The Benefits of 1031 Investment Exchange

Investors looking to defer capital gains taxes and maximize their returns often turn to the 1031 exchange, a powerful tool in real estate investment. A 1031 exchange allows investors to sell a property and reinvest the proceeds into a similar property without paying capital gains taxes on the profit.

One of the key benefits of a 1031 exchange is that it provides investors with the opportunity to defer paying taxes on their gains, allowing them to reinvest more money into a new property. This can help investors grow their real estate portfolio more quickly and efficiently.

Additionally, a 1031 exchange offers investors flexibility in choosing their replacement property. Investors are not limited to one specific property but can explore various options that align with their investment goals and strategy.

Furthermore, by utilizing a 1031 exchange, investors can diversify their portfolio without being penalized by hefty capital gains taxes. This flexibility allows investors to adapt to changing market conditions and optimize their investment strategy over time.

In conclusion, the 1031 investment exchange is a valuable tool for real estate investors seeking to defer taxes, maximize returns, and diversify their portfolio. By taking advantage of this tax-deferred exchange, investors can unlock new opportunities for growth and success in the real estate market.

Top 5 Essential Tips for Successful 1031 Investment Exchanges

- Consult with a qualified intermediary to facilitate the 1031 exchange process.

- Identify replacement properties within the specified timeframe to meet exchange deadlines.

- Ensure that replacement properties are of equal or greater value to defer capital gains tax.

- Understand the rules and requirements of a 1031 exchange to comply with IRS regulations.

- Consider seeking advice from a tax professional or financial advisor for personalized guidance.

Consult with a qualified intermediary to facilitate the 1031 exchange process.

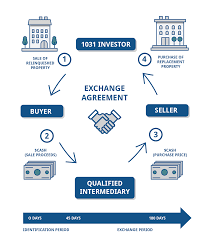

When considering a 1031 investment exchange, it is crucial to consult with a qualified intermediary to facilitate the process smoothly. A qualified intermediary plays a vital role in guiding investors through the complex requirements and regulations of a 1031 exchange, ensuring compliance with IRS rules and maximizing the benefits of tax deferral. By working with a knowledgeable intermediary, investors can navigate potential pitfalls, streamline the exchange process, and make informed decisions that align with their investment objectives. Trusting in the expertise of a qualified intermediary can help investors execute a successful 1031 exchange with confidence and peace of mind.

Identify replacement properties within the specified timeframe to meet exchange deadlines.

To ensure a successful 1031 investment exchange, it is crucial to identify replacement properties within the specified timeframe to meet exchange deadlines. Failing to find suitable replacement properties within the designated period can result in missing out on the tax-deferred benefits of the exchange. By proactively searching for and selecting potential replacement properties in a timely manner, investors can stay on track with the exchange process and maximize their opportunities for tax savings and portfolio growth.

Ensure that replacement properties are of equal or greater value to defer capital gains tax.

When engaging in a 1031 investment exchange, it is crucial to ensure that the replacement properties you acquire are of equal or greater value than the property you are selling. By adhering to this rule, investors can successfully defer capital gains taxes on their profits. This strategy not only allows investors to maximize their returns by reinvesting the full proceeds into new properties but also ensures compliance with IRS regulations governing 1031 exchanges. Choosing replacement properties of equal or greater value is a key factor in leveraging the benefits of a 1031 exchange effectively and optimizing your real estate investment portfolio.

Understand the rules and requirements of a 1031 exchange to comply with IRS regulations.

To ensure a successful 1031 investment exchange, it is crucial to thoroughly understand the rules and requirements set forth by the IRS. Compliance with IRS regulations is essential to qualify for tax-deferred treatment on your capital gains. By familiarizing yourself with the intricacies of a 1031 exchange, you can navigate the process effectively, avoid potential pitfalls, and maximize the benefits of this powerful investment strategy. Remember, staying informed and adhering to the guidelines will help you make the most out of your 1031 exchange opportunity.

Consider seeking advice from a tax professional or financial advisor for personalized guidance.

When considering a 1031 investment exchange, it is highly recommended to seek advice from a tax professional or financial advisor for personalized guidance tailored to your specific financial situation and investment goals. These professionals can provide valuable insights into the tax implications, legal requirements, and strategic considerations of a 1031 exchange. By consulting with experts in the field, you can make informed decisions that align with your long-term financial objectives and maximize the benefits of this powerful investment tool.

Tags: 1031 exchange, 1031 investment, benefits, defer capital gains taxes, investment, investors, irs rules, maximize returns, portfolio growth, qualified intermediary, real estate, replacement property, tax deferral, tax savings