The Benefits of Real Estate Equity Investment

Real estate equity investment is a popular strategy for individuals looking to grow their wealth over time. This type of investment involves purchasing an ownership stake in a property, which can offer several benefits:

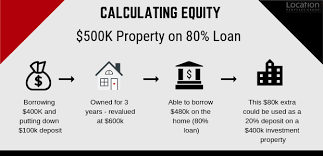

- Appreciation: Real estate properties have the potential to increase in value over time, allowing investors to build equity and generate profits when they sell the property.

- Passive Income: Rental properties can provide a steady stream of passive income through rental payments from tenants. This can be a reliable source of cash flow for investors.

- Diversification: Investing in real estate can help diversify your investment portfolio, reducing risk by spreading your investments across different asset classes.

- Tax Benefits: Real estate investors may benefit from tax advantages such as deductions for mortgage interest, property taxes, and depreciation. These tax benefits can help increase overall returns on investment.

- Hedge Against Inflation: Real estate values tend to rise with inflation, making it a good hedge against the eroding effects of inflation on the value of money.

However, real estate equity investment also comes with risks such as market fluctuations, property vacancies, and maintenance costs. It’s important for investors to conduct thorough research and due diligence before investing in real estate to mitigate these risks.

In conclusion, real estate equity investment can be a lucrative way to build wealth and achieve financial goals. By understanding the benefits and risks associated with this type of investment, investors can make informed decisions to maximize their returns over the long term.

7 Essential Tips for Successful Real Estate Equity Investment

- Do thorough research on the real estate market before investing.

- Diversify your investment portfolio to reduce risk.

- Consider long-term potential and growth prospects of the property.

- Monitor market trends and economic indicators that may impact real estate values.

- Consult with financial advisors or real estate professionals for guidance.

- Be prepared for unexpected expenses such as maintenance or repairs.

- Stay informed about tax implications related to real estate investments.

Do thorough research on the real estate market before investing.

Before diving into real estate equity investment, it is crucial to conduct thorough research on the real estate market. Understanding market trends, property values, rental demand, and potential risks can help investors make informed decisions and mitigate potential pitfalls. By arming oneself with knowledge about the local market conditions and economic factors that may impact real estate investments, individuals can increase their chances of success and maximize their returns in the long run. Research is key to making sound investment choices in the dynamic world of real estate equity investment.

Diversify your investment portfolio to reduce risk.

Diversifying your investment portfolio in real estate equity can be a smart strategy to reduce risk and enhance overall returns. By spreading your investments across different types of properties or real estate assets, you can minimize the impact of market fluctuations on your portfolio. Diversification helps ensure that a downturn in one sector or location does not significantly affect your entire investment. Additionally, investing in various types of real estate, such as residential, commercial, or industrial properties, can provide stability and potentially higher returns over the long term.

Consider long-term potential and growth prospects of the property.

When engaging in real estate equity investment, it is crucial to consider the long-term potential and growth prospects of the property. Assessing factors such as location, market trends, development plans in the area, and potential for appreciation can help investors make informed decisions that align with their investment goals. By focusing on the long-term outlook of a property, investors can position themselves to capitalize on opportunities for sustained growth and profitability in the real estate market.

Monitor market trends and economic indicators that may impact real estate values.

Monitoring market trends and economic indicators is crucial when engaging in real estate equity investment. By staying informed about factors such as interest rates, housing supply and demand, job growth, and economic stability, investors can make well-informed decisions about when to buy, sell, or hold onto their real estate assets. Understanding how these external factors may impact real estate values allows investors to adapt their strategies accordingly and position themselves for success in the ever-changing real estate market.

Consult with financial advisors or real estate professionals for guidance.

When considering real estate equity investment, it is highly recommended to consult with financial advisors or real estate professionals for expert guidance. These professionals can provide valuable insights, help assess your financial situation, and offer strategic advice tailored to your investment goals. By seeking guidance from experienced advisors, you can make informed decisions, navigate potential risks, and maximize the potential returns on your real estate equity investment.

Be prepared for unexpected expenses such as maintenance or repairs.

When engaging in real estate equity investment, it is crucial to be prepared for unexpected expenses that may arise, such as maintenance or repairs. Property ownership comes with ongoing maintenance responsibilities, and unforeseen issues can occur at any time. By setting aside funds for these unexpected expenses, investors can ensure they are financially equipped to handle any repairs or maintenance needs that may arise, ultimately safeguarding their investment and minimizing potential financial setbacks. Being proactive and budgeting for such contingencies can help investors navigate unforeseen costs with greater ease and maintain the long-term value of their real estate assets.

Stay informed about tax implications related to real estate investments.

It is crucial for investors engaged in real estate equity investment to stay informed about the tax implications associated with their investments. Understanding the tax rules and benefits applicable to real estate can help investors optimize their returns and minimize tax liabilities. From deductions for mortgage interest and property taxes to depreciation allowances, being aware of the tax implications can significantly impact the overall profitability of real estate investments. By staying informed and seeking professional advice when needed, investors can ensure they are maximizing the tax advantages available to them in their real estate ventures.

Tags: appreciation, benefits, development plans evaluation, diversification, diversify investment portfolio, enhance returns, growth prospects, hedge against inflation, location assessment, long-term potential, maintenance costs, market fluctuations, market trends analysis, passive income, potential risks, property vacancies, property values, real estate equity investment, real estate market trends, reduce risk, rental demand, research, risks, tax benefits