The Importance of Understanding Rental Yield in Real Estate Investment

When it comes to real estate investment, one key metric that every investor should be familiar with is rental yield. Rental yield is a crucial factor in determining the potential return on investment (ROI) of a rental property.

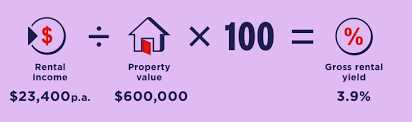

Rental yield is typically expressed as a percentage and is calculated by dividing the annual rental income generated by a property by its total cost or current market value. This calculation provides investors with an indication of how much income they can expect to earn relative to the property’s value.

Understanding rental yield is essential for investors looking to make informed decisions about which properties to invest in. A high rental yield indicates that a property has the potential to generate strong returns, while a low rental yield may suggest that the property may not be as profitable.

Factors that can influence rental yield include location, market demand, property condition, and prevailing rental rates in the area. Investors should carefully consider these factors when evaluating the potential rental yield of a property.

It’s important to note that while high rental yields can be attractive, they are not the sole indicator of a successful real estate investment. Investors should also consider other factors such as appreciation potential, maintenance costs, vacancy rates, and overall market trends.

In conclusion, understanding rental yield is essential for real estate investors looking to maximize their returns and make sound investment decisions. By carefully analyzing this metric and considering other relevant factors, investors can identify lucrative opportunities and build a successful real estate portfolio.

5 Essential Tips for Maximizing Rental Yield on Your Property

- Calculate rental yield by dividing the annual rental income by the property’s value and multiplying by 100.

- Consider the location of the property as it can significantly impact rental yield.

- Factor in additional costs like maintenance, property management fees, and vacancies when estimating rental yield.

- Regularly review and adjust rent prices to maximize rental yield based on market conditions.

- Compare rental yields of different properties to make informed investment decisions.

Calculate rental yield by dividing the annual rental income by the property’s value and multiplying by 100.

To calculate rental yield, a crucial metric for real estate investors, simply divide the annual rental income generated by a property by its current market value or total cost. Then, multiply the result by 100 to express it as a percentage. This formula provides investors with valuable insight into the potential return on investment of a rental property, helping them make informed decisions about their real estate ventures. Understanding and utilizing rental yield calculations can guide investors in identifying properties with strong income-generating potential and maximizing their overall profitability in the real estate market.

Consider the location of the property as it can significantly impact rental yield.

When evaluating rental yield, it is crucial to consider the location of the property as it plays a significant role in determining potential returns. The location can influence rental demand, rental rates, and overall property appreciation, all of which directly impact the rental yield. Properties in prime locations with high demand and amenities tend to command higher rental income, resulting in a more favorable rental yield. Therefore, investors should carefully assess the location factors to make informed decisions and maximize their investment returns in real estate.

Factor in additional costs like maintenance, property management fees, and vacancies when estimating rental yield.

When calculating rental yield for a potential investment property, it is crucial to factor in additional costs beyond just the rental income. Expenses such as maintenance, property management fees, and potential vacancies can significantly impact the overall profitability of the investment. By accounting for these costs upfront when estimating rental yield, investors can make more accurate projections of their potential returns and ensure they are prepared for any unforeseen expenses that may arise.

Regularly review and adjust rent prices to maximize rental yield based on market conditions.

To maximize rental yield based on market conditions, it is crucial to regularly review and adjust rent prices. By staying informed about the current market trends and demand in the area, landlords can ensure that their rental properties are priced competitively to attract tenants while generating optimal income. Adjusting rent prices in response to changes in the market can help landlords maintain high occupancy rates and maximize their overall rental yield.

Compare rental yields of different properties to make informed investment decisions.

To make informed investment decisions in real estate, it is crucial to compare the rental yields of different properties. By analyzing and comparing the rental yields of various properties, investors can gain valuable insights into which properties have the potential to generate higher returns. This comparison allows investors to identify lucrative opportunities, assess risks, and ultimately make strategic decisions that align with their investment goals. Evaluating rental yields across different properties is a key step in conducting thorough due diligence and maximizing the profitability of real estate investments.

Tags: appreciation potential, income, location, maintenance costs, market demand, market trends, property condition, property value, real estate investment, rental rates, rental yield, roi, vacancy rates