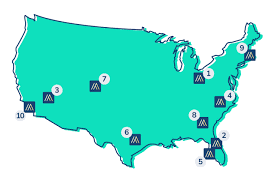

The Best States to Own Rental Property

Investing in rental property can be a lucrative venture, but choosing the right location is crucial for success. Here are some of the best states in the US for owning rental property:

Texas

With a booming economy and growing population, Texas offers great opportunities for rental property investors. Cities like Austin and Dallas have seen significant growth in rental demand, making it an attractive market for landlords.

Florida

Florida’s strong tourism industry and warm climate make it a popular destination for renters. Cities like Orlando and Miami offer a diverse rental market, with opportunities for both short-term and long-term rentals.

North Carolina

North Carolina has experienced steady population growth and offers affordable housing compared to many other states. Areas like Charlotte and Raleigh have strong rental markets, making it a favorable choice for property investors.

Tennessee

Tennessee is known for its low cost of living and landlord-friendly laws, making it an attractive state for owning rental property. Cities like Nashville and Memphis offer diverse rental markets with good potential for returns.

Colorado

Colorado’s strong job market and quality of life make it an appealing choice for rental property investment. Cities like Denver and Colorado Springs have growing populations and high demand for rental housing.

When considering investing in rental property, be sure to research each state’s landlord-tenant laws, market trends, and economic indicators to make an informed decision that aligns with your investment goals.

Top 9 Reasons These States Are Ideal for Owning Rental Property

- Strong rental demand in growing cities

- Booming economy with job opportunities

- Landlord-friendly laws and regulations

- Diverse rental market for different property types

- Steady population growth increasing tenant pool

- Affordable housing compared to other states

- High quality of life attracting renters

- Tourism industry boosting short-term rental potential

- Good potential for returns on investment

6 Challenges to Consider When Investing in Rental Properties Across Different States

- High property prices in popular rental markets may require significant initial investment.

- Competition from other landlords can lead to lower rental yields.

- Economic downturns in certain states can impact rental demand and property values.

- Stringent landlord-tenant regulations in some states may limit landlord rights and flexibility.

- Maintenance costs for properties in regions with extreme weather conditions, such as hurricanes or snowstorms, can be higher.

- Property taxes and insurance rates may vary widely across states, affecting overall profitability.

Strong rental demand in growing cities

One of the key advantages of owning rental property in states with strong rental demand in growing cities is the potential for consistent and high occupancy rates. As urban areas expand and populations increase, the need for rental housing also rises, creating a steady stream of tenants looking for accommodation. This trend not only ensures a lower risk of vacancies but also presents opportunities for landlords to command competitive rental prices and achieve favorable returns on their investment over time.

Booming economy with job opportunities

Investing in rental property in states with a booming economy and abundant job opportunities can lead to significant financial gains for property owners. These states attract a steady influx of residents seeking employment, creating a high demand for rental housing. Landlords in such states benefit from a larger pool of potential tenants, reduced vacancy rates, and the potential for increased rental income. Additionally, a strong economy typically results in higher property appreciation rates, further enhancing the long-term investment value of owning rental property in these thriving states.

Landlord-friendly laws and regulations

One significant advantage of owning rental property in states with landlord-friendly laws and regulations is the peace of mind it provides to property owners. These states typically offer clear guidelines and procedures for landlords, making it easier to handle tenant issues, evictions, and property management efficiently. Landlord-friendly laws also tend to prioritize the rights of property owners, providing a sense of security and protection against potential disputes or legal challenges. Overall, investing in rental property in states with favorable landlord regulations can streamline the rental process and contribute to a more positive landlord-tenant relationship.

Diverse rental market for different property types

One significant advantage of owning rental property in the best states is the presence of a diverse rental market that caters to different property types. Whether you are looking to invest in single-family homes, multi-unit buildings, vacation rentals, or commercial properties, these states offer a range of opportunities to suit various investment preferences. This diversity not only provides flexibility for landlords but also ensures a broader pool of potential tenants, ultimately increasing the potential for a stable and profitable rental income stream.

Steady population growth increasing tenant pool

One significant advantage of owning rental property in the best states is the steady population growth, which leads to an expanding tenant pool. As more people move into these states for job opportunities, education, or lifestyle reasons, the demand for rental housing increases. This trend not only ensures a consistent flow of potential tenants but also provides landlords with the opportunity to select from a diverse pool of renters, potentially leading to higher occupancy rates and stable rental income streams.

Affordable housing compared to other states

One of the key advantages of owning rental property in states with affordable housing compared to others is the opportunity to achieve a higher return on investment. Lower housing costs mean lower initial investment and expenses, allowing landlords to potentially generate more profit from rental income. Additionally, affordable housing can attract a wider pool of tenants, increasing the likelihood of consistent occupancy and steady cash flow. This affordability factor not only benefits property owners but also provides renters with more options and flexibility in choosing suitable housing, creating a win-win situation for both landlords and tenants.

High quality of life attracting renters

One significant advantage of owning rental property in states with a high quality of life is the inherent appeal to renters. Locations known for offering a superior quality of life, such as access to amenities, good schools, low crime rates, and overall well-being, naturally attract tenants seeking a comfortable and fulfilling lifestyle. These states not only draw in potential renters but also tend to retain them longer, leading to more stable occupancy rates and potentially higher rental income for property owners.

Tourism industry boosting short-term rental potential

The tourism industry in certain states can significantly boost the short-term rental potential for property owners. States like Florida and California, known for their popular tourist destinations, offer landlords the opportunity to capitalize on vacation rentals and short-term stays. With a steady influx of tourists throughout the year, property owners in these states can enjoy higher occupancy rates and potentially higher rental income compared to traditional long-term rentals. Investing in rental properties in states with a thriving tourism industry can be a strategic move for those looking to maximize their rental income and diversify their investment portfolio.

Good potential for returns on investment

One significant advantage of owning rental property in the best states is the potential for high returns on investment. These states typically offer strong rental markets with increasing demand, leading to steady rental income and potential appreciation in property value over time. By investing in rental property in these states, landlords can benefit from a reliable source of passive income and the opportunity to grow their wealth through real estate investments.

High property prices in popular rental markets may require significant initial investment.

One significant drawback of owning rental property in the best states is the high property prices in popular rental markets. Investing in real estate in these sought-after areas may demand a substantial initial investment, making it challenging for some potential landlords to enter the market. The high cost of properties can limit access for investors with limited capital and may require careful financial planning and strategic decision-making to ensure a profitable return on investment in the long run.

Competition from other landlords can lead to lower rental yields.

In the realm of owning rental property, one significant drawback is the intense competition from other landlords, which can ultimately drive down rental yields. When numerous property owners are vying for tenants in a particular market, it can result in decreased demand for individual properties and subsequently lower rental prices. This competitive environment often forces landlords to adjust their rental rates to attract tenants, impacting the overall profitability of their investments. To navigate this challenge effectively, landlords must employ strategic pricing and value-added services to differentiate their properties and maintain competitive rental yields amidst a crowded market.

Economic downturns in certain states can impact rental demand and property values.

During economic downturns, rental demand and property values in certain states can be significantly affected. Job losses, decreased consumer spending, and overall economic instability can lead to a decrease in demand for rental properties, causing vacancies and potential rent decreases. Additionally, property values may decline during these periods, impacting the potential return on investment for landlords. It is essential for rental property owners to consider the economic stability of a state before investing to mitigate the risks associated with market fluctuations.

Stringent landlord-tenant regulations in some states may limit landlord rights and flexibility.

Stringent landlord-tenant regulations in some states can pose a significant challenge for property owners looking to invest in rental real estate. These regulations may restrict landlord rights and limit flexibility in managing properties, such as imposing strict rent control measures, eviction procedures, or maintenance requirements. Landlords operating in states with stringent regulations may find themselves facing increased administrative burdens and legal complexities, potentially impacting their ability to maximize returns on their investments and respond effectively to market dynamics. It is essential for prospective landlords to carefully consider the regulatory environment of a state before committing to owning rental property to ensure compliance and mitigate potential risks.

Maintenance costs for properties in regions with extreme weather conditions, such as hurricanes or snowstorms, can be higher.

Maintenance costs for properties in regions with extreme weather conditions, such as hurricanes or snowstorms, can be significantly higher and pose a notable con for owning rental property in those areas. Properties located in regions prone to natural disasters may require additional investments in protective measures, insurance coverage, and regular maintenance to withstand the harsh weather conditions. These increased maintenance costs can impact the overall profitability of rental properties and require landlords to allocate more resources to ensure the safety and integrity of their investments.

Property taxes and insurance rates may vary widely across states, affecting overall profitability.

Property taxes and insurance rates can significantly impact the profitability of owning rental property, and these costs can vary widely across states. High property taxes in some states can eat into rental income, reducing the overall return on investment. Similarly, insurance rates may be higher in certain states due to factors like natural disaster risk or high crime rates, further impacting profitability. It is essential for property investors to carefully consider these expenses when evaluating potential rental markets to ensure they make informed decisions that align with their financial goals.

Tags: best states to own rental property, booming economy, colorado, diverse rental market, florida, growing cities, job opportunities, landlord-friendly laws, north carolina, property types, regulations, rental demand, rental property, states, tennessee, texas