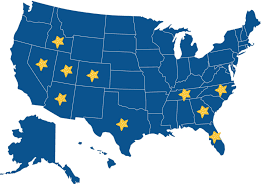

The Best States to Invest in Real Estate in 2022

Investing in real estate can be a lucrative endeavor, but choosing the right location is crucial for success. As we look ahead to 2022, certain states stand out as particularly promising for real estate investors.

Texas

With its strong job market, growing population, and diverse economy, Texas continues to be a top choice for real estate investment. Cities like Austin, Dallas, and Houston offer opportunities for both rental income and property appreciation.

Florida

Florida’s sunny climate and booming tourism industry make it an attractive destination for real estate investors. Cities such as Miami, Orlando, and Tampa are popular choices for rental properties and vacation homes.

Arizona

Arizona’s affordable housing market and steady population growth make it a promising state for real estate investment. Phoenix and Tucson are among the cities experiencing strong demand from homebuyers and renters.

North Carolina

North Carolina offers a diverse range of real estate opportunities, from coastal properties to urban developments. Cities like Charlotte and Raleigh are experiencing rapid growth, making them attractive markets for investors.

Tennessee

Tennessee’s low cost of living and strong job market make it an appealing state for real estate investment. Nashville and Memphis are popular choices for investors looking to capitalize on the state’s growing economy.

When considering where to invest in real estate in 2022, it’s important to conduct thorough research and consult with local real estate professionals. Each state offers unique opportunities and challenges, so finding the right fit for your investment goals is key to success.

Top 5 States to Invest in Real Estate in 2022: Texas, Florida, Arizona, North Carolina, and Tennessee

- Strong job market and diverse economy in Texas

- Booming tourism industry and sunny climate in Florida

- Affordable housing market and steady population growth in Arizona

- Diverse real estate opportunities in North Carolina

- Low cost of living and strong job market in Tennessee

7 Drawbacks to Consider When Investing in Real Estate in 2022’s Top States

- High competition among investors may lead to inflated property prices.

- Economic downturns can impact the real estate market in these states.

- Regulatory changes or policies may affect profitability for real estate investors.

- Natural disasters, such as hurricanes or wildfires, can pose risks to properties in certain states.

- Rapid population growth may strain infrastructure and lead to housing market imbalances.

- Local market saturation in popular cities can limit rental income potential for investors.

- Fluctuations in interest rates could impact financing costs for real estate investments.

Strong job market and diverse economy in Texas

Texas stands out as a prime choice for real estate investment in 2022 due to its robust job market and diverse economy. With a thriving business landscape across various industries, including technology, energy, and healthcare, Texas offers a stable foundation for property investors. The state’s strong job market not only attracts new residents but also ensures a steady demand for rental properties, making it an appealing option for those looking to capitalize on both rental income and long-term property appreciation.

Booming tourism industry and sunny climate in Florida

Florida’s booming tourism industry and sunny climate make it a highly attractive state for real estate investment in 2022. The consistent influx of tourists seeking warm weather and leisure opportunities creates a strong demand for rental properties and vacation homes in popular cities like Miami, Orlando, and Tampa. Investors can capitalize on Florida’s appeal as a year-round destination, offering potential for steady rental income and property appreciation in this vibrant market.

Affordable housing market and steady population growth in Arizona

Arizona stands out as a promising state for real estate investment in 2022 due to its combination of an affordable housing market and steady population growth. With housing prices that are relatively lower compared to other states, investors can capitalize on opportunities for both rental income and property appreciation. The state’s consistent population growth indicates a strong demand for housing, particularly in cities like Phoenix and Tucson, making Arizona an attractive option for those looking to enter or expand their real estate investment portfolio.

Diverse real estate opportunities in North Carolina

North Carolina stands out as a prime state for real estate investment in 2022 due to its diverse range of opportunities. From coastal properties offering serene waterfront living to urban developments providing bustling city lifestyles, North Carolina caters to a variety of preferences and investment strategies. Cities like Charlotte and Raleigh, experiencing rapid growth and economic development, present attractive prospects for investors seeking both stability and potential for high returns. With its diverse real estate landscape, North Carolina offers something for every investor looking to capitalize on the state’s vibrant market.

Low cost of living and strong job market in Tennessee

Tennessee stands out as a promising state for real estate investment in 2022 due to its combination of a low cost of living and a robust job market. With affordable housing options and a thriving economy, Tennessee offers investors the opportunity to capitalize on the state’s growth potential while providing residents with a high quality of life. Cities like Nashville and Memphis, known for their vibrant culture and economic opportunities, make Tennessee an attractive destination for those looking to invest in real estate.

High competition among investors may lead to inflated property prices.

In the realm of real estate investment in 2022, a notable con to consider is the high competition among investors, which can potentially result in inflated property prices. As more investors flock to certain states with promising real estate markets, the demand for properties increases, leading to bidding wars and driving up prices beyond their intrinsic value. This heightened competition may pose a challenge for investors seeking affordable opportunities and could impact overall profitability in the long run. It is crucial for investors to carefully assess market conditions and strategize effectively to navigate this con and make informed decisions in the competitive landscape of real estate investment.

Economic downturns can impact the real estate market in these states.

One significant con to consider when investing in real estate in the best states of 2022 is the potential impact of economic downturns on the market. While these states may currently offer promising opportunities for investors, fluctuations in the economy can have a direct effect on property values, rental demand, and overall investment returns. It is essential for investors to be prepared for potential economic challenges and have strategies in place to mitigate risks during uncertain times.

Regulatory changes or policies may affect profitability for real estate investors.

One significant con to consider when investing in real estate in 2022 is the potential impact of regulatory changes or policies on profitability. Shifts in laws, zoning regulations, tax policies, or government initiatives can directly influence the financial returns of real estate investments. These changes may lead to increased costs, decreased rental income, or limitations on property use, ultimately affecting the overall profitability for investors. Staying informed about regulatory developments and adapting investment strategies accordingly is crucial to navigate these challenges in the dynamic real estate market landscape.

Natural disasters, such as hurricanes or wildfires, can pose risks to properties in certain states.

Natural disasters, such as hurricanes or wildfires, can pose significant risks to properties in certain states, affecting their desirability as investment locations. States prone to these natural calamities may experience property damage, decreased property values, and higher insurance costs, which can impact the overall return on investment for real estate investors. It is crucial for investors to carefully consider the potential risks associated with natural disasters when evaluating the best states to invest in real estate in 2022 and to take appropriate precautions to mitigate these risks.

Rapid population growth may strain infrastructure and lead to housing market imbalances.

Rapid population growth in the best states to invest in real estate in 2022 may present a significant challenge as it could strain existing infrastructure and potentially create imbalances in the housing market. The influx of new residents could outpace the development of essential amenities such as roads, schools, and healthcare facilities, impacting the overall quality of life in these areas. Additionally, a surge in demand for housing without corresponding supply increases may result in inflated property prices, making it harder for both buyers and renters to find affordable options. Investors should be mindful of these potential pitfalls and consider the long-term implications of investing in regions experiencing rapid population growth.

Local market saturation in popular cities can limit rental income potential for investors.

In the realm of real estate investment in 2022, one notable drawback to consider is the local market saturation in popular cities. While these urban centers may initially seem like prime locations for investment due to high demand, the influx of investors can lead to oversaturation of rental properties. This oversaturation can subsequently limit the potential rental income for investors as competition drives down rental prices and occupancy rates. As a result, investors need to carefully assess market conditions and consider diversifying their portfolios beyond just popular cities to mitigate the risk of reduced rental income potential.

Fluctuations in interest rates could impact financing costs for real estate investments.

Fluctuations in interest rates pose a significant con for real estate investors looking to capitalize on the best states to invest in during 2022. Changes in interest rates can directly impact financing costs, potentially affecting the profitability of real estate investments. Higher interest rates could lead to increased borrowing costs, reducing cash flow and overall returns on investment. Investors need to closely monitor interest rate trends and factor them into their financial projections to mitigate the potential risks associated with financing fluctuations in the real estate market.

Tags: affordable housing market, austin, best states to invest in real estate 2022, booming tourism industry, charlotte, coastal properties, dallas, diverse economy, diverse range of real estate opportunities, houstonflorida, job market, low cost of living, memphis, miami, nashville, orlando, phoenix, raleightennessee, real estate investment, real estate investors, steady population growth, strong job market, sunny climate, tampaarizona, texas, tucsonnorth carolina, urban developments