Rental Property Investing: Brandon Turner

Brandon Turner is a well-known figure in the real estate investing world, particularly in the realm of rental property investments. As the co-host of the popular podcast “The BiggerPockets Real Estate Podcast” and author of several best-selling books on real estate, Brandon has established himself as an authority in the field.

One of the key principles that Brandon advocates for is the concept of passive income through rental properties. He believes that investing in rental properties can be a lucrative way to build wealth over time while providing a steady stream of income.

Brandon’s approach to rental property investing emphasizes thorough research, careful financial planning, and building strong relationships with tenants. He often shares practical tips and strategies for finding, financing, and managing rental properties effectively.

Through his work, Brandon aims to educate and empower aspiring real estate investors to achieve their financial goals through smart and strategic property investments. His insights have inspired many individuals to take their first steps into the world of rental property investing.

Whether you are a seasoned investor looking to expand your portfolio or a novice considering your first investment property, Brandon Turner’s expertise and guidance can be invaluable in navigating the complex world of real estate investing.

Top 8 FAQs on Rental Property Investing with Insights from Brandon Turner

- What are the benefits of rental property investing according to Brandon Turner?

- How can I finance my first rental property investment as suggested by Brandon Turner?

- What are some common mistakes to avoid in rental property investing according to Brandon Turner?

- How do I find good rental properties to invest in, following Brandon Turner’s advice?

- What are the key factors to consider when managing rental properties based on Brandon Turner’s recommendations?

- How can I maximize my return on investment in rental properties as advised by Brandon Turner?

- What resources does Brandon Turner recommend for learning more about rental property investing?

- What strategies does Brandon Turner suggest for dealing with difficult tenants in rental property investments?

What are the benefits of rental property investing according to Brandon Turner?

Brandon Turner, a renowned expert in rental property investing, highlights several key benefits of this investment strategy. According to Brandon, one of the primary advantages of rental property investing is the potential for generating passive income over the long term. By acquiring rental properties and leasing them to tenants, investors can enjoy a steady stream of cash flow that can supplement their income and build wealth. Additionally, Brandon emphasizes the opportunity for property appreciation, where real estate values tend to increase over time, providing investors with potential capital gains. Another benefit he often mentions is the ability to leverage other people’s money through financing options to acquire properties and maximize returns. Overall, Brandon Turner underscores that rental property investing offers a unique combination of financial stability, growth potential, and passive income generation that can help individuals achieve their long-term financial goals.

How can I finance my first rental property investment as suggested by Brandon Turner?

When it comes to financing your first rental property investment, Brandon Turner often suggests exploring various options to make the process more accessible and manageable. One common approach recommended by Brandon is leveraging financing tools such as traditional mortgages, private lenders, or partnerships to fund your initial investment. By carefully assessing your financial situation, researching different loan options, and seeking guidance from experienced investors like Brandon Turner, you can find a financing strategy that aligns with your goals and helps you take that crucial first step into the world of rental property investing.

What are some common mistakes to avoid in rental property investing according to Brandon Turner?

When it comes to rental property investing, Brandon Turner often highlights several common mistakes that investors should avoid. One key mistake is underestimating expenses, such as maintenance costs, property management fees, and unexpected repairs. Brandon emphasizes the importance of conducting thorough financial analysis to ensure that investors have a realistic understanding of the true costs involved in owning and operating rental properties. Additionally, he warns against neglecting tenant screening processes, as choosing the wrong tenants can lead to costly evictions and property damage. By heeding Brandon Turner’s advice on these and other common pitfalls, investors can increase their chances of success in the competitive world of rental property investing.

How do I find good rental properties to invest in, following Brandon Turner’s advice?

When seeking good rental properties to invest in, following Brandon Turner’s advice involves a strategic approach that emphasizes research, analysis, and due diligence. Brandon often recommends starting by identifying target markets with strong rental demand and potential for appreciation. Utilizing tools like market data analysis and networking with local real estate professionals can help in pinpointing promising investment opportunities. Additionally, conducting thorough property inspections, evaluating financial metrics such as cash flow and return on investment, and considering factors like location, amenities, and tenant profiles are crucial steps in finding high-quality rental properties that align with long-term investment goals. By following Brandon Turner’s guidance on property selection criteria and investment strategies, investors can increase their chances of success in the competitive rental property market.

What are the key factors to consider when managing rental properties based on Brandon Turner’s recommendations?

When managing rental properties, Brandon Turner emphasizes several key factors that can contribute to success in real estate investing. According to his recommendations, it is crucial to carefully screen tenants to ensure they are reliable and responsible. Maintaining open communication with tenants and promptly addressing any maintenance issues is also essential for a positive landlord-tenant relationship. Additionally, setting aside funds for unexpected expenses and having a solid understanding of local landlord-tenant laws are crucial aspects of effective property management, as highlighted by Brandon Turner. By focusing on these key factors, landlords can create a smooth and profitable rental property investment experience based on Brandon Turner’s insights.

How can I maximize my return on investment in rental properties as advised by Brandon Turner?

To maximize your return on investment in rental properties, as advised by Brandon Turner, it is essential to focus on key strategies such as thorough market research, smart property selection, and effective property management. Brandon emphasizes the importance of buying properties below market value to increase potential profits and conducting due diligence to ensure sound investment decisions. Additionally, implementing efficient property management practices, such as maintaining good tenant relationships and staying proactive in property maintenance, can help boost your rental property’s profitability in the long run. By following Brandon Turner’s advice on these fundamental aspects of rental property investing, you can work towards maximizing your ROI and achieving success in the real estate market.

What resources does Brandon Turner recommend for learning more about rental property investing?

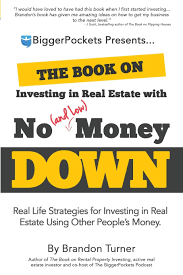

Brandon Turner often recommends a variety of resources for those looking to delve deeper into rental property investing. From his own books, such as “The Book on Rental Property Investing” and “How to Invest in Real Estate,” to the wealth of knowledge shared on the BiggerPockets website and podcast, Brandon emphasizes the importance of continuous learning and education in the real estate investment field. Additionally, he encourages aspiring investors to explore online forums, attend local real estate meetups, and seek out mentorship opportunities to gain valuable insights and practical advice from experienced professionals. By leveraging these resources, individuals can enhance their understanding of rental property investing and make informed decisions to achieve financial success in the real estate market.

What strategies does Brandon Turner suggest for dealing with difficult tenants in rental property investments?

Brandon Turner suggests several strategies for dealing with difficult tenants in rental property investments. One key approach he advocates is maintaining open communication with tenants to address any issues promptly and effectively. By fostering a positive landlord-tenant relationship built on trust and transparency, conflicts can often be resolved amicably. Brandon also emphasizes the importance of setting clear expectations from the beginning, such as outlining rules and policies in the lease agreement. Additionally, he recommends documenting all communications and incidents to have a record in case formal action is necessary. Overall, Brandon Turner’s advice for handling difficult tenants centers around proactive communication, clear boundaries, and professionalism to ensure a harmonious landlord-tenant relationship.

Tags: benefits, brandon turner, capital gains, financial stability, first rental property investment, growth potential, leverage financing, maintenance costs, partnerships, passive income, passive income generationfinancing options, private lenders, property appreciation, property management fees, rental property investing, rental property investing brandon turner, steady cash flow, tenant screening processes, thorough financial analysis, traditional mortgages, underestimating expenses, unexpected repairs, wealth building