The Rise of Fractional Property Investment: A New Way to Diversify Your Portfolio

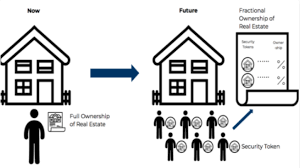

Traditional real estate investment often requires a significant amount of capital, making it inaccessible to many individuals. However, a new trend in the real estate market is changing the game – fractional property investment.

Fractional property investment allows multiple investors to pool their resources together to invest in high-value properties. This innovative approach enables individuals to own a fraction of a property, proportionate to their investment. This means that you can now invest in prime real estate locations without having to buy an entire property on your own.

One of the key advantages of fractional property investment is diversification. By spreading your investment across multiple properties, you can reduce risk and increase your chances of generating steady returns. Additionally, fractional ownership allows you to access premium properties that may have been out of reach otherwise.

Another benefit of fractional property investment is the opportunity for passive income. As a fractional owner, you can earn rental income and share in the profits generated by the property without having to deal with the day-to-day management tasks.

Moreover, fractional property investment platforms have made it easier than ever to participate in this market. These platforms provide investors with access to a wide range of properties, transparent information about each investment opportunity, and streamlined processes for managing their investments.

While fractional property investment offers many benefits, it’s essential for investors to conduct thorough research and due diligence before committing their funds. Understanding the terms of the investment, assessing the potential risks, and evaluating the track record of the platform are crucial steps in making informed decisions.

In conclusion, fractional property investment is revolutionizing the real estate market by providing individuals with a new way to diversify their portfolios and access premium properties. With its potential for steady returns and passive income opportunities, fractional ownership is becoming an attractive option for savvy investors looking to grow their wealth.

9 Essential Tips for Successful Fractional Property Investment

- Research and understand the concept of fractional property investment.

- Diversify your investments by spreading funds across multiple properties.

- Consider the location and potential growth of the property before investing.

- Review the fees and charges associated with fractional property investment platforms.

- Understand the rights and responsibilities as a fractional property owner.

- Stay updated on market trends and economic factors that may impact your investment.

- Evaluate the reputation and track record of the platform offering fractional investments.

- Have a clear exit strategy in case you need to liquidate your investment.

- Consult with financial advisors or real estate experts for guidance on fractional property investment.

Research and understand the concept of fractional property investment.

To maximize the benefits of fractional property investment, it is crucial to research and fully comprehend the concept before diving in. Understanding how fractional ownership works, the potential risks and rewards involved, and the mechanics of investing in this innovative approach will empower investors to make informed decisions. By taking the time to educate yourself on fractional property investment, you can position yourself strategically to leverage this emerging trend in real estate and unlock new opportunities for diversifying your investment portfolio.

Diversify your investments by spreading funds across multiple properties.

Diversifying your investments by spreading funds across multiple properties is a smart strategy in fractional property investment. By investing in different properties, you can reduce risk and increase the potential for steady returns. Each property may have its own market dynamics and performance, so having a diversified portfolio can help cushion against fluctuations in any single property’s value or rental income. This approach not only enhances your investment stability but also offers the opportunity to benefit from a variety of real estate markets and locations, ultimately maximizing the potential for long-term growth in your investment portfolio.

Consider the location and potential growth of the property before investing.

When delving into fractional property investment, it is crucial to carefully assess the location and growth potential of the property before making any investment decisions. The location plays a significant role in determining the property’s value, rental income potential, and overall investment returns. By choosing properties in areas with promising growth prospects and strong market demand, investors can maximize their chances of reaping long-term benefits from their fractional ownership. Conducting thorough research on the local real estate market trends and economic indicators can help investors make informed choices and ensure that their investments align with their financial goals.

Review the fees and charges associated with fractional property investment platforms.

When considering fractional property investment, it is crucial to review the fees and charges associated with the platforms offering these opportunities. Understanding the fee structure is essential for evaluating the overall cost of your investment and assessing its potential returns. Be sure to look into management fees, transaction fees, and any other charges that may apply to ensure that they align with your investment goals and expectations. By conducting a thorough review of the fees and charges upfront, you can make informed decisions and maximize the value of your fractional property investment.

Understand the rights and responsibilities as a fractional property owner.

When considering fractional property investment, it is crucial to thoroughly understand the rights and responsibilities that come with being a fractional property owner. As a fractional owner, you have the right to use the property for a specified period, typically based on your ownership percentage. However, along with these rights come responsibilities such as contributing to maintenance costs, adhering to any rules or agreements set forth by the ownership structure, and participating in decision-making processes regarding the property. By understanding and embracing these rights and responsibilities, fractional property owners can ensure a harmonious and successful investment experience.

Stay updated on market trends and economic factors that may impact your investment.

To maximize the benefits of fractional property investment, it is crucial to stay informed about market trends and economic factors that could influence your investment. By keeping a close eye on the real estate market, interest rates, economic indicators, and other relevant factors, you can make well-informed decisions to protect and grow your investment portfolio. Being proactive and adaptable to changing market conditions will help you navigate potential risks and capitalize on opportunities in the dynamic world of fractional property investment.

Evaluate the reputation and track record of the platform offering fractional investments.

When considering fractional property investment, it is crucial to evaluate the reputation and track record of the platform offering these investments. A platform’s reputation can provide valuable insights into its credibility, reliability, and past performance. By researching reviews, testimonials, and any available data on the platform’s track record, investors can gain a better understanding of the platform’s history of successful investments and overall trustworthiness. This due diligence is essential in ensuring that investors are making informed decisions and entrusting their funds to a reputable and experienced platform in the fractional property investment market.

Have a clear exit strategy in case you need to liquidate your investment.

Having a clear exit strategy is crucial when engaging in fractional property investment. It’s essential to plan for the unexpected and consider how you will liquidate your investment if the need arises. Whether you need to access funds quickly or simply want to divest your shares, having a well-defined exit strategy can help you navigate potential challenges and ensure a smooth transition out of your investment. By proactively thinking about your exit plan, you can make informed decisions that align with your financial goals and overall investment strategy in the long run.

Consult with financial advisors or real estate experts for guidance on fractional property investment.

When considering fractional property investment, it is highly recommended to consult with financial advisors or real estate experts for guidance. These professionals can provide invaluable insights into the potential risks and rewards of fractional ownership, help you assess investment opportunities, and guide you in making informed decisions that align with your financial goals. By seeking expert advice, you can navigate the complexities of fractional property investment with confidence and maximize the benefits of this innovative investment strategy.

Tags: benefits, diversification, due diligence, fractional property investment, investors, opportunities, ownership, passive income, platform, portfolio, properties, real estate, rental income, research, rewards, risks