The Best State to Buy Rental Property in 2022

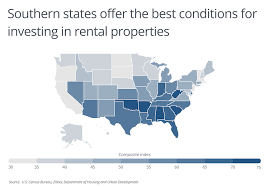

Investing in rental properties can be a lucrative venture, but choosing the right location is crucial for success. In 2022, certain states stand out as particularly attractive for real estate investors looking to buy rental properties.

Texas

With a growing population and strong job market, Texas continues to be a top choice for real estate investors. Cities like Austin, Dallas, and Houston offer diverse rental opportunities and favorable landlord laws.

Florida

Florida’s warm climate and tourist attractions make it a desirable location for rental properties. Cities such as Orlando, Tampa, and Miami provide a steady stream of renters, especially in the vacation rental market.

Tennessee

Tennessee has been gaining popularity among real estate investors due to its affordable housing market and low property taxes. Nashville and Memphis are particularly attractive cities for rental property investments.

Arizona

Arizona offers a strong rental market driven by population growth and job opportunities. Cities like Phoenix and Tucson present good investment prospects with steady demand for rental properties.

North Carolina

North Carolina combines affordability with economic growth, making it an appealing choice for real estate investors. Cities such as Charlotte and Raleigh boast strong rental demand and potential for long-term appreciation.

In conclusion, when considering the best state to buy rental property in 2022, factors such as population growth, job market strength, affordability, landlord laws, and rental demand should all be taken into account. The states mentioned above offer promising opportunities for investors seeking to expand their real estate portfolios in the coming year.

Top FAQs About Choosing the Best State for Rental Property Investment in 2022

- 1. What are the best states to buy rental property in 2022?

- 2. How do I determine which state is the best for buying rental property?

- 3. What factors should I consider when choosing a state to invest in rental properties?

- 4. Are there any specific cities within these states that are particularly good for rental property investment?

- 5. How important is the job market and population growth when deciding on a state for rental property investment?

- 6. What are the landlord laws like in the top states for buying rental property in 2022?

- 7. Are there any tax incentives or benefits for real estate investors in these states?

- 8. How can I assess the potential return on investment (ROI) when buying rental property in a specific state?

1. What are the best states to buy rental property in 2022?

When looking for the best states to buy rental property in 2022, several factors come into play. States like Texas, Florida, Tennessee, Arizona, and North Carolina are often highlighted for their combination of population growth, job market strength, affordability, landlord-friendly laws, and steady rental demand. Investors seeking promising opportunities for real estate investments this year may find these states particularly attractive due to their favorable market conditions and potential for long-term returns.

2. How do I determine which state is the best for buying rental property?

When determining the best state for buying rental property in 2022, several factors should be considered. Start by researching each state’s economic indicators, such as job growth, population trends, and overall market stability. Analyze rental market data, including rental rates, occupancy rates, and rental demand in different regions. Additionally, assess landlord-tenant laws and regulations in each state to understand the legal environment for property owners. By conducting thorough research and analysis based on these criteria, investors can make informed decisions on which state offers the most favorable conditions for buying rental property in 2022.

3. What factors should I consider when choosing a state to invest in rental properties?

When deciding on the best state to invest in rental properties in 2022, several key factors should be taken into consideration. Factors such as population growth, job market strength, affordability of housing, landlord-tenant laws, rental demand and vacancy rates, property taxes, and potential for long-term appreciation are all crucial in determining the viability of an investment. Conducting thorough research on these factors in various states can help investors make informed decisions and identify the most suitable location to maximize returns on their rental property investments.

4. Are there any specific cities within these states that are particularly good for rental property investment?

When considering the best state to buy rental property in 2022, it’s essential to delve into specific cities within these states that offer particularly good investment opportunities. Cities like Austin, Dallas, and Houston in Texas; Orlando, Tampa, and Miami in Florida; Nashville and Memphis in Tennessee; Phoenix and Tucson in Arizona; and Charlotte and Raleigh in North Carolina are known for their strong rental markets, economic growth, job opportunities, and potential for long-term appreciation. These cities within the mentioned states stand out as hotspots for rental property investment due to factors such as population growth, affordability, rental demand, and landlord-friendly laws.

5. How important is the job market and population growth when deciding on a state for rental property investment?

When considering the best state to buy rental property in 2022, the job market and population growth play crucial roles in the decision-making process. A strong job market indicates economic stability and a higher likelihood of attracting renters looking for employment opportunities. Additionally, population growth suggests a growing demand for housing, which can translate into a steady stream of potential tenants for rental properties. Therefore, investors should carefully evaluate these factors when selecting a state for rental property investment to maximize their chances of success in the real estate market.

6. What are the landlord laws like in the top states for buying rental property in 2022?

When considering the best states to buy rental property in 2022, it’s essential to take into account the landlord laws in each location. Landlord laws can vary significantly from state to state and can have a significant impact on your rights and responsibilities as a property owner. Understanding the landlord-tenant regulations, such as eviction processes, security deposit limits, and lease terms, is crucial for successful property management. Before making any investment decisions, it’s advisable to thoroughly research and familiarize yourself with the landlord laws in the top states for buying rental property in 2022 to ensure compliance and protect your interests as a landlord.

7. Are there any tax incentives or benefits for real estate investors in these states?

When considering the best state to buy rental property in 2022, a frequently asked question revolves around tax incentives and benefits for real estate investors in these states. Many states offer various tax advantages to real estate investors, such as deductions for property expenses, depreciation benefits, and favorable capital gains tax rates. It is essential for investors to research and understand the specific tax incentives available in each state to maximize their investment returns and make informed decisions when choosing where to buy rental properties.

8. How can I assess the potential return on investment (ROI) when buying rental property in a specific state?

When evaluating the potential return on investment (ROI) for rental properties in a specific state, several key factors should be considered. Start by researching the state’s current real estate market trends, including property values, rental rates, and vacancy rates. Calculate your potential rental income based on market data and compare it to your estimated expenses, such as property taxes, insurance, maintenance costs, and property management fees. Additionally, assess the state’s economic stability, job market growth, population trends, and local amenities that can impact rental demand and property appreciation. Conducting thorough due diligence and working with real estate professionals can help you make informed decisions about the ROI prospects of buying rental property in a particular state in 2022.

Tags: 2022, affordability, arizona, best state to buy rental property 2022, florida, job market strength, landlord laws, north carolina, population growth, real estate investors, rental demand, rental property, tennessee, texas