Exploring the Benefits of a 1031 Exchange into REITs

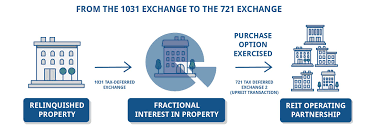

Real Estate Investment Trusts (REITs) have become a popular investment vehicle for individuals looking to diversify their portfolios and generate passive income. One innovative strategy that investors can consider is utilizing a 1031 exchange to transition from direct real estate ownership to investing in REITs.

A 1031 exchange, also known as a like-kind exchange, allows investors to defer capital gains taxes on the sale of investment property by reinvesting the proceeds into another qualifying property. By leveraging this tax-deferred exchange, investors can potentially maximize their returns and preserve their wealth.

When considering transitioning from direct real estate holdings to REIT investments through a 1031 exchange, there are several benefits to take into account:

- Diversification: Investing in REITs provides exposure to a diversified portfolio of real estate assets across various sectors and geographic locations, reducing individual property risk.

- Liquidity: REIT investments offer greater liquidity compared to owning physical properties, allowing investors to easily buy or sell shares on public exchanges.

- Professional Management: REITs are managed by experienced professionals who handle property acquisition, management, and disposition, relieving investors of the day-to-day responsibilities of property ownership.

- Passive Income: REITs typically distribute regular dividends to shareholders, offering a consistent income stream without the need for active involvement in property management.

- Tax Efficiency: By utilizing a 1031 exchange into REITs, investors can defer capital gains taxes on the sale of their properties and potentially benefit from ongoing tax advantages associated with REIT investments.

It’s important for investors considering a 1031 exchange into REITs to consult with financial advisors and tax professionals to assess their individual financial goals and circumstances. While this strategy offers potential benefits, it’s essential to understand the risks and implications associated with investing in REITs.

In conclusion, combining the advantages of a 1031 exchange with the benefits of investing in REITs can be an effective way for real estate investors to optimize their portfolios and achieve long-term financial growth. By exploring this innovative approach, investors can capitalize on the opportunities presented by both real estate ownership and REIT investments.

Understanding 1031 Exchanges: Key FAQs on Real Estate, REITs, and Investment Restrictions

- Can you 1031 stocks into real estate?

- What is not allowed in a 1031 exchange?

- Can a 1031 exchange be put into a trust?

- Can you do a 1031 exchange into stocks?

- Can you do a 1031 exchange into an REIT?

- Can you do a 1031 exchange into an annuity?

- Can I use a 1031 exchange to pay off another property?

Can you 1031 stocks into real estate?

One frequently asked question regarding 1031 exchanges is whether it is possible to exchange stocks into real estate. The answer is no; the IRS allows for like-kind exchanges of real property for other real property. Stocks, being considered personal property, do not qualify for a 1031 exchange into real estate. However, investors can explore alternative strategies such as selling stocks and using the proceeds to invest in real estate directly or through Real Estate Investment Trusts (REITs) to achieve their investment objectives while considering tax implications and financial goals.

What is not allowed in a 1031 exchange?

In a 1031 exchange, certain types of property transactions are not allowed to qualify for tax-deferred treatment. This includes exchanging personal-use properties such as primary residences or vacation homes, as well as stocks, bonds, and partnership interests. Additionally, any property held for sale or inventory purposes does not meet the criteria for a like-kind exchange. It’s essential to adhere to the IRS guidelines and ensure that only qualifying real estate properties are involved in a 1031 exchange to take advantage of the tax benefits it offers.

Can a 1031 exchange be put into a trust?

One frequently asked question regarding a 1031 exchange into a Real Estate Investment Trust (REIT) is whether the exchange can be put into a trust. The answer to this question is that, generally, a 1031 exchange can be structured to involve a trust. However, it is crucial to consult with legal and tax professionals to ensure that the trust structure complies with all relevant regulations and requirements. Trusts can offer certain benefits in estate planning and asset protection, but the specific details of how a 1031 exchange interacts with a trust will depend on individual circumstances and the goals of the investor.

Can you do a 1031 exchange into stocks?

One frequently asked question regarding 1031 exchanges is whether it is possible to do a 1031 exchange into stocks. The answer is no. A 1031 exchange, also known as a like-kind exchange, allows for the deferral of capital gains taxes on the sale of investment property by reinvesting in another qualifying property. Stocks are not considered like-kind properties to real estate, so they do not qualify for a 1031 exchange. Investors looking to transition from real estate investments to other asset classes like stocks would need to consider different tax strategies and implications for their investment portfolio diversification.

Can you do a 1031 exchange into an REIT?

One frequently asked question in the realm of 1031 exchanges is whether it’s possible to execute a 1031 exchange into a Real Estate Investment Trust (REIT). The answer is no – a 1031 exchange involves the direct exchange of one investment property for another like-kind property, and REITs are considered securities, not direct real estate holdings. However, investors can still leverage the benefits of a 1031 exchange by selling their investment property and reinvesting the proceeds into a diversified portfolio of REITs to potentially achieve tax deferral and other advantages offered by both strategies. It’s crucial for investors to understand the distinctions between direct real estate ownership and REIT investments when considering their options for maximizing returns and tax efficiency.

Can you do a 1031 exchange into an annuity?

One frequently asked question regarding 1031 exchanges is whether it is possible to exchange real estate into an annuity. While a 1031 exchange allows for the deferral of capital gains taxes by reinvesting in like-kind properties, exchanging into an annuity is not a qualifying investment for this tax-deferred exchange. Annuities are considered financial instruments rather than real property, making them ineligible for participation in a 1031 exchange. Investors exploring 1031 exchanges should focus on reinvesting in qualified real estate assets to take advantage of the tax benefits provided by this strategy.

Can I use a 1031 exchange to pay off another property?

When considering a 1031 exchange to pay off another property, it’s important to note that the primary purpose of a 1031 exchange is to defer capital gains taxes on the sale of investment property by reinvesting the proceeds into another qualifying property. Using a 1031 exchange solely to pay off another property may not meet the requirements of a like-kind exchange. The Internal Revenue Service (IRS) has specific guidelines regarding the identification and acquisition of replacement properties in a 1031 exchange. It’s advisable to consult with tax professionals or qualified intermediaries to ensure compliance with IRS regulations and maximize the benefits of a 1031 exchange.

Tags: 1031 exchange, 1031 exchange into reit, benefits, diversification, liquidity, passive income, professional management, real estate investment trusts, reits, tax efficiency