Buying Your First Investment Property

Investing in real estate can be a lucrative way to build wealth and secure your financial future. Buying your first investment property is an exciting step towards creating a passive income stream and growing your portfolio. Here are some essential tips to consider before diving into the world of real estate investments:

Set Clear Financial Goals

Before you start looking for investment properties, define your financial goals. Determine how much you can afford to invest, what return on investment (ROI) you are aiming for, and the time frame in which you want to see results.

Research the Market

Do thorough research on the real estate market in the area where you plan to buy your investment property. Look at property trends, rental demand, vacancy rates, and potential growth opportunities to make an informed decision.

Calculate Your Budget

Determine your budget by considering not only the purchase price of the property but also additional costs such as maintenance, repairs, property management fees, and taxes. Make sure you have a clear understanding of all expenses involved.

Get Pre-Approved for Financing

If you need financing to purchase your investment property, get pre-approved for a loan before starting your search. Having pre-approval will show sellers that you are a serious buyer and can help expedite the buying process.

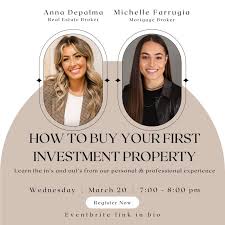

Consider Hiring a Real Estate Agent

A real estate agent with experience in investment properties can be a valuable asset in helping you find suitable properties, negotiate deals, and navigate the buying process smoothly. Consider working with a professional who understands your investment goals.

Conduct Due Diligence

Before making an offer on a property, conduct thorough due diligence. Inspect the property for any issues, review rental history if applicable, and assess its potential for generating rental income or appreciation over time.

Plan for Property Management

If you do not plan to manage the property yourself, consider hiring a professional property management company to oversee day-to-day operations such as tenant screening, rent collection, and maintenance requests.

Buying your first investment property is an exciting opportunity to grow your wealth and create long-term financial stability. By following these essential tips and doing thorough research, you can make informed decisions that lead to successful real estate investments.

7 Compelling Reasons to Invest in Your First Property: Building Wealth, Passive Income, and More

- Build equity and wealth over time.

- Generate passive income through rental payments.

- Diversify your investment portfolio beyond stocks and bonds.

- Take advantage of tax benefits such as deductions on mortgage interest and property expenses.

- Potential for property value appreciation in the long term.

- Control over your investment decisions and property management.

- Opportunity to leverage real estate financing to maximize returns.

4 Challenges to Consider Before Buying Your First Investment Property

- High upfront costs for down payment and closing expenses can be a barrier for first-time investors.

- Ongoing maintenance and repair costs can eat into your rental income and require careful budgeting.

- Vacancies between tenants can result in periods of no rental income, impacting your cash flow.

- Market fluctuations and economic downturns can affect property values and rental demand, potentially leading to financial losses.

Build equity and wealth over time.

One significant advantage of buying your first investment property is the opportunity to build equity and wealth over time. As property values typically appreciate, owning real estate allows you to increase your net worth gradually. By leveraging the property through rental income or resale, you can generate a steady stream of passive income and create a valuable asset that contributes to your overall financial portfolio. Investing in real estate provides a tangible way to grow your wealth steadily and secure your financial future for the long term.

Generate passive income through rental payments.

One significant advantage of buying your first investment property is the ability to generate passive income through rental payments. By renting out the property to tenants, you can create a steady stream of income without having to actively work for it on a daily basis. This passive income can provide financial stability, supplement your existing income, and help you build wealth over time. Additionally, rental payments can help cover mortgage expenses, property maintenance costs, and even contribute to future real estate investments. Generating passive income through rental payments is a compelling reason to consider investing in real estate for long-term financial growth.

Diversify your investment portfolio beyond stocks and bonds.

One significant advantage of buying your first investment property is the opportunity to diversify your investment portfolio beyond traditional assets like stocks and bonds. Real estate offers a tangible and potentially lucrative alternative that can provide added stability and potential for long-term growth. By including real estate in your investment mix, you can spread risk across different asset classes and take advantage of the unique benefits that property ownership can offer, such as rental income, property appreciation, and tax advantages. This diversification can help protect your portfolio against market volatility and economic fluctuations, providing a more balanced and resilient investment strategy for the future.

Take advantage of tax benefits such as deductions on mortgage interest and property expenses.

When buying your first investment property, you can take advantage of tax benefits that can help reduce your financial burden. One significant pro is the ability to deduct mortgage interest and property expenses from your taxable income. By leveraging these tax benefits, you not only lower your overall tax liability but also increase your cash flow from the investment property. This advantage makes real estate investing an attractive option for those looking to build wealth while enjoying tax incentives that can positively impact their bottom line.

Potential for property value appreciation in the long term.

One significant advantage of buying your first investment property is the potential for property value appreciation in the long term. Real estate has historically shown a tendency to increase in value over time, making it a valuable asset for building wealth. By investing in a property that is located in a desirable area or has growth potential, you stand to benefit from capital appreciation as the market value of the property appreciates steadily over the years. This can lead to significant returns on your initial investment and contribute to your overall financial goals and portfolio growth.

Control over your investment decisions and property management.

One significant advantage of buying your first investment property is the control it gives you over your investment decisions and property management. Unlike other forms of investment where you have limited say in how your money is managed, real estate allows you to take charge of every aspect of your property. From selecting the right property to managing rental agreements, maintenance, and upgrades, having control over these decisions empowers you to maximize the potential returns on your investment and tailor your strategies to suit your financial goals.

Opportunity to leverage real estate financing to maximize returns.

One significant advantage of buying your first investment property is the opportunity to leverage real estate financing to maximize returns. By using financing options such as mortgages or loans, you can invest a smaller amount of your own capital upfront while potentially gaining access to a larger, income-producing asset. This strategy allows you to increase the potential return on your investment by utilizing borrowed funds to purchase properties that have the potential for long-term appreciation or rental income. Leveraging real estate financing can be a powerful tool in building wealth and expanding your investment portfolio in the real estate market.

High upfront costs for down payment and closing expenses can be a barrier for first-time investors.

One significant drawback of buying your first investment property is the high upfront costs associated with down payments and closing expenses, which can pose a significant barrier for first-time investors. Accumulating the funds needed for a substantial down payment and covering closing costs can be challenging, especially for individuals who are just starting their real estate investment journey. These financial requirements may limit the pool of potential properties that new investors can consider, making it harder to enter the market and potentially delaying their ability to start generating rental income or building equity through property appreciation.

Ongoing maintenance and repair costs can eat into your rental income and require careful budgeting.

One significant con of buying your first investment property is the ongoing maintenance and repair costs that can erode your rental income and necessitate meticulous budgeting. From routine maintenance tasks to unexpected repairs, these expenses can quickly accumulate and impact your cash flow. It is essential for property owners to set aside a portion of their rental income for maintenance reserves to ensure that they can cover these costs without jeopardizing the financial viability of their investment. Careful planning and proactive maintenance strategies are crucial to mitigate the impact of these ongoing expenses on your bottom line.

Vacancies between tenants can result in periods of no rental income, impacting your cash flow.

One significant drawback of buying your first investment property is the potential for vacancies between tenants, which can lead to periods of no rental income. These gaps in occupancy can directly impact your cash flow, making it challenging to cover mortgage payments, maintenance costs, and other expenses associated with the property. It is essential for new property investors to factor in these potential vacancies and plan accordingly to mitigate the financial impact on their investment portfolio.

Market fluctuations and economic downturns can affect property values and rental demand, potentially leading to financial losses.

Market fluctuations and economic downturns pose a significant con when buying your first investment property. These external factors can impact property values and rental demand, ultimately affecting your potential for generating income. During times of economic instability, property values may decrease, making it challenging to sell or rent out your investment property at a profitable price. Additionally, a decrease in rental demand can lead to longer vacancies and lower rental income, potentially resulting in financial losses for the property owner. It is crucial for first-time investors to be aware of these risks and have contingency plans in place to mitigate the impact of market fluctuations on their investment properties.

Tags: budget, buying your first investment property, due diligence, equity, financial goals, financing, investment property, market research, passive income, property management, real estate, real estate agent, rental payments, wealth