The Best Way to Buy Investment Property

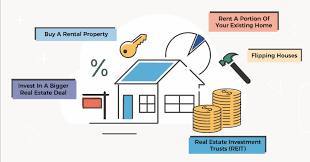

Investing in real estate can be a lucrative venture, but it requires careful planning and strategy. Here are some tips on the best way to buy investment property:

Define Your Investment Goals

Before you start looking for properties, determine your investment goals. Are you looking for long-term rental income or short-term capital gains? Understanding your objectives will help you narrow down your options and make informed decisions.

Research the Market

Thoroughly research the real estate market in the area where you plan to buy property. Look at trends in property values, rental rates, vacancy rates, and economic indicators. This information will help you identify opportunities and make smart investments.

Set a Budget

Determine how much you can afford to invest in a property. Consider not just the purchase price but also additional costs like maintenance, repairs, property taxes, and insurance. Setting a budget will help you avoid overextending yourself financially.

Consider Financing Options

Explore different financing options such as traditional mortgages, hard money loans, or partnerships with other investors. Choose the option that best fits your financial situation and investment goals.

Work with a Real Estate Professional

Consider working with a real estate agent or a property management company that specializes in investment properties. They can provide valuable insights, help you find suitable properties, and guide you through the buying process.

Conduct Due Diligence

Before making an offer on a property, conduct thorough due diligence. Inspect the property for any issues, review financial documents like rent rolls and expenses, and assess its potential for rental income or appreciation.

Negotiate Wisely

Negotiate effectively with sellers to get the best deal possible. Be prepared to walk away if the terms are not favorable or if the property does not meet your criteria.

By following these steps and approaching your investment property purchase with diligence and care, you can increase your chances of success in the real estate market.

Top 5 FAQs About Buying Investment Properties: Market Trends, Location, Financing, and More

- What are the current real estate market trends for investment properties?

- How can I determine the best location to buy an investment property?

- What financing options are available for purchasing investment properties?

- Should I consider hiring a real estate agent or property management company when buying an investment property?

- What due diligence should I conduct before finalizing the purchase of an investment property?

What are the current real estate market trends for investment properties?

Investors looking to buy investment properties often inquire about the current real estate market trends. Understanding these trends is crucial for making informed decisions and maximizing investment potential. As of now, the real estate market for investment properties is showing a mix of opportunities and challenges. Factors such as increasing demand for rental properties, low mortgage rates, and urban migration patterns are influencing market dynamics. Additionally, the rise of remote work has led to shifts in property preferences, with suburban and rural areas gaining popularity. Keeping a close eye on these trends, conducting thorough market research, and seeking expert advice can help investors navigate the current real estate landscape effectively.

How can I determine the best location to buy an investment property?

When determining the best location to buy an investment property, several factors come into play. Consider the neighborhood’s economic stability, job market growth, population trends, and proximity to amenities like schools, shopping centers, and transportation hubs. Additionally, research the rental demand in the area and assess the potential for property appreciation. By conducting thorough market research and analyzing these key factors, you can identify a location that aligns with your investment goals and offers long-term potential for success in real estate investing.

What financing options are available for purchasing investment properties?

When considering the best way to buy investment property, one frequently asked question revolves around financing options available for purchasing such properties. Investors have a range of financing options to choose from, including traditional mortgages, hard money loans, private money lenders, and partnerships with other investors. Each option comes with its own set of requirements, benefits, and risks. It is crucial for investors to carefully evaluate these financing options based on their financial situation, investment goals, and risk tolerance to make an informed decision that aligns with their long-term investment strategy.

Should I consider hiring a real estate agent or property management company when buying an investment property?

When considering the best way to buy an investment property, whether to hire a real estate agent or property management company is a common question. Both professionals can offer valuable expertise and guidance throughout the buying process. A real estate agent can help you find suitable investment properties, negotiate deals, and navigate the complexities of real estate transactions. On the other hand, a property management company can assist in managing the property, handling tenant relations, maintenance issues, and ensuring a steady rental income stream. Ultimately, whether to hire a real estate agent or property management company depends on your specific needs, experience level, and availability to oversee the investment property yourself. Consulting with both professionals can help you make an informed decision that aligns with your investment goals and preferences.

What due diligence should I conduct before finalizing the purchase of an investment property?

Before finalizing the purchase of an investment property, conducting thorough due diligence is crucial to making a sound investment decision. Start by inspecting the property for any structural issues or necessary repairs. Reviewing financial documents such as rent rolls, expenses, and historical income can provide insight into the property’s financial performance. Assessing the property’s potential for rental income and appreciation in value is also essential. Additionally, researching the local market trends and economic indicators can help you make an informed decision about the property’s viability as an investment. By performing comprehensive due diligence, you can minimize risks and maximize the potential returns on your investment property.

Tags: best way to buy investment property, economic stability, expert advice, financing options, hard money loans, investment property, job market growth, location, market research, mortgage rates, partnerships with other investors, population trends, private money lenders, property appreciation, real estate market trends, remote work, rental demand, rental properties, rural areas, suburban areas, traditional mortgages, urban migration patterns