The Best Markets for Real Estate Investing

Real estate investing can be a lucrative venture, but choosing the right market is crucial for success. Here are some of the best markets for real estate investing:

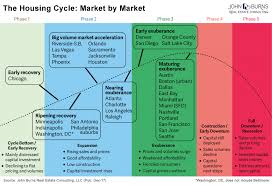

- Phoenix, Arizona: With a growing population and strong job market, Phoenix offers great opportunities for real estate investors. The affordable housing market and steady appreciation make it an attractive choice.

- Austin, Texas: Known for its vibrant economy and booming tech industry, Austin is a hot spot for real estate investment. The city’s population growth and high demand for housing make it a promising market.

- Atlanta, Georgia: Atlanta’s diverse economy and affordable housing market make it an appealing option for real estate investors. The city’s strong rental market and steady appreciation rates offer potential for long-term gains.

- Nashville, Tennessee: Nashville’s thriving music and healthcare industries drive its robust economy, making it a prime location for real estate investment. The city’s rapid population growth and low unemployment rate contribute to its attractiveness to investors.

- Denver, Colorado: Denver’s strong job market and quality of life attract residents from across the country, fueling demand for real estate. The city’s stable housing market and consistent appreciation rates make it a desirable choice for investors.

When considering real estate investment opportunities, it’s essential to research local market trends, economic indicators, and growth projections. By choosing the right market based on these factors, investors can maximize their returns and build a successful real estate portfolio.

Whether you’re a seasoned investor or new to the game, exploring these top markets can help you make informed decisions and achieve your financial goals through real estate investing.

Top 5 Strategies for Identifying Prime Real Estate Investment Markets

- Research the market trends and forecasts to identify areas with high potential for appreciation.

- Consider the location’s proximity to amenities such as schools, shopping centers, and public transportation.

- Evaluate the economic stability of the region to ensure long-term growth and demand for real estate.

- Look for emerging neighborhoods or areas undergoing revitalization for potential investment opportunities.

- Consult with local real estate experts or agents to gain insights into market conditions and investment strategies.

Research the market trends and forecasts to identify areas with high potential for appreciation.

To make informed decisions in real estate investing, it is crucial to research market trends and forecasts diligently. By analyzing data and projections, investors can pinpoint areas with high potential for appreciation. Understanding the factors driving growth in specific markets allows investors to capitalize on opportunities and maximize their returns. Keeping a close eye on market trends ensures that investment decisions are strategic and aligned with long-term goals.

Consider the location’s proximity to amenities such as schools, shopping centers, and public transportation.

When evaluating the best markets for real estate investing, it is crucial to consider the location’s proximity to amenities such as schools, shopping centers, and public transportation. Properties located near schools tend to attract families, while easy access to shopping centers and public transportation can increase the property’s desirability and potential for higher rental yields or resale value. Investing in real estate in areas with convenient access to these amenities can not only enhance the quality of life for residents but also contribute to long-term investment success.

Evaluate the economic stability of the region to ensure long-term growth and demand for real estate.

When considering the best markets for real estate investing, it is crucial to evaluate the economic stability of the region. A strong and diverse economy can ensure long-term growth and sustained demand for real estate properties. Regions with stable job markets, growing industries, and low unemployment rates are more likely to attract residents and businesses, driving the demand for housing and commercial spaces. By carefully assessing the economic indicators of a region, investors can make informed decisions that align with their long-term investment goals and maximize their returns in the dynamic real estate market.

Look for emerging neighborhoods or areas undergoing revitalization for potential investment opportunities.

When seeking the best markets for real estate investing, it’s wise to keep an eye out for emerging neighborhoods or areas undergoing revitalization. These areas often present promising investment opportunities due to their potential for growth and increased property values. Investing in such neighborhoods at an early stage of development can yield significant returns as the area transforms and attracts more residents and businesses. By recognizing the signs of revitalization and understanding the factors driving growth in these emerging areas, investors can position themselves strategically for long-term success in the real estate market.

Consult with local real estate experts or agents to gain insights into market conditions and investment strategies.

Consulting with local real estate experts or agents is a valuable tip for investors looking to navigate the best markets for real estate investing. These professionals possess in-depth knowledge of market conditions, trends, and investment strategies specific to their area. By seeking their guidance, investors can gain valuable insights that can help them make informed decisions and maximize their investment potential. Local experts can provide valuable advice on property values, rental rates, neighborhood dynamics, and emerging market opportunities, ensuring that investors are well-equipped to succeed in their real estate ventures.

Tags: amenities proximity, appreciation potential, arizona, atlanta, austin, best markets for real estate investing, colorado, denver, economic stability, forecasts, georgia, market trends, nashville, phoenix, public transportation, real estate investing, schools, shopping centers, tennessee, texas