabilizing local housing markets, improving property conditions, and providing alternative rental options. While there are valid concerns surrounding this trend, recognizing its potential advantages helps shed light on this aspect of BlackRock’s involvement in real estate.

More affordable housing options available to potential buyers.

Title: BlackRock’s Home Buying Initiative: Expanding Affordable Housing Opportunities

Introduction:

BlackRock’s entry into the housing market has generated significant discussion, and while concerns have been raised, there are also potential benefits to consider. One notable advantage of BlackRock buying homes is the potential increase in affordable housing options available to potential buyers. This article explores how BlackRock’s involvement may contribute to expanding affordability in the housing market.

Addressing the Affordability Crisis:

The United States, like many countries, faces an ongoing challenge of affordable housing shortages. Rising home prices and limited supply have made it increasingly difficult for individuals and families to enter the market. BlackRock’s large-scale home purchases can help address this crisis by injecting liquidity and creating opportunities for more affordable housing options.

Boosting Supply and Stabilizing Prices:

By purchasing homes on a large scale, BlackRock contributes to stabilizing prices and reducing inventory levels. This can alleviate some of the pressure on local markets where demand often outpaces supply. With more available properties, potential buyers have a greater chance of finding homes within their budget range.

Revitalizing Distressed Neighborhoods:

BlackRock’s investment in distressed properties can bring about positive transformations in struggling neighborhoods. By acquiring these properties, they have the resources to renovate and improve them, ultimately raising property values and attracting other buyers to the area. This revitalization can lead to increased community pride, enhanced amenities, and improved overall living conditions.

Encouraging Competition in Real Estate:

BlackRock’s presence as a major player in home buying introduces healthy competition into the real estate market. This competition can drive innovation among developers, builders, and other investors who may be motivated to offer more affordable housing solutions to remain competitive. As a result, potential buyers may benefit from a wider range of affordable options tailored to their needs.

Collaboration with Local Governments:

In some instances, BlackRock has collaborated with local governments or nonprofit organizations to develop affordable housing initiatives. These partnerships can leverage the expertise and financial resources of both parties, leading to the creation of more affordable housing units. By working together, BlackRock and local entities can make significant strides in addressing the affordability crisis.

Conclusion:

While concerns surrounding BlackRock’s involvement in home buying are valid, it is important to acknowledge the potential benefits it brings, particularly in terms of expanding affordable housing options. By boosting supply, stabilizing prices, revitalizing distressed neighborhoods, encouraging competition, and collaborating with local governments, BlackRock’s initiative has the potential to make homeownership more attainable for a wider range of potential buyers. As we navigate the evolving landscape of real estate, a balanced approach that addresses both concerns and advantages will be key to ensuring a sustainable and inclusive housing market.

Ability to purchase multiple homes at once, making the process easier and faster.

One of the advantages of BlackRock’s entry into the home buying market is its ability to purchase multiple homes at once, streamlining and expediting the process for both buyers and sellers. This approach offers several benefits worth considering.

Firstly, the ability to buy multiple homes simultaneously can be a game-changer for sellers looking to offload their properties quickly. Instead of dealing with individual buyers one at a time, which can be time-consuming and uncertain, selling multiple properties to BlackRock allows for a faster and more efficient transaction. This can be especially appealing for homeowners looking to liquidate their real estate investments or those facing financial constraints that necessitate a swift sale.

Moreover, this streamlined process can also benefit buyers who are searching for their dream home in a competitive market. By purchasing multiple homes at once, BlackRock increases the available inventory, providing more options to potential buyers. This expanded selection can save buyers valuable time that would otherwise be spent on extensive property searches or bidding wars.

Additionally, BlackRock’s ability to acquire multiple properties simultaneously may contribute to stabilizing local housing markets. When distressed or vacant properties are purchased in bulk by institutional investors like BlackRock, it helps reduce inventory levels and prevent blight in neighborhoods. This revitalization can have positive effects on property values and community development.

Furthermore, this approach offers convenience for investors seeking exposure to real estate markets without having to navigate complex transactions individually. By pooling resources and leveraging economies of scale, BlackRock provides investors with an opportunity to diversify their portfolios efficiently.

While there are valid concerns surrounding institutional investment in housing, such as potential impacts on affordability and tenant rights, the ability of BlackRock to purchase multiple homes at once presents an alternative perspective. It introduces a streamlined process that benefits both sellers and buyers by expediting transactions and broadening housing options.

As with any significant shift in the real estate market, it is essential for policymakers and stakeholders to carefully monitor these developments and ensure that adequate regulations are in place to strike a balance between market efficiency and the protection of individual homeownership opportunities.

Potential for increased rental income from tenants in Blackrock-owned properties.

One of the potential advantages of BlackRock’s entry into home buying is the possibility for increased rental income from tenants residing in BlackRock-owned properties. As the world’s largest asset management firm, BlackRock has the financial resources and expertise to invest in property maintenance and management, potentially leading to improved rental conditions.

By purchasing a significant number of homes, BlackRock can leverage economies of scale in property management. This could result in more efficient operations, better maintenance standards, and enhanced amenities for tenants. Such improvements can attract higher-quality tenants who are willing to pay higher rents for well-maintained properties.

Moreover, BlackRock’s presence in the rental market may offer tenants a broader range of housing options. With their extensive portfolio, they can provide a variety of housing types and sizes to cater to different needs and preferences. This increased supply can help address housing shortages in certain areas and offer tenants more choices when searching for a place to live.

Additionally, as an institutional investor with a long-term investment horizon, BlackRock may be motivated to maintain stable rental income streams. This could mean that they are more inclined to keep rent increases moderate over time compared to individual landlords who might be driven by short-term profit maximization. Tenants may find reassurance in having a reliable and predictable rental cost structure.

However, it is important to note that the potential for increased rental income should be balanced against concerns about affordability and tenant rights. While higher-quality properties may command higher rents, it is crucial that affordability remains a priority so that renting does not become unattainable for many individuals or families.

In conclusion, one potential benefit of BlackRock buying homes is the potential for increased rental income from tenants residing in their properties. Through efficient property management and an expanded supply of high-quality housing options, BlackRock’s presence in the rental market has the potential to enhance living conditions for tenants while also generating stable returns for investors. Nonetheless, it is essential to ensure that affordable housing remains accessible and that tenant rights are protected as the role of institutional investors in the rental market continues to evolve.

Access to a larger pool of potential buyers, giving sellers more bargaining power in negotiations and increasing their chances of selling quickly and profitably.

BlackRock’s foray into home buying has brought about several potential advantages for sellers in the real estate market. One significant pro is the access to a larger pool of potential buyers, which can provide sellers with increased bargaining power during negotiations and improve their chances of selling quickly and profitably.

By entering the housing market on a large scale, BlackRock brings substantial financial resources and expertise. This allows them to make competitive offers and close deals swiftly. With their vast network and resources, they can reach a broader audience of interested buyers who may not have been accessible otherwise.

The presence of BlackRock as an institutional investor also adds credibility to the market. Sellers may benefit from the perception that a reputable entity like BlackRock is interested in their property, instilling confidence in potential buyers and enhancing the overall desirability of the listing.

Furthermore, having more interested buyers vying for a property can create a sense of urgency among them. This heightened competition can lead to multiple offers, driving up prices and potentially resulting in a more profitable sale for the seller.

In addition to financial advantages, BlackRock’s involvement may also expedite the selling process. Their streamlined operations and efficient procedures enable faster transaction timelines, reducing the time it takes for sellers to find suitable buyers and close deals. This efficiency can be particularly beneficial for those looking to sell quickly due to personal circumstances or market conditions.

However, it is important to note that while this aspect of BlackRock’s entry into home buying presents benefits for sellers, it does not come without potential drawbacks or concerns. It is crucial for regulators and stakeholders to monitor these developments closely to ensure fair competition and protect against any negative impact on housing affordability or community stability.

In conclusion, one notable advantage of BlackRock’s involvement in home buying is the access it provides sellers to a larger pool of potential buyers. This increased interest enhances bargaining power during negotiations, increases chances of selling quickly, and potentially results in more profitable transactions. As the real estate market continues to evolve, it is essential to strike a balance that benefits both sellers and the overall stability of the housing market.

Reduced risk of foreclosure due to Blackrock’s ability to buy up troubled mortgages and restructure them into more manageable payments for homeowners in need of assistance with their mortgage payments or other financial issues related to their home ownership status.

Title: BlackRock’s Home Buying Initiative: Mitigating Foreclosure Risks and Providing Relief

Introduction:

BlackRock, the world’s largest asset management firm, has garnered attention for its venture into buying homes. While there are concerns surrounding this trend, one significant advantage of BlackRock’s involvement is its ability to reduce the risk of foreclosure. Through strategic acquisitions and restructuring of troubled mortgages, BlackRock offers homeowners in financial distress a lifeline to navigate challenging times and retain their homes.

A Solution for Homeowners in Need:

One pro of BlackRock’s home buying initiative is its capacity to purchase troubled mortgages from distressed homeowners. When individuals face financial difficulties that hinder their ability to make mortgage payments, they often find themselves at risk of foreclosure. However, with BlackRock’s resources and expertise, these homeowners have an opportunity for assistance and relief.

Restructuring Mortgages for Manageable Payments:

Upon acquiring troubled mortgages, BlackRock works with homeowners to restructure their loan terms into more manageable payments. This approach allows struggling homeowners to avoid the devastating consequences of foreclosure while staying in their homes. By tailoring payment plans according to individual circumstances, BlackRock helps alleviate the burden on homeowners and provides them with a path towards financial stability.

Preserving Communities:

The reduced risk of foreclosure not only benefits individual homeowners but also helps preserve the fabric of communities. Foreclosures often lead to vacant properties and declining neighborhoods, affecting property values and community well-being. BlackRock’s intervention minimizes the number of foreclosed properties, thereby maintaining stability within communities and supporting local economies.

Collaboration with Local Housing Agencies:

BlackRock recognizes that addressing housing challenges requires collaboration with local housing agencies. By partnering with these organizations, BlackRock ensures that assistance reaches those who need it most effectively. This collaborative approach promotes community engagement and empowers local stakeholders to work together towards sustainable solutions.

A Model for Socially Responsible Investing:

BlackRock’s commitment to mitigating foreclosure risks demonstrates the potential of socially responsible investing in the housing market. By leveraging its financial strength and expertise, BlackRock combines profit-seeking with a genuine concern for homeowners’ well-being. This approach sets a positive example for other institutional investors, encouraging them to prioritize the social impact of their investment strategies.

Conclusion:

While debates continue regarding BlackRock’s involvement in home buying, one undeniable advantage is its ability to reduce the risk of foreclosure. Through strategic acquisitions and mortgage restructuring, BlackRock offers struggling homeowners a lifeline to overcome financial difficulties and retain their homes. This initiative not only benefits individual homeowners but also helps preserve communities and promotes socially responsible investing practices. As BlackRock’s efforts continue, it is crucial to monitor their impact on housing stability and ensure that assistance reaches those who need it most.

Improved job opportunities as Blackrock expands its presence in local markets through its home purchases, creating new employment opportunities for those living in the area where it operates or invests in real estate assets such as single family homes or apartment buildings/complexes that they own outright or through investments with other partners such as banks, pension funds, etc..

Title: BlackRock’s Home Purchases: Boosting Local Job Opportunities

Introduction:

BlackRock’s venture into home buying has garnered attention for various reasons. One notable advantage of their presence in local markets is the potential for improved job opportunities. As BlackRock expands its real estate investments, it creates a ripple effect that stimulates economic growth and generates employment prospects for individuals residing in the areas where it operates.

Expanding Local Workforce:

With its significant financial resources, BlackRock’s real estate investments often involve large-scale projects such as developing or renovating properties, managing rental units, and maintaining housing infrastructure. These endeavors require a diverse range of skilled professionals, including construction workers, architects, engineers, property managers, maintenance staff, and more.

Job Creation through Partnerships:

BlackRock’s involvement in the housing market extends beyond direct ownership. They often collaborate with banks, pension funds, and other partners to invest in real estate assets such as single-family homes or apartment buildings/complexes. This collaboration not only diversifies investment portfolios but also fosters partnerships that can lead to additional job opportunities. Financial institutions may require local expertise to manage these properties effectively.

Stimulating Local Economy:

As BlackRock invests in local communities, it injects capital into the economy through property acquisitions and subsequent development or improvement projects. This infusion of funds can have a multiplier effect on the local economy by stimulating spending on goods and services from surrounding businesses. The increased demand for goods and services can create new jobs across various sectors such as retail, hospitality, transportation, and more.

Revitalizing Neighborhoods:

BlackRock’s commitment to improving neighborhoods goes beyond financial gains. By investing in distressed properties or areas that need revitalization, they contribute to community development efforts. This includes not only rehabilitating homes but also enhancing public spaces and amenities within the neighborhood. Such initiatives can attract businesses and further boost employment opportunities within the vicinity.

Long-Term Economic Impact:

BlackRock’s presence in local markets can have lasting effects on job creation and economic stability. By investing in real estate assets, they provide a foundation for long-term growth and prosperity. The improved housing infrastructure can attract new residents, businesses, and investors, leading to sustained economic development and job opportunities well into the future.

Conclusion:

BlackRock’s entry into home buying brings with it the potential for significant positive impacts on local job opportunities. Through their investments and partnerships, they stimulate economic growth, create employment prospects in various sectors, and contribute to the revitalization of communities. As BlackRock expands its presence in local markets, it is crucial to monitor how these job opportunities are distributed equitably among residents and ensure that the benefits extend to all members of the community.

Increased economic activity resulting from an influx of capital into local communities through the purchase of homes by Blackrock which can result in a boost to local businesses who rely on consumer spending for their survival and growth within a given region or city/town/village/etc..

Title: BlackRock’s Home Buying Spurs Local Economic Growth

Introduction:

BlackRock’s entry into the housing market as a significant buyer of homes has sparked discussions about its potential impact on local communities. While there are concerns about affordability and rental practices, one notable advantage of BlackRock’s involvement is the increased economic activity it can bring to these areas. This article explores how BlackRock’s home purchases can stimulate local economies and benefit businesses within the community.

Boosting Consumer Spending:

By injecting capital into local communities through home purchases, BlackRock creates an opportunity for increased consumer spending. As new homeowners settle into their properties, they often engage in renovations, furnishing, and other related expenditures. This surge in consumer activity benefits various sectors such as construction, home improvement stores, furniture retailers, and local service providers.

Job Creation and Business Growth:

The influx of capital from BlackRock’s home buying can also lead to job creation and business growth within the community. As consumer spending rises, businesses experience increased demand for their products and services. This often results in expanded operations and the need for additional employees. The ripple effect extends beyond immediate industries to include hospitality, retail, dining establishments, and more.

Revitalizing Local Businesses:

In areas where economic growth may have stagnated or faced challenges, BlackRock’s investment in homes can breathe new life into local businesses. As neighborhoods improve due to property maintenance efforts by institutional investors like BlackRock, it attracts potential buyers and renters alike. This increased interest can lead to higher property values and a revitalized commercial sector that benefits from a larger customer base.

Supporting Small Businesses:

The positive impact of BlackRock’s home purchases extends beyond larger companies; it also provides support for small businesses that rely on consumer spending for survival and growth. Local shops, restaurants, cafes, boutiques, and other independent enterprises can experience an uptick in foot traffic as new homeowners settle into the area. The presence of an economically active community can attract entrepreneurs and foster a vibrant local business ecosystem.

Conclusion:

While concerns surrounding BlackRock’s involvement in the housing market are valid, it is essential to acknowledge the potential benefits it can bring to local communities. Increased economic activity resulting from their home purchases can provide a much-needed boost to local businesses, leading to job creation, business growth, and the revitalization of neighborhoods. Striking a balance between responsible investment practices and ensuring affordability remains crucial as we navigate the evolving dynamics of the real estate market.

Enhanced property values due to the overall increase in demand that comes with having large institutional investors like Blackrock buying up properties within certain neighborhoods which can lead to an overall rise in prices across the board regardless if they are sold directly by Blackrock or not (i.e., increased competition between buyers).

Title: BlackRock’s Impact on Property Values: The Ripple Effect of Institutional Investment

Introduction:

The entry of institutional investors like BlackRock into the real estate market has sparked discussions about the potential benefits and drawbacks. While concerns exist, one notable advantage worth exploring is the enhanced property values that can result from the overall increase in demand generated by large institutional investors. This article delves into how BlackRock’s presence can lead to an overall rise in prices across certain neighborhoods, creating a competitive environment among buyers.

The Power of Increased Demand:

BlackRock’s substantial financial resources and strategic investments in properties within specific neighborhoods can significantly impact local housing markets. By acquiring a significant number of homes, they effectively create a surge in demand that extends beyond their direct purchases. This increased demand can have a ripple effect throughout the neighborhood, resulting in heightened competition among buyers.

Competition Driving Prices Up:

When there is an influx of buyers vying for limited housing inventory, it naturally leads to increased competition and bidding wars. As more potential buyers enter the market, they drive up prices due to the scarcity of available homes. Even if properties are not directly sold by BlackRock, their presence as a large institutional investor creates an atmosphere where prices are pushed higher across the board.

Neighborhood Transformation:

The rise in property values resulting from BlackRock’s investment can bring positive changes to neighborhoods. As home prices increase, homeowners may experience a boost in their equity and overall net worth. This newfound wealth can enable them to invest further in their properties or use it for other purposes such as education or retirement planning.

Additionally, higher property values often attract more attention from developers and businesses looking to invest in these desirable areas. This increased interest can lead to additional infrastructure development, improved amenities, and an overall enhancement of the neighborhood’s appeal.

Considerations and Caveats:

While rising property values may seem advantageous at first glance, it is essential to acknowledge potential downsides. Affordability concerns may arise as homeownership becomes more challenging for first-time buyers, especially in areas where prices escalate rapidly. This can contribute to increased wealth disparities and limit housing access for certain segments of the population.

Furthermore, the long-term sustainability of rising property values driven by institutional investment needs to be monitored. It is crucial to strike a balance between market forces and ensuring that communities remain inclusive and accessible for all residents.

Conclusion:

BlackRock’s presence as a large institutional investor can have a notable impact on property values within specific neighborhoods. The overall increase in demand resulting from their investments can create a competitive environment among buyers, driving prices up across the board. While this may bring financial benefits to existing homeowners, it is essential to address affordability concerns and ensure that communities remain diverse and inclusive. Striking this balance will be crucial as we navigate the evolving landscape of institutional investment in real estate.

Reduced Availability of Affordable Housing

Reduced Availability of Affordable Housing: BlackRock’s Impact on Housing Affordability

BlackRock’s foray into the housing market has raised concerns regarding the potential impact on housing affordability, particularly for those who already struggle to find affordable homes. As the world’s largest asset management firm, BlackRock’s substantial financial resources and buying power could potentially reduce the availability of affordable housing in certain areas, creating a housing shortage that disproportionately affects lower-income individuals and families.

One of the main concerns is that BlackRock’s large-scale purchases of homes can drive up prices in local markets. With their vast resources, they have the ability to outbid individual buyers, pushing property values beyond what many can afford. This increased competition for limited housing supply can result in higher prices across the board, making it even more challenging for those seeking affordable options to secure a home.

Furthermore, as BlackRock acquires properties, there is a risk that these homes may be converted into rental units rather than being made available for purchase. While rental options are necessary and valuable in any housing market, an excessive focus on rental properties could further limit homeownership opportunities for individuals and families striving to build wealth through property ownership.

The reduced availability of affordable housing not only impacts individuals but also has broader societal implications. Affordable housing plays a crucial role in promoting social equity and providing stability for communities. When people are priced out of neighborhoods due to rising costs associated with institutional investors like BlackRock, it can lead to displacement and disrupt established community networks.

To address this concern, it is crucial for policymakers and regulators to carefully monitor the activities of institutional investors like BlackRock in the housing market. Implementing measures that promote affordable housing initiatives, such as inclusionary zoning policies or incentives for developers to prioritize affordable units within their projects, can help mitigate some of these challenges.

Additionally, fostering partnerships between institutional investors and local communities can be beneficial. By collaborating with community organizations and stakeholders, investors like BlackRock can contribute to the development of affordable housing options that align with the needs of the community.

In conclusion, while BlackRock’s entry into the housing market brings potential benefits, such as increased liquidity and neighborhood revitalization, it is essential to address concerns about reduced availability of affordable housing. Balancing investment opportunities with a commitment to ensuring access to affordable homes for all is crucial for creating inclusive and sustainable communities. By working together, policymakers, regulators, and investors can strive to achieve a housing market that meets the needs of diverse populations while maintaining affordability for those who need it most.

Increased Gentrification

Increased Gentrification: The Concern of BlackRock Buying Homes

BlackRock’s entry into the housing market has sparked concerns about the potential for increased gentrification in certain neighborhoods. Gentrification refers to the process in which wealthier individuals or institutions invest in and revitalize lower-income areas, leading to rising property values, displacement of existing residents, and a transformation of the neighborhood’s character.

As a behemoth in the financial industry, BlackRock’s substantial purchasing power can significantly impact local housing markets. By acquiring large volumes of homes, they contribute to increased demand, which can drive up property prices. While this may seem positive for homeowners on paper, it can have adverse effects on long-time residents who may struggle to afford escalating rents or property taxes.

The influx of investment in gentrifying neighborhoods often leads to physical improvements and amenities, attracting wealthier individuals and businesses. While revitalization can bring positive changes such as improved infrastructure and increased economic activity, it can also result in the displacement of lower-income families and small businesses that cannot keep up with rising costs.

Gentrification not only affects housing affordability but also alters the social fabric and cultural identity of a neighborhood. Displaced residents often lose their connections to their community, including access to familiar schools, services, and support networks. Additionally, new residents may bring different preferences and lifestyles that can lead to clashes with existing residents or erode the unique character that drew people to the area in the first place.

To address these concerns, it is crucial for policymakers and communities to consider strategies that promote inclusive development. This could involve implementing affordable housing requirements for new developments or providing assistance programs for vulnerable residents facing displacement. It is essential to strike a balance between revitalization efforts and preserving affordable housing options for existing community members.

While BlackRock’s involvement in home buying has undoubtedly brought attention to gentrification concerns, it is important not to solely place blame on one entity. Gentrification is a complex issue influenced by various factors such as market forces, government policies, and societal dynamics.

In conclusion, the increased demand for housing brought about by BlackRock’s home buying activities can contribute to gentrification in certain neighborhoods. This raises concerns about the displacement of existing residents and changes to the cultural fabric of these communities. It is vital for stakeholders to engage in thoughtful discussions and implement inclusive strategies to ensure that revitalization efforts benefit all members of society, both old and new.

Disadvantageous to Low-Income Homeowners

Disadvantageous to Low-Income Homeowners: The Impact of BlackRock’s Home Buying

BlackRock’s venture into the housing market has sparked concerns, particularly among low-income homeowners who may face disadvantages as a result. One significant worry is the potential impact on property values and the subsequent affordability challenges that may arise.

As BlackRock and other institutional investors purchase large volumes of homes, they can drive up property prices in certain neighborhoods. While this may be beneficial for sellers and investors, it can have adverse effects on low-income homeowners who are already struggling to keep up with rising costs.

The rise in property values can lead to a situation where low-income homeowners find themselves priced out of their own neighborhoods. As home prices increase, property taxes and mortgage payments also rise, making it increasingly difficult for these homeowners to afford their homes. This can create financial burdens that push them towards foreclosure or even force them to sell their properties at a loss.

Additionally, the presence of institutional investors like BlackRock may contribute to gentrification in certain areas. Gentrification often leads to an influx of wealthier residents, resulting in higher living costs and a change in the character of the neighborhood. Low-income homeowners may find themselves unable to cope with rising expenses or feel pressured to sell their homes due to changing demographics.

The impact on low-income homeowners extends beyond financial concerns. Displacement from their own communities can disrupt social connections and support networks that are crucial for individuals and families. The loss of affordable housing options can also limit access to essential services, such as schools, healthcare facilities, and employment opportunities.

Addressing these challenges requires a comprehensive approach that balances investment opportunities with safeguards for vulnerable populations. Policymakers must consider implementing measures that promote affordable housing initiatives, provide protections against displacement, and ensure equitable access to homeownership opportunities.

Furthermore, community engagement is vital in shaping inclusive housing policies that prioritize the needs of all residents. Collaboration between local government, housing advocacy groups, and institutional investors can help create solutions that mitigate the negative impacts on low-income homeowners and foster sustainable communities.

While BlackRock’s entry into the housing market brings potential benefits, it is crucial to recognize and address the disadvantages faced by low-income homeowners. By doing so, we can strive for a housing market that is both inclusive and supportive of all individuals, regardless of their income level.

Tags: 2008 financial crisis, affordability challenges, asset management firm, balance, blackrock buying homes, cause for concern, communities, community impact, distressed properties, distressed properties or those facing foreclosure, financial resources, financial stability for homeowners, game-changer, global reach, home buying, homeownership, housing arena, implications, inclusive housing policies, increased oversight and regulation, institutional investors, liquidity, local communities, long-term investment strategy, long-term renting, prevent further price depreciation, property maintenance and management, real estate market, reduce inventory, regulatory response, rental market, rental practices, revitalize neighborhoods, stabilize local housing markets, stabilize prices, stable returns, unexpected player, venture, wealth disparities