The Impact of Depreciation on Rental Property

Depreciation is a crucial concept for landlords and property owners to understand when it comes to managing rental properties. In real estate, depreciation refers to the gradual decrease in the value of a property over time due to wear and tear, age, and other factors.

While depreciation may sound like a negative aspect, it can actually provide significant tax benefits for rental property owners. The Internal Revenue Service (IRS) allows property owners to deduct the cost of depreciation from their taxable income each year, which can help offset rental income and reduce tax liability.

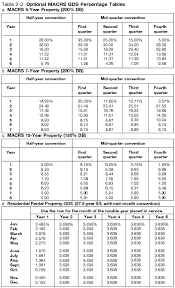

It’s important for landlords to accurately calculate and track depreciation for their rental properties. The IRS provides guidelines on how to determine the depreciable value of a property based on its useful life, which typically ranges from 27.5 to 39 years for residential properties.

By taking advantage of depreciation deductions, landlords can lower their taxable income and increase their cash flow from rental properties. This tax benefit can help offset other expenses associated with owning and maintaining rental properties, such as repairs, maintenance, and mortgage interest.

However, it’s essential for landlords to stay compliant with IRS regulations regarding depreciation deductions. Failing to accurately calculate or report depreciation could lead to penalties or audits by the IRS.

In conclusion, understanding the impact of depreciation on rental property is crucial for maximizing tax benefits and managing cash flow effectively. By leveraging depreciation deductions in accordance with IRS guidelines, landlords can optimize their financial returns from rental properties while staying compliant with tax laws.

Maximizing Tax Benefits: 6 Essential Tips for Depreciating Your Rental Property in the US

- 1. Understand the depreciation rules for rental property in the US.

- 2. Keep detailed records of the property’s purchase price, improvements, and other relevant expenses.

- 3. Consider hiring a professional to help calculate depreciation accurately.

- 4. Regularly review and update the depreciation schedule for tax purposes.

- 5. Be aware of recapture rules when selling a depreciated rental property.

- 6. Consult with a tax advisor or accountant for personalized guidance on depreciating rental property.

1. Understand the depreciation rules for rental property in the US.

To maximize tax benefits and financial returns from rental properties in the US, it is essential for landlords to have a solid grasp of the depreciation rules governing such investments. Understanding the depreciation guidelines set forth by the Internal Revenue Service (IRS) is crucial in accurately calculating and claiming depreciation deductions on rental properties. By familiarizing themselves with the applicable rules and regulations, landlords can ensure compliance with tax laws, optimize their tax savings, and effectively manage their cash flow from rental income.

2. Keep detailed records of the property’s purchase price, improvements, and other relevant expenses.

To effectively leverage depreciation for rental property, it is essential to maintain meticulous records of the property’s purchase price, any improvements made over time, and all other relevant expenses incurred. Keeping detailed documentation not only ensures accurate calculation of depreciation but also helps in maximizing tax benefits by providing a clear overview of the property’s financial history. By maintaining organized records, landlords can confidently claim depreciation deductions while staying compliant with IRS regulations, ultimately optimizing their tax savings and overall financial management of the rental property.

3. Consider hiring a professional to help calculate depreciation accurately.

When dealing with the depreciation of rental property, it is wise to consider hiring a professional to ensure accurate calculations. Property depreciation can be a complex process, and having a knowledgeable expert on board can help navigate the intricacies of determining depreciation values based on IRS guidelines. By enlisting the assistance of a professional, landlords can avoid potential errors in depreciation calculations and maximize their tax benefits while staying compliant with tax regulations.

4. Regularly review and update the depreciation schedule for tax purposes.

Regularly reviewing and updating the depreciation schedule for tax purposes is a crucial tip for landlords and property owners looking to maximize their tax benefits from rental properties. By ensuring that the depreciation schedule accurately reflects the current value and useful life of the property, landlords can optimize their deductions and reduce their taxable income. Keeping track of any changes in the property’s condition or improvements made over time is essential to maintaining an up-to-date depreciation schedule that complies with IRS guidelines. By staying proactive in reviewing and updating the depreciation schedule, landlords can effectively manage their tax liabilities and enhance their overall financial strategy for rental properties.

5. Be aware of recapture rules when selling a depreciated rental property.

When selling a depreciated rental property, it is important to be aware of recapture rules. Recapture rules require property owners to report and pay taxes on any depreciation deductions that were previously claimed when selling the property. This means that a portion of the proceeds from the sale may be subject to higher tax rates than the standard capital gains tax. By understanding and planning for recapture rules in advance, landlords can better estimate their tax liability and make informed decisions when selling a depreciated rental property.

6. Consult with a tax advisor or accountant for personalized guidance on depreciating rental property.

For personalized guidance on depreciating rental property, it is advisable to consult with a tax advisor or accountant. These professionals can offer tailored advice based on your specific financial situation and the intricacies of tax laws. By seeking expert assistance, landlords can ensure that they accurately calculate depreciation, maximize tax benefits, and stay compliant with IRS regulations. Consulting with a tax advisor or accountant can help landlords navigate the complexities of depreciating rental property effectively and optimize their overall financial strategy.

Tags: cash flow, compliance, deductions, depreciating rental property, depreciation, financial returns, irs guidelines, landlords, rental property, tax benefits, taxable income